Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at SciPlay (NASDAQ:SCPL), and the best and worst performers in the consumer internet group.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 34 consumer internet stocks we track reported a slower Q2; on average, revenues beat analyst consensus estimates by 0.92%, while on average next quarter revenue guidance was 0.04% under consensus. Tech stocks have been under pressure as inflation makes their long-dated profits less valuable and consumer internet stocks have not been spared, with share prices down 17.1% since the previous earnings results, on average.

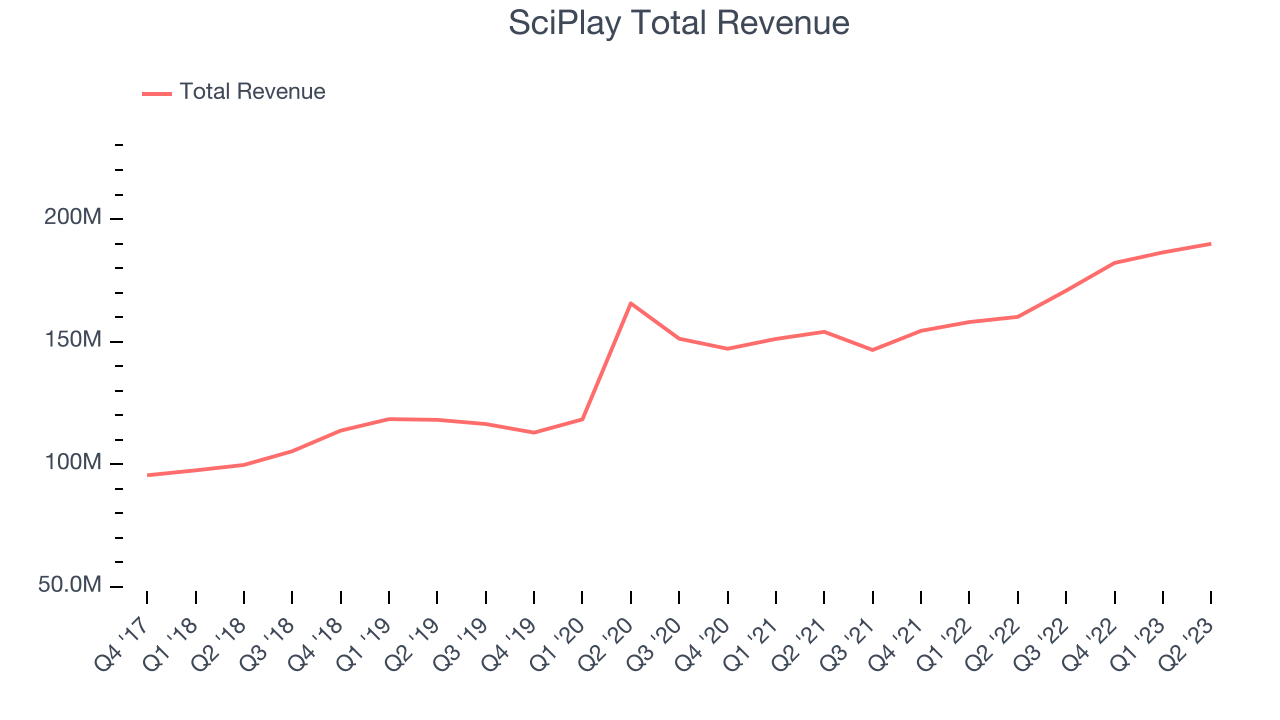

Headquartered in Las Vegas, SciPlay (NASDAQ:SCPL) offers digital casino games that favor repetition over skill.

SciPlay reported revenues of $189.9 million, up 18.6% year on year, beating analyst expectations by 4.72%. It was a decent quarter for the company, with a decent beat of analysts' revenue estimates.

Josh Wilson, Chief Executive Officer of SciPlay, commented, "SciPlay has consistently grown our business and led the social casino market in performance over the past six consecutive quarters. Our strong and consistent growth reflects the delivery of great gaming and entertainment experiences to our players, and the unrivaled execution of our team.

The stock is up 16% since the results and currently trades at $22.8.

Is now the time to buy SciPlay? Access our full analysis of the earnings results here, it's free.

