The Canadian equity market continues to conspire against this weekly column, remaining prohibitively expensive in technical terms while offering up a minimal number of oversold trading opportunities.

The S&P/TSX Composite climbed a decent 0.82 per cent Thursday to Thursday, and its Relative Strength Index reading of 66.2 hovers close to the overbought sell signal of 70. While not officially in danger territory, the benchmark is sufficiently extended to keep sane index investors on the sidelines.

The Ned Goodman empire has the unfortunate honour of two spots on the oversold list with Dundee Corp. and Dundee REIT, which fell 2.73 and 0.74 per cent respectively over the past five trading sessions.

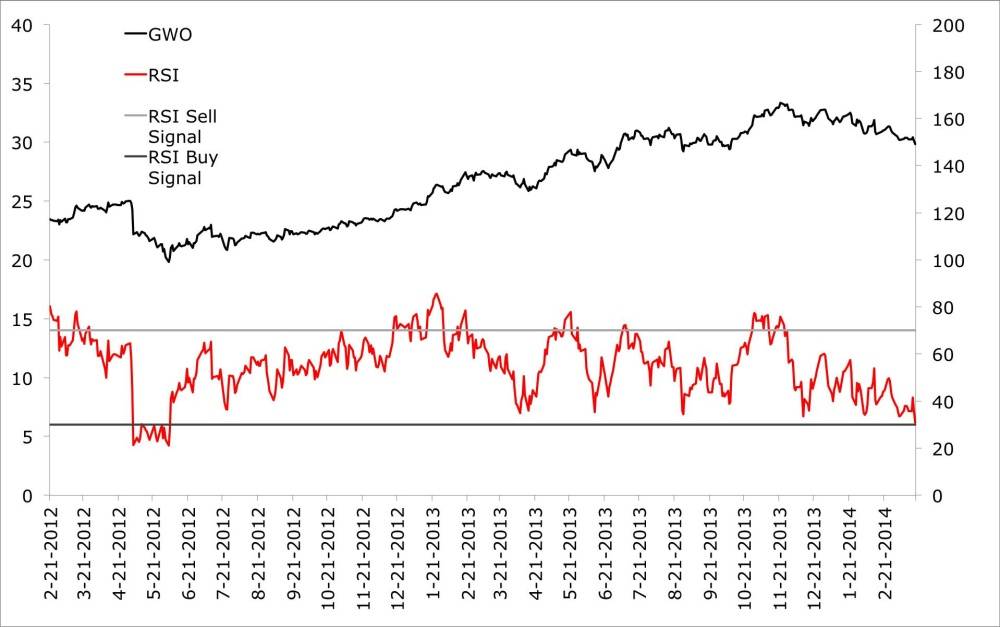

Upheaval in the executive suite makes Great-West Lifeco Inc. the most interesting oversold stock in the benchmark. The stock fell 1.7 per cent over the past week after analyst downgrades by CIBC, TD and RBC.

Negative sentiment surrounds Great-West but, even with the downgrades, the average 12 month price target indicates a nice 12.6 per cent return from current levels. The company's 4.1 per cent indicated dividend yield is nothing to sneeze at and should also protect the stock from further significant downside.

Great-West is our focus chart this week. It's not as oversold now as it was in April of 2012, but the stock's 50 per cent appreciation since then is encouraging nonetheless.

CIBC is now the most overbought, technically extended stock in the S&P/TSX Composite with an RSI of 78. The current management team has done an excellent job de-risking operations, but there will likely be better times to add to holdings of the stock.

Maple Leaf Foods is also overbought which at first glance is a bit of a mystery given the forward price-to-earnings of 143 times.

The usual caveats apply. Technical tools like RSI are effective as part of an overall stock selection process that involves fundamental analysis – they're not enough on their own.

Follow Scott Barlow on Twitter at @SBarlow_ROB.

| Name | Ticker | RSI | 1W Return % | PE Ratio TTM | PE Ratio Fwd |

|---|---|---|---|---|---|

| **OVERSOLD** | |||||

| Dundee Corp -Cl A | DC.A | 23.05 | -2.37 | N/A | N/A |

| Westjet Airlines Ltd | WJA | 24.95 | -4.11 | 11.52 | 11.23 |

| Thompson Creek Metals Co Inc | TCM | 28.34 | -10.90 | N/A | N/A |

| Dundee Real Estate Investm-A | D.UN | 30.06 | -0.74 | 6.80 | 10.32 |

| Great-West Lifeco Inc | GWO | 30.88 | -1.71 | 13.80 | 12.14 |

| **OVERBOUGHT** | |||||

| Can Imperial Bk Of Commerce | CM | 78.06 | 1.32 | 10.93 | 11.10 |

| Altagas Ltd | ALA | 76.84 | 2.02 | 29.39 | 25.24 |

| Firstservice Corp | FSV | 76.34 | 2.81 | N/A | 19.77 |

| Black Diamond Group Ltd | BDI | 76.28 | 5.24 | 26.91 | 18.82 |

| Canadian Energy Services & T | CEU | 74.55 | 12.30 | 52.00 | 29.71 |

| Canadian Utilities Ltd-A | CU | 74.00 | 2.54 | 17.41 | 16.88 |

| Badger Daylighting Ltd | BAD | 73.66 | 9.79 | 34.08 | 27.76 |

| Saputo Inc | SAP | 73.63 | 2.09 | 20.81 | 18.20 |

| Raging River Exploration Inc | RRX | 73.00 | 7.32 | 31.19 | 20.24 |

| Bankers Petroleum Ltd | BNK | 72.85 | 3.76 | 20.37 | 14.88 |

| Maple Leaf Foods Inc | MFI | 72.53 | 4.16 | 141.75 | 123.26 |

| Hudson'S Bay Co | HBC | 72.25 | 4.55 | 15.57 | 27.13 |

| Enerflex Ltd | EFX | 72.09 | 3.59 | 23.34 | 14.36 |

| Vermilion Energy Inc | VET | 72.05 | 5.45 | 24.35 | 20.08 |

| Precision Drilling Corp | PD | 71.63 | 9.75 | 18.99 | 13.99 |

| H&R Real Estate Inv-Reit Uts | HR-UN | 71.11 | 1.29 | 16.21 | 13.27 |

| Toronto-Dominion Bank | TD | 70.69 | 0.64 | 13.72 | 11.97 |

| Baytex Energy Corp | BTE | 70.50 | 4.99 | 33.81 | 18.37 |

| Algonquin Power & Utilities | AQN | 69.84 | 1.69 | 27.96 | 23.66 |