Small- and medium-sized businesses may not see much benefit from the Bank of Canada's most recent interest rate cut, economists say.

Some predict the drop in the Canadian dollar that followed Wednesday’s rate cut could actually prove harmful to the large number of businesses that rely on imports.

After the Bank of Canada announcement to cut the overnight rate by 25 basis points to 0.5 per cent, the loonie fell more than one cent to a six-year low of 77.40 cents (U.S.). This followed January’s surprise BofC rate cut, which also caused the loonie to fall, raising prices for importers.

“More small- and medium-sized businesses in Canada are importers than exporters,” said Ted Mallett, chief economist at the Canadian Federation of Independent Business, “and we’ve already heard from some of them after the January cut that they’ve had to pass the extra cost into their own prices domestically.”

Other businesses are absorbing the costs themselves.

“We are basically riding it out right now,” said Stan Lye, a director at Chemroy, a Brampton, Ont.-based importer of chemical, rubber and organic products. “With the exchange rate going up it’s gotten very expensive to buy.”

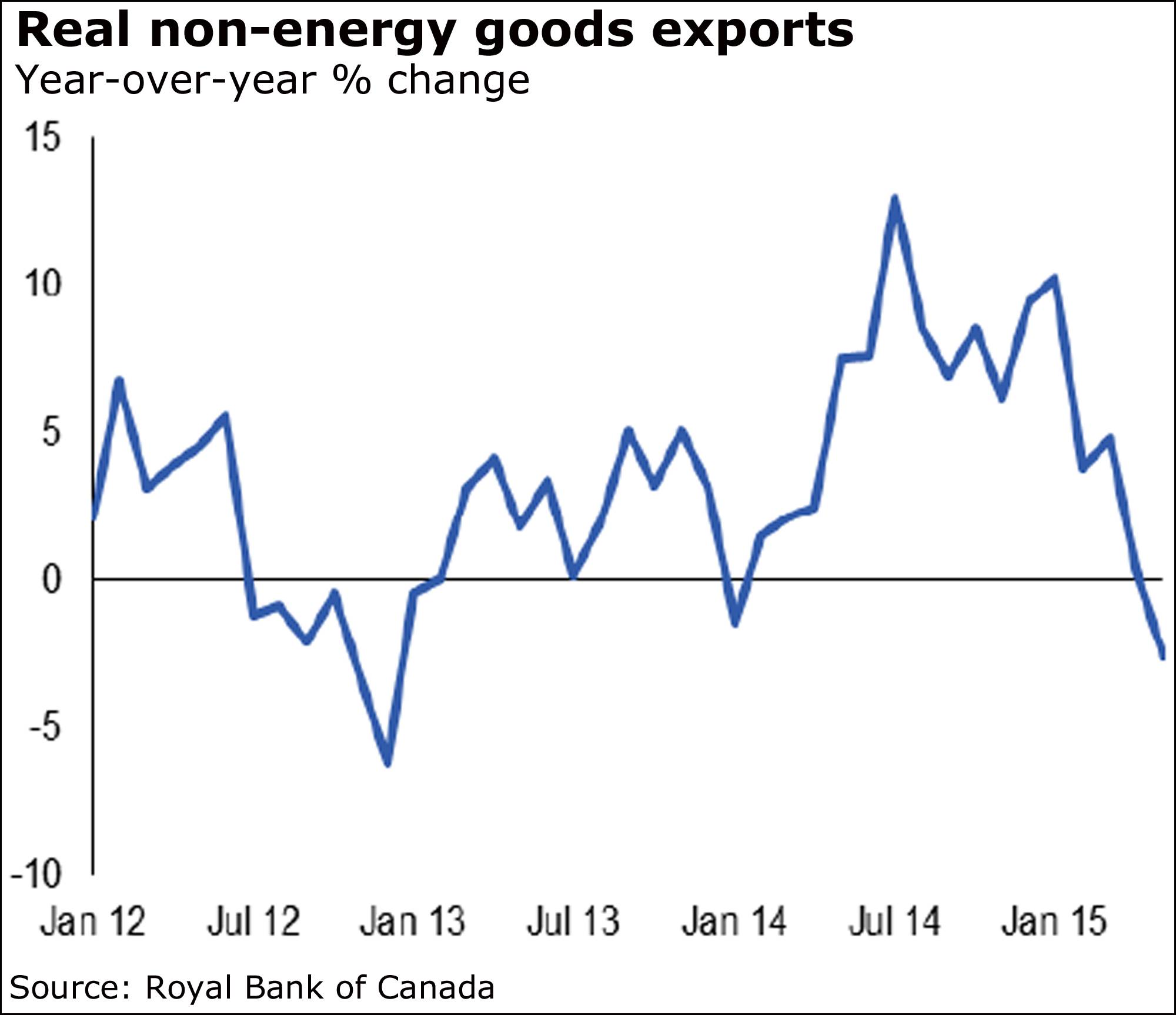

While Bank of Canada Governor Stephen Poloz says interest rate moves aren’t meant to change the value of the dollar, he has been hoping that a weak loonie will boost the economy by making Canadian goods more attractive to foreign buyers.

But the impact so far hasn’t met the hopes of the central bank.

Businesses are still waiting on the United States to show stronger demand, economists say.

