Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.

Artificial intelligence (AI)continues to play a pivotal role in business operations across multiple industries. Various companies with the capabilities to do so are taking full advantage of this technology to enhance their product portfolios and strengthen their financials.

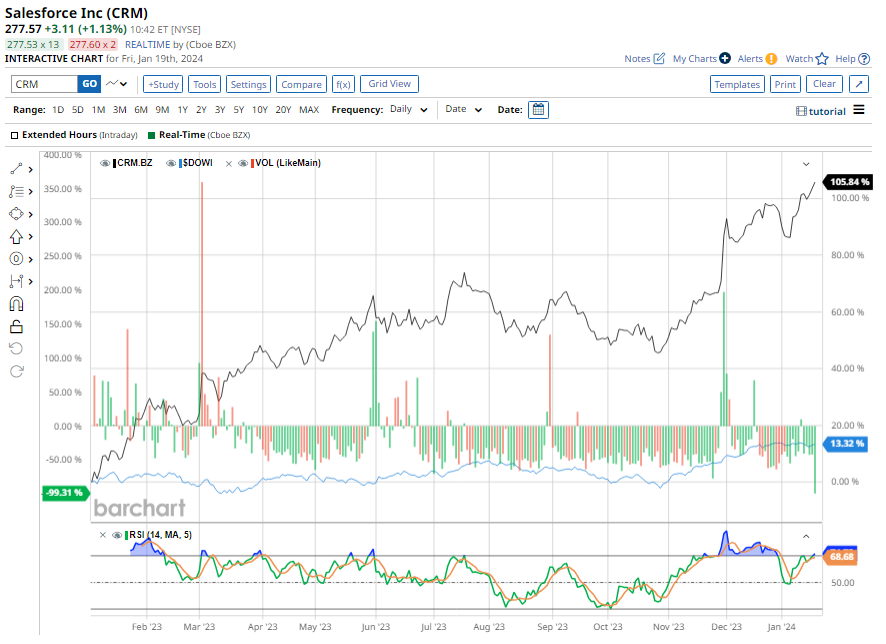

One such company is enterprise software giant Salesforce (CRM), which stood out as the best-performing Dow stock of 2023, thanks to its robust third-quarter results and upbeat outlook. Salesforce stock surged 98.5% during 2023, easily beating the Dow Jones Industrial Average's ($DOWI) return of 10%. It also outperformed the tech-heavy NASDAQ Composite's ($NASX) gain of 45%.

Nevertheless, Wall Street believes Salesforce has more upside in the near future, and many analysts have raised their target prices for CRM stock this month. Let’s find out more.

Salesforce, valued at a market cap of $265.6 billion, is the global leader in customer relationship management (CRM) software. Beyond its core CRM offerings, Salesforce has significantly expanded its product portfolio. With acquisitions like Tableau, Slack for enterprise collaboration, and MuleSoft for integration, Salesforce now provides a comprehensive suite of tools that cater to diverse business needs.

For the third quarter ended Oct. 31, Salesforce revenue came in at $8.72 billion, an 11% increase year-over-year. The company's subscription and support revenues grew 13%, while professional services and other revenues fell 4% from the year-ago quarter.

Diluted earnings per share (EPS) under GAAP (generally accepted accounting principles) jumped a staggering 495.2% to $1.25 in the quarter.

The company's growth prospects are further boosted by strategic partnerships and collaborations. One such strategic partnership is with retailer Williams-Sonoma (WSM), which intends to use Salesforce's offerings in data, marketing, and cloud to improve its customers' shopping experiences.

Salesforce has strategically embraced AI with its Einstein platform. This commitment to AI is a strategic move aimed at providing clients with predictive analytics, automation, and personalized experiences. Williams-Sonoma plans to explore the AI-powered Einstein platform.

Furthermore, CRM has collaborated with Alphabet's (GOOGL) Google to integrate their respective generative AI assistants to boost customer productivity.

Salesforce is expected to report fiscal fourth-quarter 2024 results in February. Management expects revenue to fall between $9.18 billion and $9.23 billion, with EPS landing between $1.26 and $1.27.

For comparison, analysts forecast a 10% year-over-year increase in revenue to $9.2 billion in Q4, along with a GAAP net profit of $1.29 per share, versus a loss of $0.10 in the year-ago quarter. Furthermore, analysts predict Salesforce to report full fiscal year revenue and earnings growth of 11% and 56%, respectively.

Longer-term, analysts forecast revenue and earnings to grow by 10.8% and 16.6%, respectively, year-over-year in fiscal 2025.

As businesses increasingly recognize the value of leveraging AI across CRM tools, Salesforce is well-positioned to capture a larger market share. Priced at 28 times forward 2025 earnings and six times forward sales, Salesforce stock appears reasonably valued for a tech stock with AI prospects.

