The bad news is the S&P/TSX had a terrible five trading sessions ending with Thursday's close, falling 2.1 per cent in total. The silver lining is that more stocks are technically oversold by Relative Strength Index.

It's not an official ban yet, but I'm going to avoid discussing oversold energy stocks for the time being. The commodity price – which is entirely out of the control of individual energy companies – is just too volatile to expect stocks to bounce merely because they are technically attractive. Last week, I discussed Encana Corp. as a potential opportunity (in my defense, the natural gas price was showing strength at the time) but it got beat up this week to the tune of 4.9 per cent.

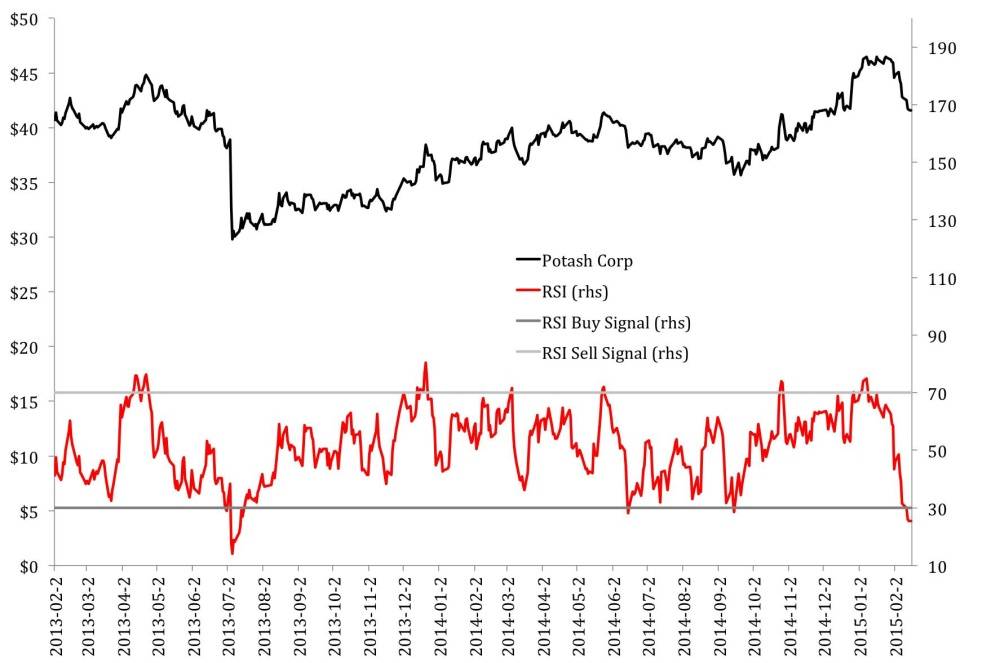

I picked Potash Corp of Saskatchewan for the focus chart this week but it comes with the firm caveat that, while I think it's worth watching, I'm not recommending anyone buy it before doing a lot more homework on their own.

The first thing notable about RSI and Potash stock is that sell signals should be taken very seriously. RSI readings above 70 signalled major declines in April 2013, June of 2014 and January of this year.

There have been five sub-30 buy signals for Potash in the past 24 months. The stock was deeply, deeply oversold in July 2013 before a sustained price rally that lasted 11 months and saw the stock climb almost 40 per cent. The July 2014 sell signal was little help – the stock went sideways-to-slightly-lower in the ensuing three months.

The October sell signal was far more lucrative, successfully identifying a temporary bottom after which the stock climbed 30 per cent.

Switching to overbought, technically vulnerable TSX constituents, Rona Inc. remains surprisingly strong at the top of the list. TMX Group (disclosure: My wife works there), Cott Corp. Superior Plus Corp and Quebecor Inc. are also overbought.

Overall, I'm not convinced this is a good time to jump into the market in search of bargains, no matter what the technicals say. Global markets continue to digest the new strong U.S. dollar environment and the prospect for higher American interest rates. As Bank of Montreal strategist Brian Belski recently noted, the market trends that drove portfolio performance over the past decade were largely dependent on a weak dollar and may be completely exhausted.

Investors should be patient, cautious and diligent in the weeks ahead, taking time with fundamental research and macroeconomic analysis before making any investment decisions.

Follow Scott Barlow on Twitter @SBarlow_ROB.