Illustration by Sam Island

In my brief career as a life insurance agent, it was drilled into me to ask prospective customers one simple question: What happens if you don’t come home tomorrow?

Most people had no response and looked nervously toward their partner for an answer.

It shouldn’t be a surprise. Nobody wants to think about their death and who wants to spend money today to prepare for that depressing inevitability?

In this, the last instalment of the Retire Rich Roadmap, we cover the “what if?” question and what you need to do to ensure you don’t leave a big mess behind for your loved ones. (If you’re just discovering this newsletter course for the first time, you can sign up to get all five weekly editions delivered to your inbox here.)

There are plenty of moving parts to this guide, but you should end up with a solid plan in the event you or your partner don’t come home tomorrow.

Become a legally recognized ghost

Who doesn’t want to call the shots even after they are gone? With a will and accompanying legal instruments, such as trusts and insurance policies, you can ensure that the wealth and possessions you have accumulated will go to the family, friends or charities of your choosing. A well-crafted last will and testament allows you to call the shots from beyond the grave.

An Angus Reid Institute poll recently found that half of adult Canadians don’t have a will – an extraordinary figure. Of those who do have a will, many likely have one that is out-of-date and fails to account for new assets or life-changing events such as marriage, children, divorces, etc.

Many believe that creating a will is a cumbersome, time-consuming, and expensive process. It can be if you have significant wealth in the form of real estate, businesses and investments. (But that should be a nice problem to have).

It’s logical to assume that wealthier families with more assets would naturally have a far higher percentage of wills than the rest of Canadians. That’s not the case, according to Legalwills.ca, a will preparation company. Its 2016 survey of 2,000 adults found that higher-income Canadians (earning $100,000-plus annually) were less likely to have an existing or updated will than those with more modest incomes.

Experts recommend that people review their wills every five years. In addition, major family events (births, deaths, divorces) and financial changes such as new businesses or real estate assets should prompt updates to wills.

Illustration by Sam Island

Some will nitty gritty

Unlike the common perception, the creation of a rock-solid will does not have to be expensive or time consuming. Depending on your needs, costs can range from less than $100 to more than $1,000 when working with a lawyer, largely depending on the complexity of your estate.

You can buy an online will kit and do it yourself. A few caveats: Two witnesses need to both watch you sign the will and add their signatures to the document themselves. These witnesses cannot be family or individuals named in the will.

While you don’t need a lawyer to help you draft your will, it makes sense to work with one in certain circumstances. They include if you have a sizable estate with multiple real estate holdings, own a business, have a complicated family structure such as a blended family, or have a beneficiary with physical or mental challenges.

A will can also serve as an estate planning and tax minimization tool. Some assets such as a home jointly owned with a spouse do not become part of the estate and are passed directly to the spouse. As well, registered accounts (such as tax-free savings accounts, registered retirement savings plans or registered retirement income funds) that have separately named beneficiaries bypass the estate process and probate taxes.

The process is laid out in Rob Carrick’s guide to naming a beneficiary of your TFSA, RRSP or RRIF.

Worst job … ever

Perhaps the most important aspect of will-making concerns naming an executor.

The executor is sort of the CEO of your death, responsible for carrying out your will’s instructions and finalizing your estate. Duties include dealing with banks, insurance companies and government entities and communicating with beneficiaries and family members. It can be a thankless job so choose your executor carefully. Vancouver lawyer Stephen Hsia says executors should have the “three Ts” of trust, time and territory (residing in Canada). Appointing a non-resident executor could have potential tax consequences.

I would add a fourth “T” to the list: terminal. Do not appoint an executor (at least without a named alternate), who is unlikely to outlive you because of age or ill health. More detail on wills can be found in this excellent Globe article about creating a legal will.

Illustration by Sam Island

No will, no problem?

Up until now, we have laid out the how on wills. What about the why?

Dying without a will – or “dying intestate” in legal lingo – is about the worst thing that you can do to your family and loved ones. Not having a will guarantees the process will be longer, messier and could cause strife among those you leave behind.

Dying intestate means the government will decide who inherits your assets, with every province and territory using different intestate rules. You are not only dead, you are voiceless.

That means no opportunity to minimize taxes, or ensure family members receive the assets you wanted them to have.

Death, taxes (and insurance)

Death and taxes are sadly inevitable. Insurance should be too.

In fact, insurance is mandatory in Canada. Third-party liability insurance for vehicle owners has been government-mandated for decades. Similarly, mortgage insurance is required for home buyers who have less than a 20-per-cent down payment, and chartered banks forcefully promote insurance for most of the mortgages they provide. (Mortgage insurance is a great deal for lenders, btw).

