Hubspot Inc(HUBS-N)NYSE

HubSpot (NYSE:HUBS) Posts Better-Than-Expected Sales In Q4, Stock Soars

Sales and marketing software maker HubSpot (NYSE:HUBS) announced better-than-expected results in Q4 FY2023, with revenue up 23.9% year on year to $581.9 million. Guidance for next quarter's revenue was also better than expected at $597 million at the midpoint, 1.6% above analysts' estimates. It made a non-GAAP profit of $1.76 per share, improving from its profit of $1.11 per share in the same quarter last year.

Is now the time to buy HubSpot? Find out by accessing our full research report, it's free.

HubSpot (HUBS) Q4 FY2023 Highlights:

- Revenue: $581.9 million vs analyst estimates of $558.8 million (4.1% beat)

- EPS (non-GAAP): $1.76 vs analyst estimates of $1.55 (13.8% beat)

- Revenue Guidance for Q1 2024 is $597 million at the midpoint, above analyst estimates of $587.6 million

- Management's revenue guidance for the upcoming financial year 2024 is $2.56 billion at the midpoint, beating analyst estimates by 0.9% and implying 17.7% growth (vs 25.4% in FY2023)

- Free Cash Flow of $78.54 million, up 29.8% from the previous quarter

- Customers: 205,091, up from 194,098 in the previous quarter

- Gross Margin (GAAP): 84.8%, up from 82.9% in the same quarter last year

- Market Capitalization: $30.4 billion

Started in 2006 by two MIT grad students, HubSpot (NYSE:HUBS) is a software-as-a-service platform that helps small and medium-sized businesses market themselves, sell, and get found on the internet.

Sales Software

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

Sales Growth

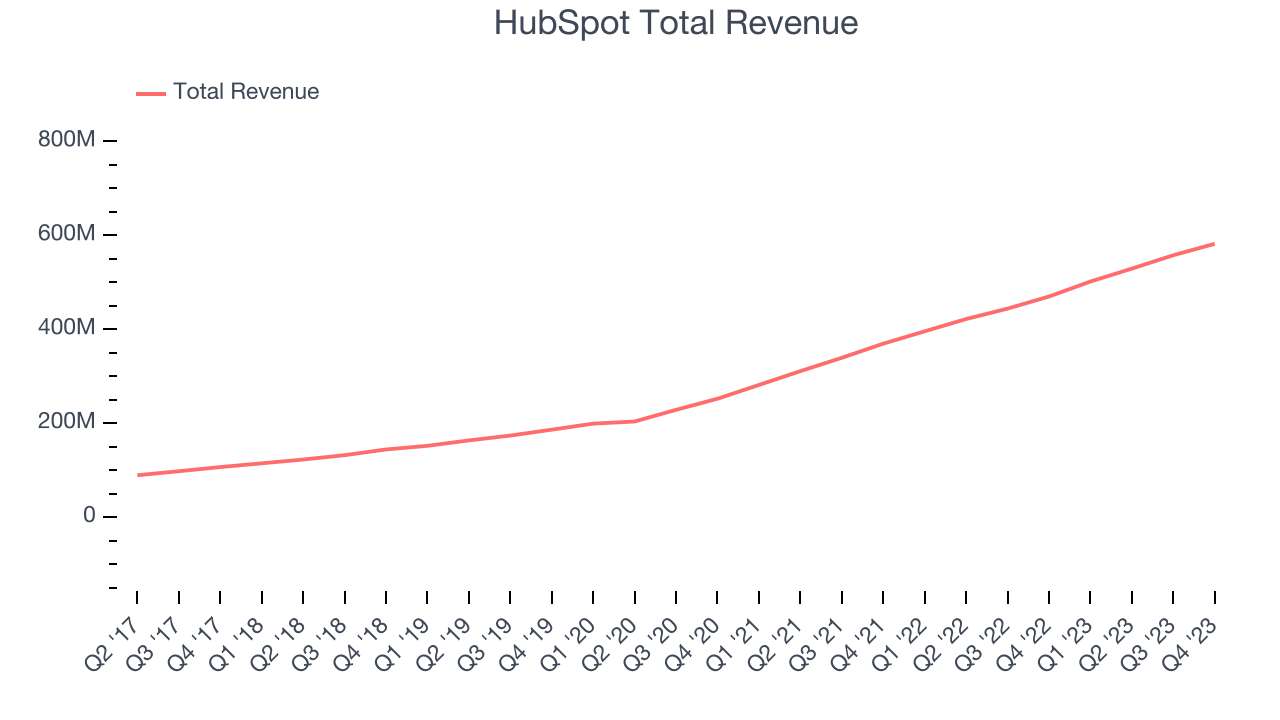

As you can see below, HubSpot's revenue growth has been strong over the last two years, growing from $369.3 million in Q4 FY2021 to $581.9 million this quarter.

This quarter, HubSpot's quarterly revenue was once again up a very solid 23.9% year on year. However, its growth did slow down a little compared to last quarter as the company increased revenue by $24.36 million in Q4 compared to $28.42 million in Q3 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that HubSpot is expecting revenue to grow 19% year on year to $597 million, slowing down from the 26.8% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $2.56 billion at the midpoint, growing 17.7% year on year compared to the 25.4% increase in FY2023.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Customer Growth

HubSpot reported 205,091 customers at the end of the quarter, an increase of 10,993 from the previous quarter. That's a fair bit better customer growth than last quarter and quite a bit above the typical growth we've seen in past quarters, demonstrating that the business has strong sales momentum. We've no doubt shareholders will take this as an indication that HubSpot's go-to-market strategy is working very well.

Key Takeaways from HubSpot's Q4 Results

HubSpot delivered a very solid beat & raise quarter, one of the likes tech stocks used to deliver back in good old 2021. The major difference is the company is now free cash flow positive. And while its revenue guidance for next year suggests a slowdown in demand, revenue is still growing fast and customer acquisition strategy is working well (as it should for a company like HubSpot). Overall, this quarter's results seemed positive and shareholders should feel optimistic. The stock is up 5.3% after reporting and currently trades at $663 per share.

HubSpot may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.