Southern Copper Corp(SCCO-N)NYSE

Copper- The Trend Remains Bullish

Nearby COMEX copper futures traded in a $1.86 per pound range in 2022, a significant range considering the record high dating back to the late 1960s before 2005 was $1.6475 per pound. Copper’s fundamentals have changed over the past years. While the red metal remains the leader of the base metals trading on the London Metals Exchange (LME) and a critical input for infrastructure building, copper has become a crucial green energy metal. Goldman Sachs’ analysts have said that there is “No decarbonization without copper.” Rising copper demand for green energy initiatives has changed the metal’s supply and demand equation.

Copper has been in a bullish trend for over two decades, which is likely to continue in 2023. The U.S. Copper ETF product (CPER) follows the price of the nonferrous metal futures higher and lower.

A long-term bull market

Nearby COMEX copper futures were sitting around the $3.75 per pound level on December 19.

The chart dating back to the late 1960s shows a pattern of higher lows and higher highs. While copper never traded above the $1.6475 per pound level before 2005, the red nonferrous metal has not traded below that price since 2008. Moreover, copper has been above the $2 level since early 2016 and over $3 per pound since October 2020. While copper corrected from the March 2022 record $5.01 per pound high to $3.15 four months later in July 2022, the long-term bullish trend remains firmly intact.

Copper is the base metals leader

Copper has always been an infrastructure building block leading the other base metals trading on the London Metals Exchange, the world’s leading nonferrous trading platform. While copper futures trade on the CME’s COMEX division, the LME offers more liquidity as it attracts more producer and consumer activity because the three-month forwards allow for hedging and other transactions that settle each business day. Aluminum, nickel, lead, zinc, and tin trade on the LME. While the aluminum and zinc markets may trade more volume than copper, the red metal is the barometer for all industrial metals. Many metals traders consider Dr. Copper the benchmark as it has a Ph.D. in economics and has a history of forecasting economic growth or contraction before other markets follow its lead.

Copper has taken on a new role over the past years, as it is now a crucial component in EVs, wind turbines, and other green energy initiatives. The green applications of the red metal have changed its fundamental equation, increasing the demand side.

China is the world’s leading consumer

Chile remains the world’s 800-pound gorilla in copper production.

Source: Statista

The chart shows that Chile produced almost as much cooper as Peru, DR Congo, and China combined in 2021. While production in the DRC will likely increase, the political instability and previous scandals could prevent the African producer from reaching its potential. China is the fourth-leading copper-producing country, but its consumption is far more than its output.

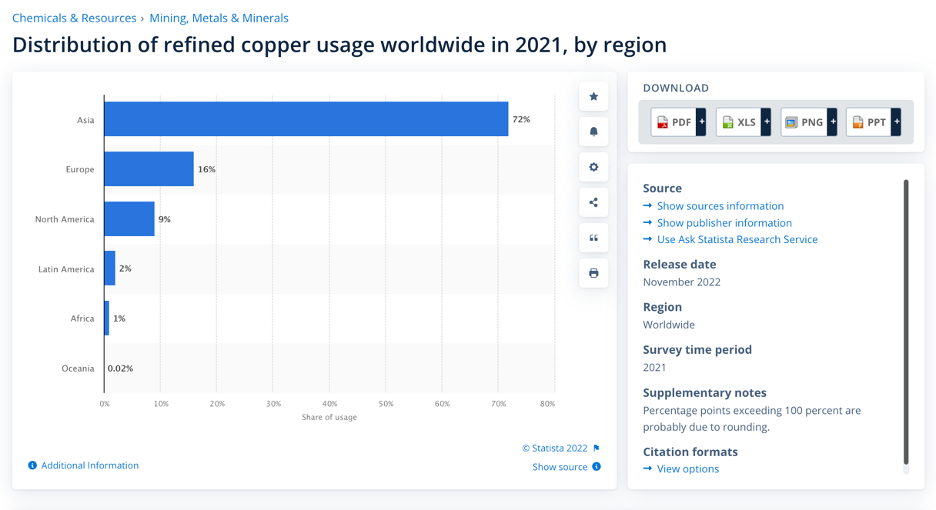

Source: Statista

The chart illustrates that Asia accounted for 72% of the world’s refined copper demand in 2021, and China alone consumed 52% of copper during the year. China continues to build infrastructure as its economy grows, but the increased demand from worldwide green energy initiatives will cause competition for the metal to rise, pushing prices higher over the coming years.