When it comes to insuring lives and livelihoods, however, Canadians are in the “what me worry?” camp. Nearly half of Canadians do not have life insurance (despite internet searches for life insurance peaking during the pandemic).

According to online insurance provider policyme.com, 44 per cent of Canadians do not have life insurance. Of those that do have insurance, nearly two-thirds (62 per cent) have it through their employers and more than half of those (55 per cent) have no additional insurance.

Here are two rough and general rules about life insurance. The older you get, the more expensive it gets. The more you want it or need it, the harder it may be to get. For example, if you have serious health conditions such as cancer or heart attack or stroke, it may be impossible or prohibitively expensive to get coverage.

Illustration by Sam Island

How much is enough insurance?

Most employer-backed life insurance policies will provide one to two years’ worth of salary in a payout, which in no way makes up for the loss of years or decades of income. In reality, working adults with dependent children may need coverage that is 10 times their annual income or more, depending on debt levels and other unique factors.

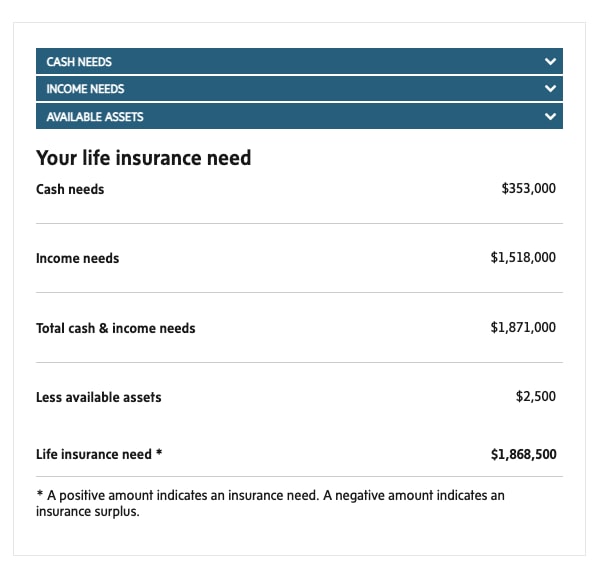

There is a handy Globe calculator to give you some idea of how much life insurance you require.

There is also the question of whole life versus term life insurance. A simple way to look at the two options is that you “own” a whole life insurance policy versus “renting” insurance for a shorter term such as 10 years. Continuing the rent versus own analogy, it is much cheaper to rent insurance with a term policy than buying a whole life policy. Term insurance may make sense for younger adults with dependants and debts to provide for today. Older, debt- and dependant-free adults may need no insurance at all.

Besides the peace of mind that comes with knowing your loved ones are taken care of, the best attribute of life insurance is that the payouts are generally tax-free. In fact, life insurance can play a role in tax and estate planning because of its tax-free status.

In addition to whole and term life policies, universal life insurance is a more niche product that may appeal to those who have maximized registered investment vehicles such as TFSAs and RRSPs. Insurance that carries investment characteristics as well as a cash value, universal policies can rise and fall in value, and premiums could potentially rise if the underlying investments underperform.

The most important type of insurance

What’s the most important type of insurance for Canadians to have? Hands down it is disability insurance, according to Manulife Securities financial adviser Kurt Rosentreter.

Rather than insuring your life, disability policies insure your income and your most important asset, namely your future earnings potential. It will pay you partial (often tax-free) income over the term of your disability.

The numbers for disability insurance (DI) are even worse than for life insurance generally. Less than half of working Canadians have disability insurance through their employer and most without employer policies have not purchased DI themselves.

How much it costs depends on the type of policy (short or long term) and factors such as age, length of benefit, health, and coverage amount. Employer-provided DI tends to be the cheapest for individuals, however long-term coverage may need to be purchased privately.

Illustration by Sam Island

Critical coverage

The final piece of the insurance portfolio is critical illness insurance. As the name implies, it provides financial benefits in the event a breadwinner is unable to work because of an illness or condition such as cancer, heart attack or other serious illness.

CI policies generally cover a long list of specific critical illnesses and will provide a lump sum or series of payouts for the medical condition. Insurance payouts hinge upon a medical diagnosis and a doctor’s confirmation that your illness fits in the insurance policy’s definition of “critical.”

A sample test run of the Globe insurance calculator. Try it to see where you are deficient.The Globe and Mail

Try this at home

- What is in your insurance “portfolio” today? Do you know what your employer-provided package includes? How much is the life insurance worth? Do you have disability or critical illness coverage?

- Try running the Globe insurance calculator to see where you are deficient.

- If you have a financial adviser, review insurance coverage for you and your partner.

- If you have a will, how long ago did you create it? What has changed in your life since then?

- What non-financial assets (family heirlooms, sentimental possessions, etc.), do you want specific family and friends to inherit that are not included in your will?