The S&P/TSX Composite's 0.5 per cent decline since last Thursday has taken some of the froth out of domestic equities, driving the benchmark's Relative Strength Index below the sell signal of 70 and providing more oversold, bottom-fishing opportunities for traders.

New entries in the oversold category are primarily in the energy sector, where a 22 per cent one-week bludgeoning for Penn West Petroleum sees that stock as the TSX's most oversold by RSI. Lightstream Resources and Bonavista Energy Corp. round out the top three most oversold after a tough week for both firms, and are followed by Trinidad Drilling Ltd and MEG Energy Corp.

Financials still dominate the overbought list. Sun-Life Financial and National Bank are into the RSI's temporary no-fly zone above 80. TD Bank, Manulife Financial, Home Capital Group Inc., CIBC, Bank of Nova Scotia and Power Corp remain overbought but much less so than last week.

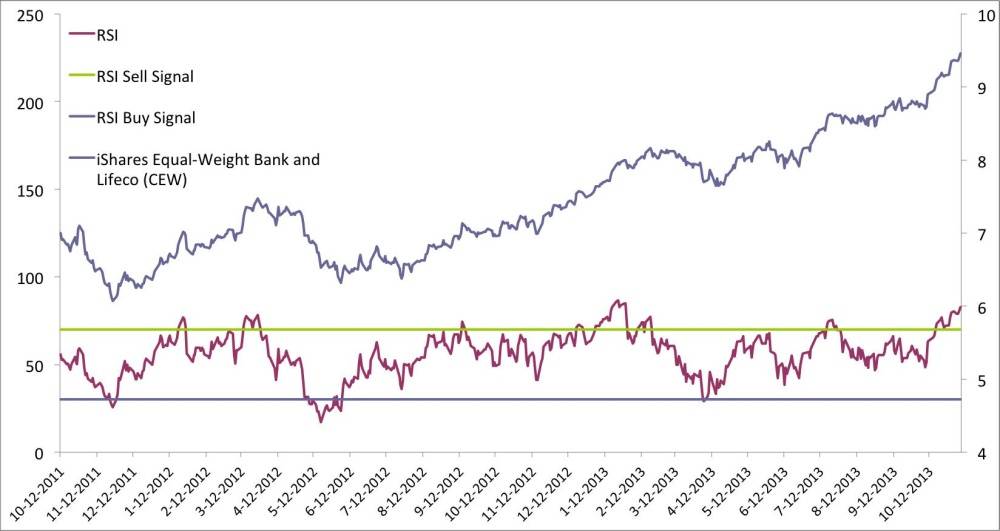

This week's focus chart – the iShares Equal Weighted Banks and LifeCo ETF – shows how technically extended financial stocks are, and helps explain why I think shorter-term-focused investors should wait until things calm down before buying.

This ETF is dangerously overbought with an RSI of 82.7. The only other period in the last 24 months when it breached 80, the average three month decline was 2.4 per cent. Not calamitous, but why start in the hole?

Overall, the Canadian equity market continues the healthy process of burning off froth. Opportunities are appearing in the oil patch, particularly because the recent decline in domestic oil prices is because of infrastructure issues, not slowing demand.

Standard warnings: RSI changes fast and, on its own, is not sufficient reason to buy or sell a stock.

To view these charts on mobile devices, click on the following links:

S&P/TSX Composite index - oversold by RSI - Nov 8: http://bit.ly/195gJDh

S&P/TSX Composite index - overbought by RSI - Nov 8: http://bit.ly/18dczcN

Scott Barlow

Scott Barlow