Production struggles to keep pace with the demand

It takes eight to ten years to bring new copper production online. While the leading copper-producing companies, including Freeport McMoRan (FCX), Glencore (GLNCY), BHP Billiton (BHP), Southern Copper (SCCO), and Rio Tinto (RIO), are scouring the earth for new copper deposits, with some venturing into DR Congo despite its scandalous past. Meanwhile, Goldman Sachs points out that:

Sticky supply threatens to deplete copper stocks by mid-decade. Copper is a predominantly long-cycle commodity – it takes 2-3 years to extend an existing mine and as long as 8 years to establish a new greenfield project. This long lead time for the majority of copper supply, combined with the mining sector’s resistance towards new capex, leaves the copper market running out of runway to secure the necessary supply to meet demand in the second half of the decade. Perversely, this means copper prices must rise now to incentivise enough supply to solve prospective deficits, or risk chronic scarcity pricing in the second half of the decade. Copper is so integral to the green transition – a global effort underpinned by government support – that the supply requirements necessitate a spike in copper prices. History has seen many examples of commodities solving similar mid-term depletion risks with extreme nearer-dated price spikes, not least US natural gas and nickel in the early 2000s where projections for severe shortages were countered by significant increases in price and followed by the required supply innovation. Copper, lacking any obvious productivity innovations on the horizon, needs higher prices to stimulate a record set of established short cycle (scrap, demand substitution) and long cycle (mine investment) responses.

The trend in global inventories supports Goldman’s thesis that stocks will not be able to satisfy copper’s growing deficit.

Source: LME/Kitco

The chart of LME copper inventories shows the pattern of lower highs and lower lows over the past five years. On December 16, the LME stocks stood below the 85,000 metric ton level, not far from the recent lows.

CPER with copper below $4 could be a golden opportunity

Goldman’s report suggests copper is on a “necessary path to $15,000” per ton. On December 19, March COMEX copper futures were around the $3.75 per pound level, with LME three-month forwards at $8,516.50 per ton. A $15,000 price would put the COMEX futures at over $6.60 per pound, over 75% higher than the current price. Therefore, at below $4, copper could be on sale.

The most direct route for a risk position in copper is via the COMEX futures and options and the forwards and options on the London Metals Exchange. Copper mining companies tend to offer leverage as they often outperform the metal's percentage gains on the upside but underperform during price corrections.

The U.S. Copper ETF product (CPER) provides an alternative for investors and traders seeking exposure to the base metal without venturing onto the COMEX or LME or taking the leveraged risks of mining shares. At $22.80 on December 19, CPER had $176.227 million in assets under management. CPER trades an average of 99,767 shares daily and charges an 0.88% management fee.

Nearby March copper futures rallied from $3.1425 on July 15 to $3.9470 per pound on November 14, 2022, a 25.6% rise.

Over the same period, CPER appreciated from $19.11 to $23.82 per share or 24.6%. CPER does an excellent job tracking the COMEX and LME copper prices.

One of the ETFs’ drawbacks is copper can make highs or lows during European hours when the U.S. stock market is not operating. CPER only trades during U.S. stock market hours, so it can miss peaks or valleys in the copper price.

The long-term technical trend in copper remains bullish, and supply and demand fundamentals support higher prices over the coming years. Copper could be on sale at below $4 per pound in late 2022.

More Metals News from Barchart

- Dollar Climbs on Weak Stocks and Hawkish Fed Comments

- Stocks Fall as Central Banks Remain Hawkish

- Dollar Rallies on Safe-Haven as Stocks Plunge

- Stocks Plunge as Fed and ECB Signal Higher Interest Rates

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.