A humorous look at the companies that caught our eye, for better or worse, this week.

Apple

AAPL (Nasdaq)

Mar. 13, 2015 close: $123.59 (U.S.)

down $3.01 or 2.4% over week

Information you don’t really need to know:

1) How many times you stood up during the day;

2) How many steps you took to get to the office bathroom and back;

3) How many calories you burned walking to the store for a Coke and a bag of Doritos.

But the new Apple Watch will tell you all of this crucial information and more – for the low entry-level model price of just $349 (U.S.). No wonder the stock fell.

Dollar General

DG (NYSE)

Mar. 13, 2015 close: $74.30 (U.S.)

up $2.98 or 4.2% over week

Business quiz!

Which of the following is not an actual dollar-store chain?

a) Dollar General;

b) Dollar Tree;

c) Family Dollar;

d) Dollarama;

e) Ain’t Got No Dollar.

Answer: e.

Shareholders of Dollar General made more than a few dollars this week when the company initiated a dividend and said it plans to accelerate new store openings to take on newly merged rivals Family Dollar and Dollar Tree. Investors are filling their shopping carts with stock.

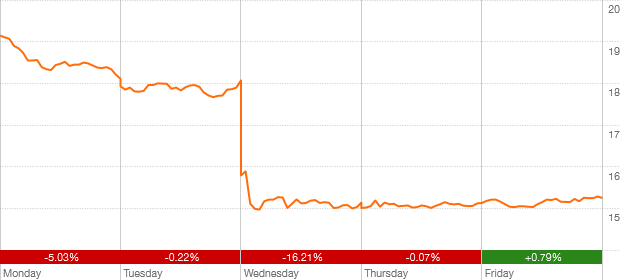

Vera Bradley

VRA (Nasdaq)

Mar. 13, 2015 close: $15.25 (U.S.)

down $3.82 or 20% over week

What hurts more than getting hit in the head with a handbag? Investing in designer handbag maker Vera Bradley, that’s what. Shares of the company – which also sells backpacks, luggage and jewellery – got clobbered after fourth-quarter earnings fell short of estimates, hit by a 14-per-cent drop in comparable sales. With the company slashing its outlook and closing a plant in Indiana, there’s plenty of pain to go around.

Concordia Healthcare

CXR (TSX)

Mar. 13, 2015 close: $86.19

up $22.03 or 34.3% over week

Mommy always said: Just say no to drugs. But Mommy didn’t know a thing about investing, obviously. Shares of Concordia surged after the company – whose products treat a range of conditions including ADHD, head lice and asthma – made a $1.2-billion (U.S.) “transformative acquisition” of 18 drugs from Switzerland-based Covis Pharma including treatments for cancer, heart failure and arthritis. The stock’s a picture of health.

Avon Products

AVP (NYSE)

Mar. 13, 2015 close: $7.72 (U.S.)

down $1.18 or 13.3% over week

My cousin Pat was a successful Avon lady – until people found out he was actually a man wearing a lot of makeup. Avon investors got a surprise of their own this week when shares of the direct-selling company sank on concerns that the surging U.S. dollar will put a dent in its bottom line. With 85 per cent of Avon’s sales coming from outside the United States, investors are so upset their mascara is running.