The Chinese equity market has been more or less useless as a leading indicator for resource prices and Canadian equities, but South Korea's KOSPI benchmark has been remarkably effective. Canadian investors should ignore the Shanghai Composite index and focus on Korea's export-heavy, globally integrated market for hints on the future of global economic activity and, by extension, domestic equity performance.

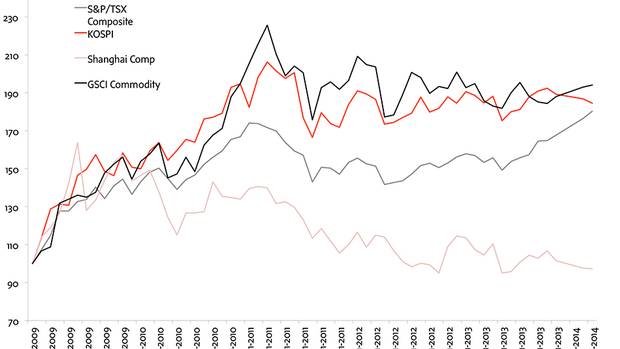

The chart below shows the performance of the S&P/TSX Composite, KOSPI, GSCI Commodity and Shanghai Composite indexes, set to a base of 100 in January 2009. Right away, it's clear that the Shanghai Composite has been drifting lower for the entire period, and has not been associated with the other benchmarks.

S&P/TSX Composite vs KOSPI vs GSCI Commodity Index vs Shanghai Composite

China is the largest importer of almost every commodity on the planet and, on the surface at least, it makes no sense that its asset markets are the least connected with global commodity prices, and Canadian equities. How can investors gauge interest in commodities, and by extension, the TSX?

The answer to this dilemma is that the Korean economy’s central position in the global supply chain makes it a better indicator of global growth. Samsung, for example, makes and exports electronic components to China to assemble into iPhones, builds LNG tankers through its Samsung Heavy Industries division, provides energy infrastructure through its engineering division, and sells televisions and smartphones worldwide.

Chinese accounting standards, the economic dominance of state-owned enterprises (which are not reflected in the equity benchmark) and limits on foreign investment together mean that Korean stocks like Samsung Group and Hyundai Group are in many ways a better reflection of the Chinese economy than the Shanghai Composite. The more globally diversified KOSPI is also clearly a better indicator of global economic growth activity.

The recent stability of the Korean benchmark is good news for Canadian investors, validating the recent strength in the S&P/TSX Composite. Domestic investors, particularly those in economically sensitive market sectors like resources, should pay close attention to the South Korean equity markets as a sign of future revenue growth for their portfolio.