A humorous look at the companies that caught our eye, for better or worse, this week

MITSUBISHI MOTORS (DOG)

How to improve fuel economy test results:

1) Drive the car downhill with a strong tailwind;

2) Remove the spare tire, jack and back seat;

3) Launch the car with a giant slingshot.

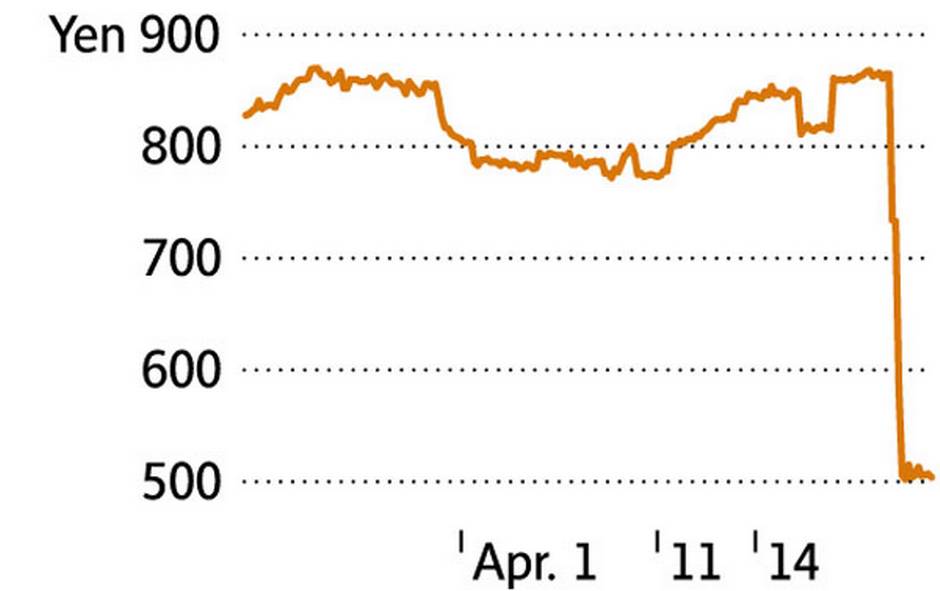

Mitsubishi didn’t go quite that far, but the Japanese auto maker did admit to falsifying tire pressure data “to present better fuel consumption rates than the actual rates” for about 625,000 mini-cars. The stock promptly veered off the road and into the ditch.

7211 (Tokyo), ¥504 ($5.71) down ¥343 or 40.5% over week

NETFLIX (DOG)

Want drama? Don’t watch Netflix, invest in it. The video-streaming giant took its biggest one-day tumble in 18 months after the company’s outlook left Wall Street cold. With growth slowing – Netflix expects to add two million international customers in the second quarter, down from 4.51 million in the first – investors are beginning to think the stock’s price-to-earnings multiple of 350 might not be warranted after all. You don’t say.

NFLX (Nasdaq), $95.90 (U.S.) down $15.61 or 14% over week

COCA-COLA (DOG)

Care for a can of warm, flat Coke? Investors in the beverage giant didn’t exactly get their thirst quenched by the soft- drink maker’s first-quarter results: Hurt by a strong U.S. dollar and health-conscious consumers turning away from sugary drinks, Coca-Cola posted a 4-per-cent drop in net operating revenues as earnings slipped by a penny to 34 cents a share. With Coke struggling to revive pop sales, the stock’s lost its fizz.

KO (NYSE), $44.54 (U.S.) down $1.56 or 3.4% over week

IBM (DOG)

Proof that Warren Buffett is human: He bought IBM. Even as first-quarter results topped expectations thanks to double-digit growth in cloud services, Big Blue posted its 16th consecutive quarter of lower revenue as its hardware business continued to shrink. Having lost about $2.6-billion on IBM as of Dec. 31, Mr. Buffett said he thinks the stock will recover “but I could be wrong, and if I’m wrong we’ll accept that.” Easy to say when you’re a billionaire.

IBM (NYSE), $148.50 (U.S.) down $3.22 or 2.1% over week

MATTEL (DOG)

Toys are supposed to be fun, but investing in this toy company? Not so much. Hit by currency headwinds and falling sales of Barbie, American Girl and Monster High dolls, Mattel’s worldwide revenue slumped 6 per cent in the first quarter as its net loss widened to $73-million from $58.2-million a year earlier. It’s no wonder kids have lost interest in toys when they’re staring at tablets and smartphones 24/7.

MAT (Nasdaq), $32.02 (U.S.) down $1.73 or 5.1% over week