Angi Inc(ANGI-Q)NASDAQ

Q2 Earnings Roundup: PlayStudios (NASDAQ:MYPS) And The Rest Of The Consumer Internet Segment

As Q2 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the consumer internet stocks, including PlayStudios (NASDAQ:MYPS) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 34 consumer internet stocks we track reported a slower Q2; on average, revenues beat analyst consensus estimates by 0.92%, while on average next quarter revenue guidance was 0.04% under consensus. Technology stocks have been hit hard on fears of higher interest rates as investors search for near-term cash flows and consumer internet stocks have not been spared, with share prices down 18.2% since the previous earnings results, on average.

PlayStudios (NASDAQ:MYPS)

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

PlayStudios reported revenues of $77.8 million, up 13.8% year on year, in line with analyst expectations. It was a mixed quarter for the company, with impressive growth in its user base but full-year revenue guidance missing analysts' expectations.

Andrew Pascal, Chairman and Chief Executive Officer of PLAYSTUDIOS, commented, “Our momentum continued in the second quarter of 2023 as we posted another solid quarter. Revenue and AEBITDA were well ahead of year ago results and exceeded Wall Street’s expectations for the third consecutive quarter. Similar to the first quarter, building momentum in our portfolio of games, increased focus on execution, and cost discipline are driving the results. Our AEBITDA margins grew over 1,000 basis points versus last year to 20.9%. This is a continuation of the strong year over year gains we achieved in the first quarter of 2023 and a reflection of our operational refinements over the past six months. Reaching margin parity with our peers is a primary goal of ours and something we’ll continue to advance as we balance our focus on operational improvements with our ongoing investments in future growth.”

PlayStudios delivered the weakest full year guidance update of the whole group. The company reported 13.9 million monthly active users, up 109% year on year. The stock is down 32.9% since the results and currently trades at $3.1.

Is now the time to buy PlayStudios? Access our full analysis of the earnings results here, it's free.

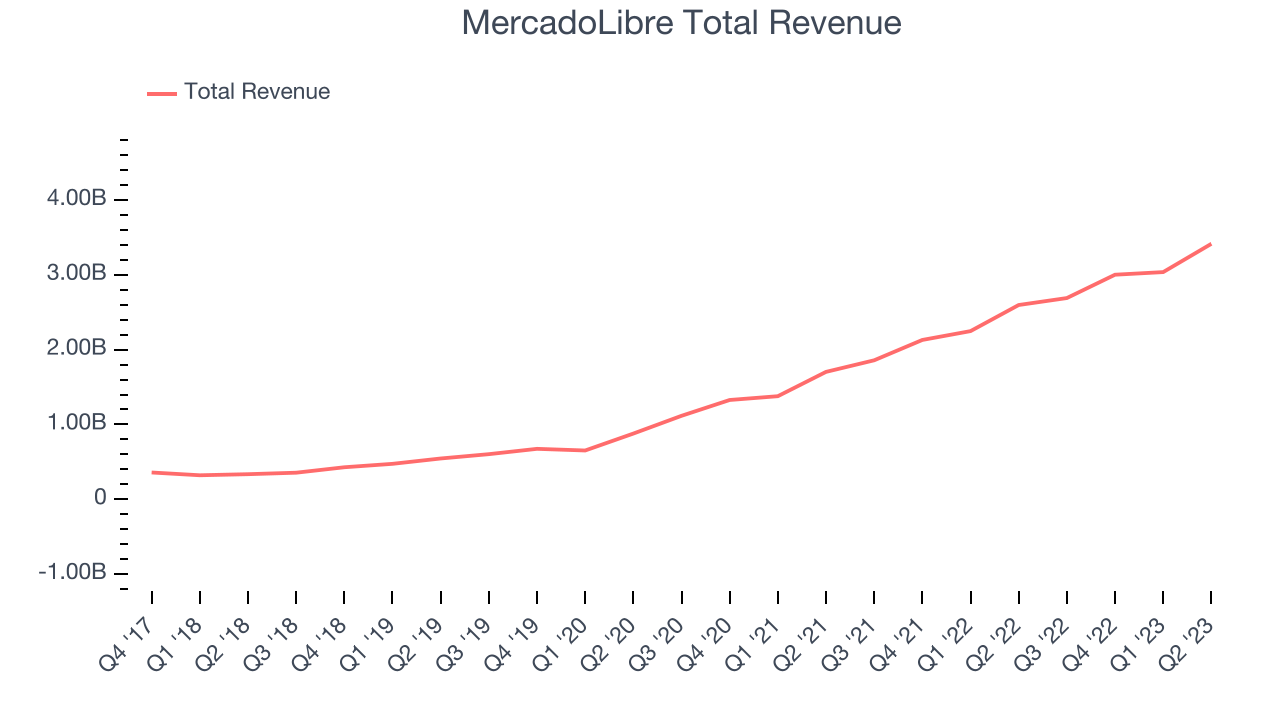

Best Q2: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) today is a one-stop e-commerce marketplace in Latin America.

MercadoLibre reported revenues of $3.42 billion, up 31.5% year on year, beating analyst expectations by 4.4%. It was a very strong quarter for the company, with impressive growth in its user base and a decent beat of analysts' revenue estimates.

MercadoLibre pulled off the fastest revenue growth among its peers. The company reported 109 million daily active users, up 29.8% year on year. The stock is up 9.41% since the results and currently trades at $1,275.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Angi (NASDAQ:ANGI)

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi reported revenues of $375.1 million, down 27.3% year on year, missing analyst expectations by 6.79%. It was a weak quarter for the company, with declining users and revenue.

The stock is down 47.9% since the results and currently trades at $2.02.

Read our full analysis of Angi's results here.

Nextdoor (NYSE:KIND)

Helping residents figure out what's happening on their block in real time, Nextdoor (NYSE:KIND) is a social network that connects neighbors with each other and with local businesses.

Nextdoor reported revenues of $56.9 million, up 4.31% year on year, beating analyst expectations by 6.51%. It was a decent quarter for the company, with a solid beat of analysts' revenue and adjusted EBITDA estimates but slow revenue growth.

The company reported 41.6 million daily active users, up 12.7% year on year. The stock is down 39% since the results and currently trades at $1.77.

Read our full, actionable report on Nextdoor here, it's free.

Wayfair (NYSE:W)

Launched in 2002 by founder Niraj Shah, Wayfair (NYSE: W) is a leading online retailer for mass market home goods in the US, UK, Canada, and Germany.

Wayfair reported revenues of $3.17 billion, down 3.44% year on year, beating analyst expectations by 2.38%. It was a decent quarter for the company, as the company beat analysts' revenue expectations, driven by a nice beat on orders and a slight beat on active customers. It was even better to see Wayfair smash adjusted EBITDA and free cash flow expectations, showing that its focus on profitability is paying off. On the other hand, the decline in its user base was not a great sign.

The company reported 21.8 million active buyers, down 7.63% year on year. The stock is down 18% since the results and currently trades at $59.77.

Read our full, actionable report on Wayfair here, it's free.

The author has no position in any of the stocks mentioned