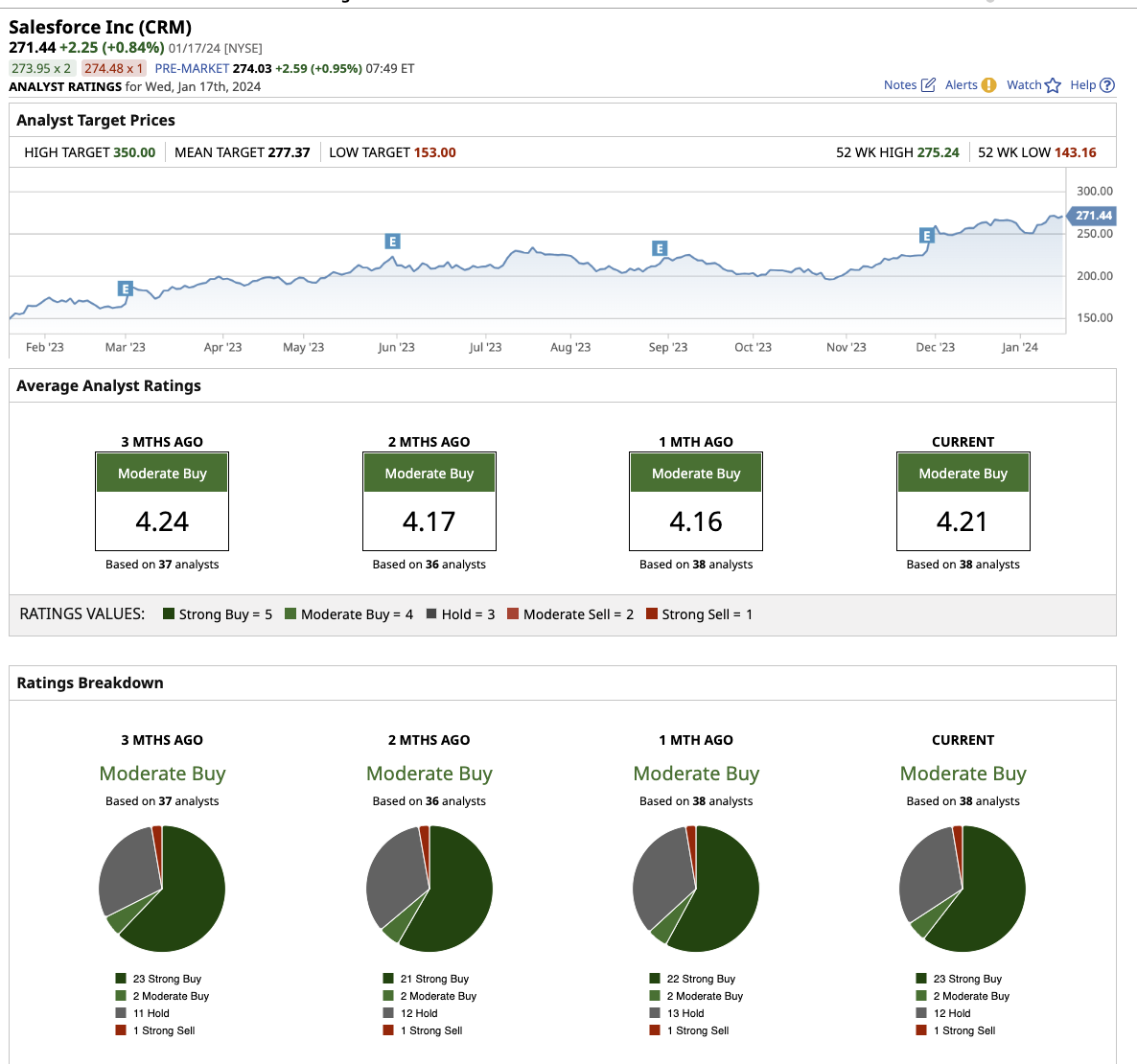

Wall Street, in general, is bullish on Salesforce, rating it a “moderate buy.” Out of the 38 analysts that cover the stock, 23 scream a “strong buy,” while two recommend a “moderate buy,” 12 rate it a “hold,” and one suggests a “strong sell.”

Following its drastic surge in 2023, Salesforce stock is now trading just about even with its average target price of $277.37. However, Goldman Sachs analyst Kash Rangan believes CRM stock can surge as high as $345, which implies a potential upside of 24% from current levels. The analyst believes CRM is pacing to achieve its targets for operating margin and free cash flow, and added, “Despite fears of high-single-digit growth, 4Q guide of 10% growth looks conservative in the context of strong renewals and a large customer win."

Baird analyst Rob Oliver shares the same opinion that there could be more in store for Salesforce this year. The analyst upgraded the stock to “outperform” and increased the target price to $300. He believes the company’s willingness to drive its margins is being underestimated and that there is a chance Salesforce might surprise investors with more revenue growth than estimated.

Just this month, analysts at Oppenheimer, Bernstein, Jefferies, Piper Sandler, and Evercore ISI have all increased their target prices for CRM stock.

Salesforce stock may reach its high target price within the next 12 months, as it currently hovers around the average target price. Its dominance in the CRM market, strategic diversification, commitment to AI, subscription-based revenue model, and global presence all leave it poised for sustained growth in the coming years.

Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.

All market data (will open in new tab) is provided by Barchart Solutions. Copyright © 2024.

Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. For exchange delays and terms of use, please read disclaimer (will open in new tab).