Bitcoin is back in the headlines, having roared to a new record high, just as many of the world’s major central banks are starting to pave the way towards cutting interest rates, but only if inflation behaves.

Investment flows into cryptocurrencies, inflation numbers from the United States, China and the UK, as well as a potentially market-moving snap election in Portugal will all be under the microscope in the coming week.

Here is your week-ahead look at global markets:

BOOMING BITCOIN

An advertisement for Bitcoin cryptocurrency is displayed on a street in Hong Kong, on Feb. 17, 2022.Kin Cheung/The Associated Press

Bitcoin has hit a new all-time high above $69,000, bringing it back to where it was in November 2021, when rates were low and “blockchain” and “Web3″ were all the rage.

That 2021 boom was followed by a “crypto winter” fraught with bankruptcies and collapses at the biggest crypto firms that left millions out of pocket. Various crypto executives were hit with criminal charges and regulators stepped up their warnings about the risks.

But this does not seem to have deterred a new wave of money from coming in. No one knows for sure what’s driving the gains, although analysts point to the billions of dollars that have flowed into U.S. spot bitcoin ETFs that launched this year.

Crypto fans say the industry has matured, but central bankers and regulators are still wary. Now investors are wondering: how much bigger can it get and is it different this time?

EYE ON CPI

Signs advertise Black Friday deals at a Walmart in Secaucus, N.J., Nov. 22, 2022.Seth Wenig/AP

Tuesday’s U.S. inflation report could help answer one of the key questions hovering over markets -- when can the Federal Reserve start cutting interest rates?

The consumer price index for February is expected to rise 0.4%, after January’s CPI rose at a faster-than-expected 0.3%.

Investors have dialled back expectations for the number of interest rate cuts in 2024 amid lingering concerns about strength in the economy reigniting inflation. Fed Chair Jerome Powell told Congress in recent days that rate reductions will still “likely be appropriate” later this year, if officials gain more confidence in the steady decline of inflation.

With the fourth-quarter corporate earnings season ending, economic and inflation data is front and centre ahead of the Fed’s next meeting later in March.

OPENING DAY DISAPPOINTMENT

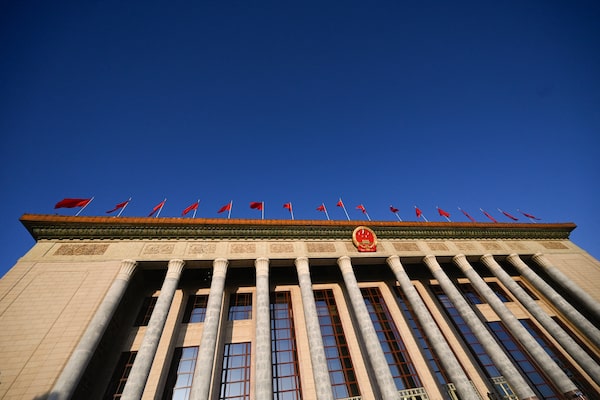

This picture shows a general view of the Great Hall of the People before the 14th National People's Congress (NPC) in Beijing on March 8.PEDRO PARDO/Getty Images

Investors weren’t throwing any parties after the opening of China’s week-long National People’s Congress, as Beijing announced a stable and as-expected 5% growth target for 2024, but didn’t break down what stimulus it would deploy to get the economy up and dancing.

The ailing property sector may be getting worse instead of better, with bonds in state-backed developer Vanke having sold off sharply. New home prices could fall further this year as support measures so far have had little impact, with the latest data due on March 15.

There is potentially room to loosen monetary policy, because although Chinese interest rates are already low compared with the U.S., the deflationary environment means real rates could come down. Inflation data on March 9 will offer fresh hints on how long this trend will continue.

PAY DAY

The Bank of England is seen in London on July 30, 2023.Hollie Adams/Reuters

Britain’s economy has narrowly avoided recession, as business activity is expanding at a healthy clip and consumers hit the shops in earnest - even with interest rates at 16-year highs and persistent inflation.

The Bank of England is less concerned about growth and far more focussed on inflation. The jobs market is showing signs of moderating. Vacancies fell for the 19th time in a row in the three months to January. But businesses are still struggling to find and retain staff. High levels of long-term sickness are also hampering employers.

Average regular pay - key for the BoE - decelerated to a rate of 6.2% in December, the slowest pace of growth in over a year, but not slow enough to convince policymakers rates will need to fall sooner rather than later. Data on March 12 might shift that thinking.

NOTHING TO SEE IN PORTUGAL?

People wait for Socialist Party (PS) Secretary General Pedro Nuno Santos to arrive for a campaign rally ahead of the snap elections in Afurada, Vila Nova de Gaia, Portugal, March 4.Pedro Nunes/Reuters

Portugal holds its second snap election in two years on Sunday. In the past, such uncertainty and political instability would have unnerved investors.

Yet the premium they demand to hold Portuguese bonds over top-rated Germany is at the lowest in a year, around 134 bps. Sentiment towards Portuguese debt (and southern Europe) is positive.

Ratings agency S&P Global just raised Portugal’s rating to “A-” from “BBB+”, citing an improved debt outlook and saying a change in government shouldn’t alter that trajectory.

So is this a “nothing to see” election? Not exactly.

Sunday’s vote is unlikely to produce a clear winner. The far-right Chega is expected to get 15%-20% of vote, possibly becoming kingmaker.

With EU-wide elections in June, the growing success of the far right and the impact of populism is one to watch.

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up today.