A humorous look at the companies that caught our eye, for better or worse, this week

Tiffany - STAR

Whew. We can all stop worrying about the rich people now. Shares of high-end jewellery retailer Tiffany had fallen off a cliff this year, hurt by a strong U.S. dollar that kept foreign tourists out of its U.S. stores and reduced the value of its sales abroad. But with first-quarter sales and profits exceeding expectations and Tiffany maintaining its full-year earnings outlook, it looks like millionaires are getting their mojo back.

TIF (NYSE), $93.73 (U.S.), up $6.82 or 7.8% over week

Michael Kors - DOG

Your handbag, sunglasses and shoes say Michael Kors. But your portfolio says: I’m broke. Shares of the luxury-goods maker plunged after it posted fourth-quarter earnings that missed expectations and issued a first-quarter forecast that fell well short of analysts estimates. With EPS now expected to be just 74 cents (U.S.) to 78 cents, compared with Wall Street’s outlook of $1.03, the stock has landed in the discount bin.

KORS (NYSE), $46.50 (U.S.), down, $15.13 or 24.5% over week

Legacy Oil & Gas - DOG

Normally when a company receives a takeover offer, the shares rise. Not Legacy Oil + Gas. Struggling with high debt and shrinking cash flow, Legacy was on the receiving end of an all-stock offer worth about $563-million from Crescent Point Energy. But when Crescent Point’s stock fell on the news, Legacy’s shares tumbled as well. When even a takeover can’t lift an energy stock, you know times are tough in the oil patch.

LEG (TSX), $2.63, down 30¢ or 10.2% over week

Air Canada - STAR

Now that Air Canada’s pension has swung from a $4.2-billion deficit to a $1.2-billion surplus, the company has opted out of regulations requiring it to make special funding payments. The decision, which frees up cash and eliminates restrictions on dividends and share buybacks, will help “transform Air Canada into a sustainably profitable company for the long term,” CEO Calin Rovinescu said. Now let’s not get carried away: you’re an airline, remember.

AC (TSX), $13.76, up $1.18 or 9.4% over week

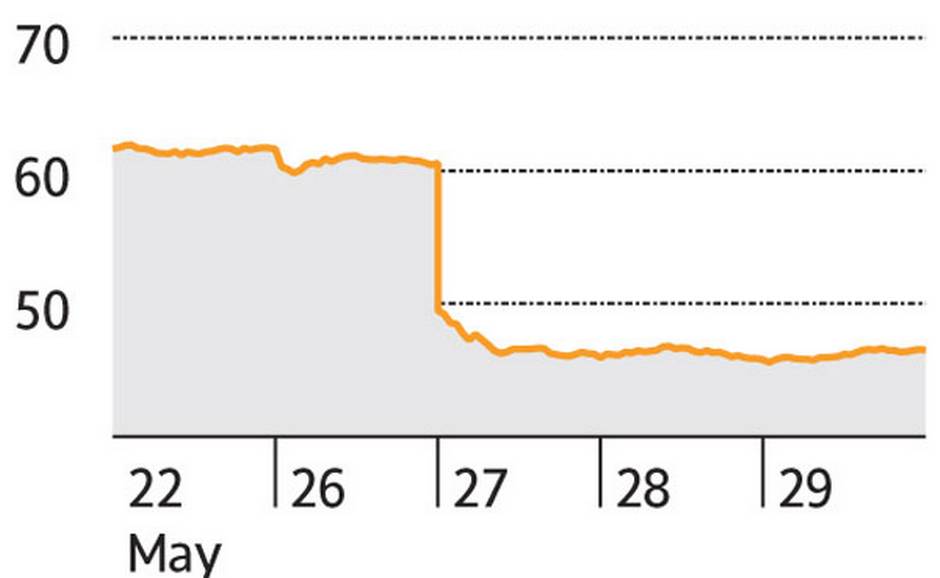

Canadian Pacific Railway - DOG

Bridge out ahead! For years, railway stocks have been big winners as their cars were chock full of raw materials, automobiles and other goods. But with shipments of coal and oil falling and the U.S. economy slowing, sentiment has suddenly shifted for the worse: After touching a record high in October, Canadian Pacific’s stock has tumbled about 17 per cent. It’s almost as much fun as riding the rails during the Great Depression.

CP (TSX), $204.92, down $12.85 or 5.9% over week