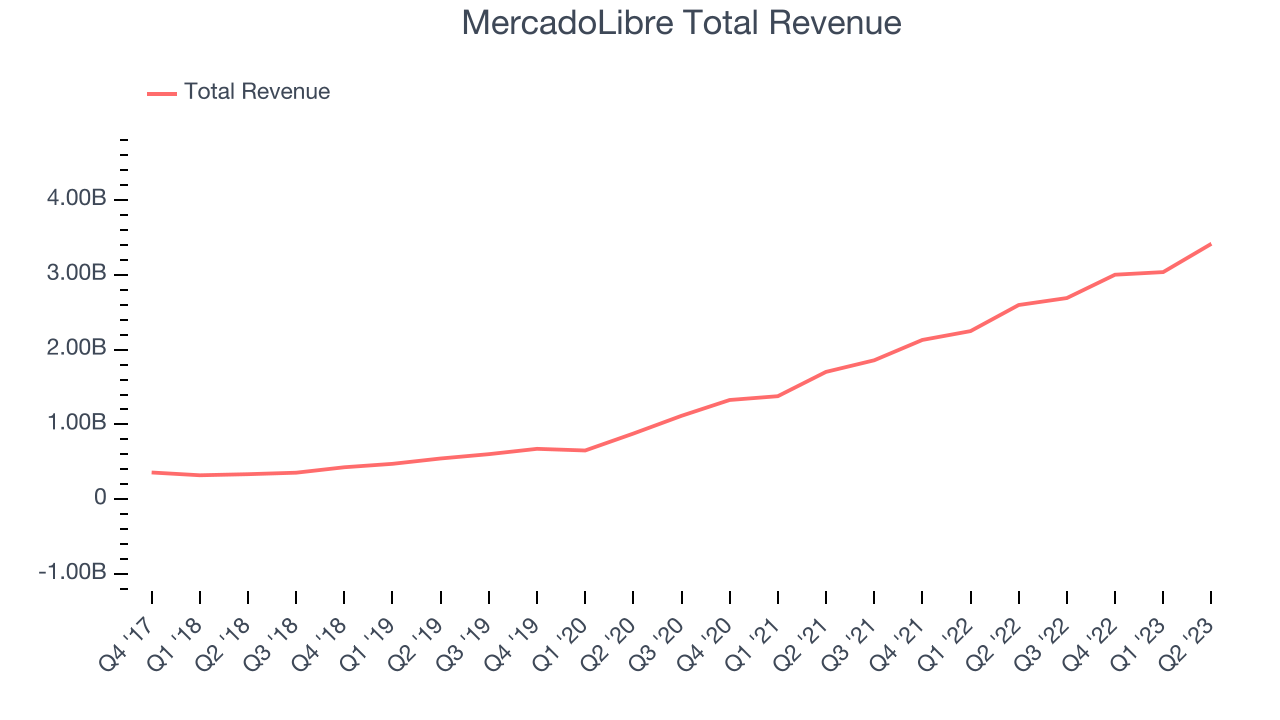

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) today is a one-stop e-commerce marketplace in Latin America.

MercadoLibre reported revenues of $3.42 billion, up 31.5% year on year, beating analyst expectations by 4.4%. It was a very strong quarter for the company, with impressive growth in its user base and a decent beat of analysts' revenue estimates.

MercadoLibre achieved the fastest revenue growth among its peers. The company reported 109 million daily active users, up 29.8% year on year. The stock is up 12.4% since the results and currently trades at $1,310.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi reported revenues of $375.1 million, down 27.3% year on year, missing analyst expectations by 6.79%. It was a weak quarter for the company, with a declining user base and revenue.

The stock is down 46.6% since the results and currently trades at $2.07.

Read our full analysis of Angi's results here.

Founded by Logan Green and John Zimmer as a long-distance intercity carpooling company Zimride, Lyft (NASDAQ: LYFT) operates a ridesharing network in the US and Canada.

Lyft reported revenues of $1.02 billion, up 3.04% year on year, missing analyst expectations by 0.17%. It was a mixed quarter for the company, with optimistic revenue guidance for the next quarter but slow revenue growth.

The company reported 21.5 million users, up 8.19% year on year. The stock is down 9.85% since the results and currently trades at $10.43.

Read our full, actionable report on Lyft here, it's free.

Originally started as a joint venture between several media companies including The Washington Post and The New York Times, Cars.com (NYSE:CARS) is a digital marketplace that connects new and used car buyers and sellers.

Cars.com reported revenues of $168.2 million, up 3.26% year on year, missing analyst expectations by 0.53%. It was a weak quarter for the company, with slow revenue growth and a decline in its user base.

The company reported 18.8 thousand active buyers, down 3.75% year on year. The stock is down 23.4% since the results and currently trades at $17.17.

Read our full, actionable report on Cars.com here, it's free.

The author has no position in any of the stocks mentioned

All market data (will open in new tab) is provided by Barchart Solutions. Copyright © 2024.

Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. For exchange delays and terms of use, please read disclaimer (will open in new tab).