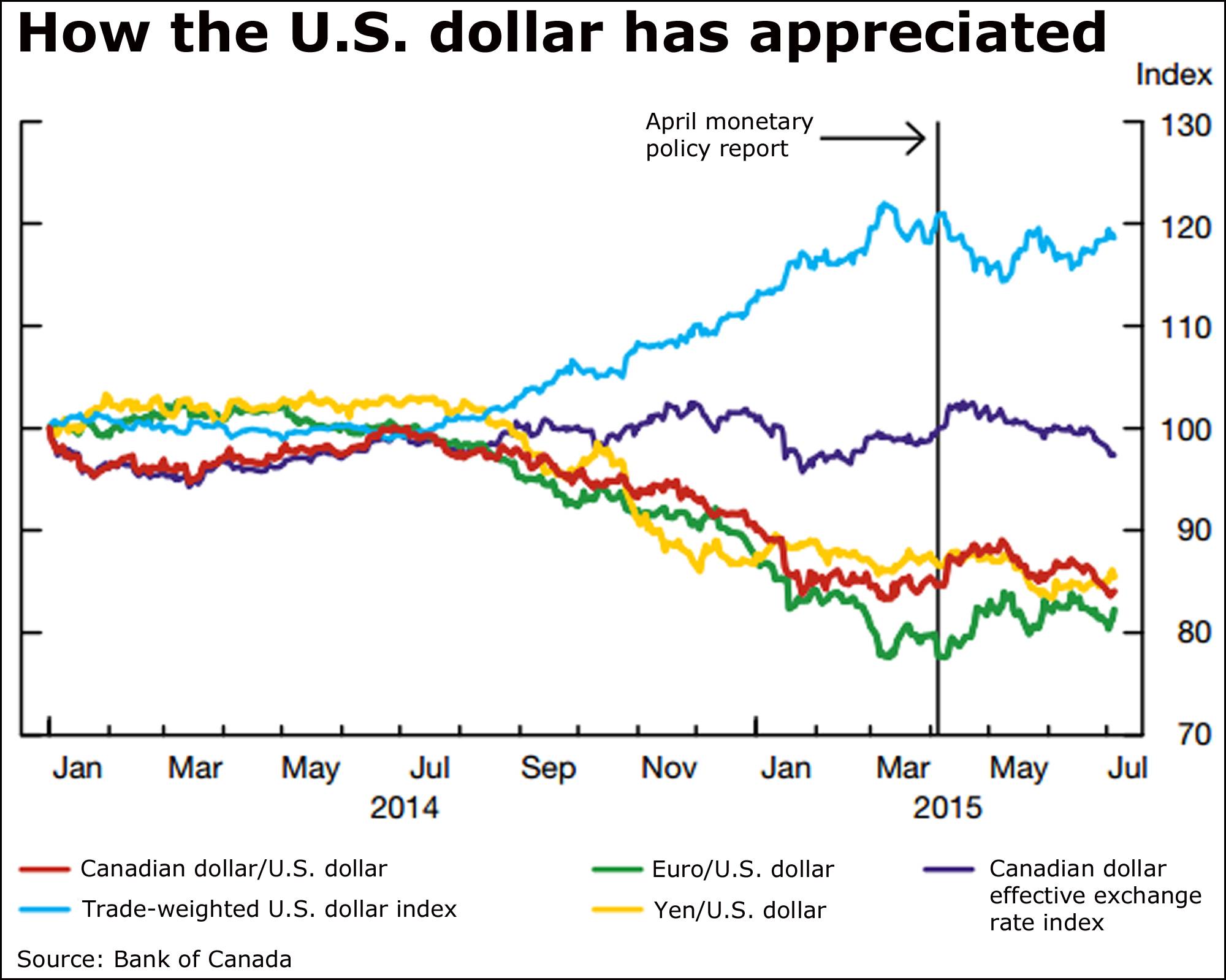

And while the loonie is often talked about in relation to the U.S. dollar, it must also be considered relative to other currencies like the euro.

And while the loonie is often talked about in relation to the U.S. dollar, it must also be considered relative to other currencies like the euro.

“We haven’t moved much against the euro,” said Mike Holden, director of economic policy at the Canadian Manufacturers & Exporters. “It’s been harder to sell into Europe and more difficult to compete with European goods in the U.S. market.”

The majority of Canadian exporters are also in some capacity importers, said Mr. Holden, and their higher import costs will chip away at gains from potential export sales growth. Some exporters also may be locked into long-term pricing contracts, but buy their inputs as needed.

“So they have to swallow the higher input costs themselves without benefitting from the other end,” Mr. Holden noted.

Small businesses do stand to benefit from reduced borrowing costs, but these gains will be minor, Mr. Mallett said. After the January cut of 25 basis points, the banks reduced their lending rates by only 15 basis points.

Again this time, the big banks have cut by 15 basis points.

“The banks are diluting some of the potential impact that the Bank of Canada is trying to infuse into the economy,” Mr. Mallett said.

Many small business owners are waiting to see what happens with the loonie before launching expansion plans.

“Businesses are looking for economic stability before they make decisions to expand or grow,” Mr. Mallett said. “It all depends on expectations of the future and right now there is a lot of uncertainty. There isn’t going to be a rebound if companies don’t see a sustained period of stability first.”