The extreme levels of volatility in the domestic equity market weren't a lot of fun for anyone, but did have one positive outcome: The S&P/TSX composite benchmark is now more attractively valued than the S&P 500. This implies that the era of U.S. equity market outperformance may be at an end.

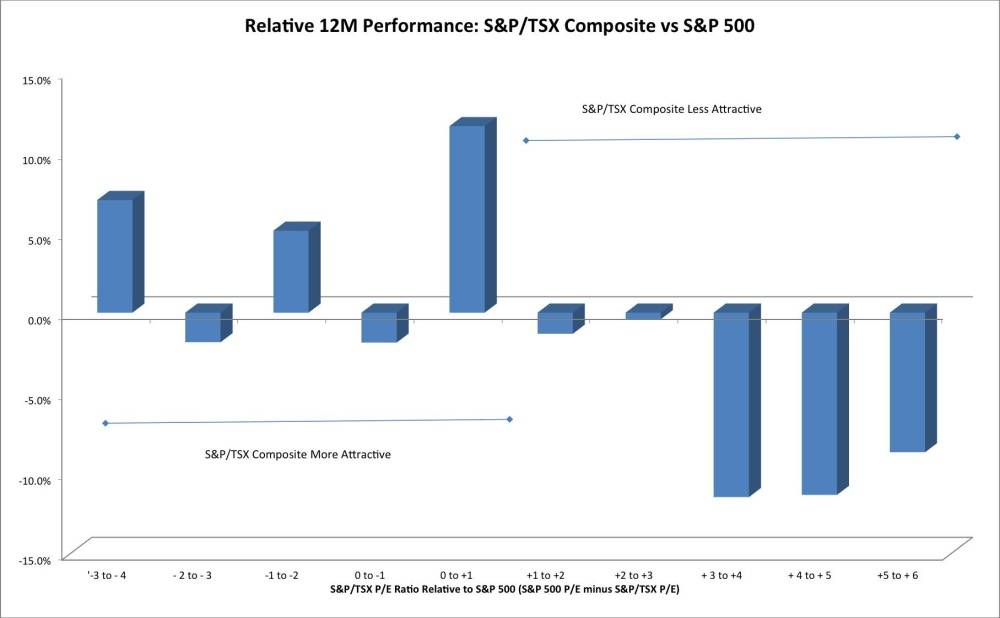

The week's chart verifies that the valuation differential between the Canadian and U.S. stocks matters for future performance. When the domestic benchmark has a price-earnings ratio below the S&P 500, the odds of TSX outperformance rise significantly.

The bar on the far left, for example, shows that when the P/E ratio of the S&P/TSX composite is between three and four times lower than that of the S&P 500(meaning Canadian stocks are cheaper and more attractive), domestic stocks outperform U.S. equities by an average of 7 per cent in the following 12 months.

On the far right-hand side, the bar shows that when the S&P/TSX P/E ratio is between five and six times higher than the S&P 500, domestic stocks underperform U.S. equities by an average of 8.7 per cent in the next year.

The Canadian market was more expensive than the U.S. market in terms of P/E from late 2009 until the end of October, 2014. The S&P/TSX composite is now 17.26, which is 0.6 (times earnings) more attractive than the S&P 500's 17.84.

According to the chart, when the S&P/TSX is cheaper by between zero and one times trailing earnings the domestic benchmark has still underperformed, but by a very small amount. In terms of valuation levels, Canadian and U.S. stocks are on roughly even footing as 2014 draws to a close.

It is important to note that, for the sake of simplicity, the chart does not adjust the performance data for currency changes – the S&P 500 returns were calculated in U.S dollars and the Canadian equity returns are in loonies.

It is certainly possible that a big move in the greenback versus the Canadian dollar could be a bigger factor in future performance than the relatively small difference in equity valuations. But currencies are notoriously difficult to predict and, while diversification is important, investment strategies based primarily on currency forecasts are prohibitively risky.

The current state of North American equity valuations implies that Canadian investors can be comfortable in selecting the best investment opportunities without worrying about which side of the border the stock trades.

Follow Scott Barlow on Twitter @SBarlow_ROB.