The S&P/TSX Composite Index climbed a hefty 1.7 per cent for the week ending with Thursday's close. Recent strength has the domestic benchmark approaching overbought, technically vulnerable territory according to Relative Strength Index (RSI), my favoured technical indicator. The current RSI reading is 64.9, not far from the sell signal of 70.

There is only one S&P/TSX Composite stock trading in official oversold, technically attractive territory using RSI, Hudson's Bay Co. The stock however, is only barely oversold – the RSI reading is 29.4, just under the 30 buy signal. Hudson's Bay is also trading well below its 200-day moving average, and, as we've discussed previously, RSI buy signals are less reliable when this is the case.

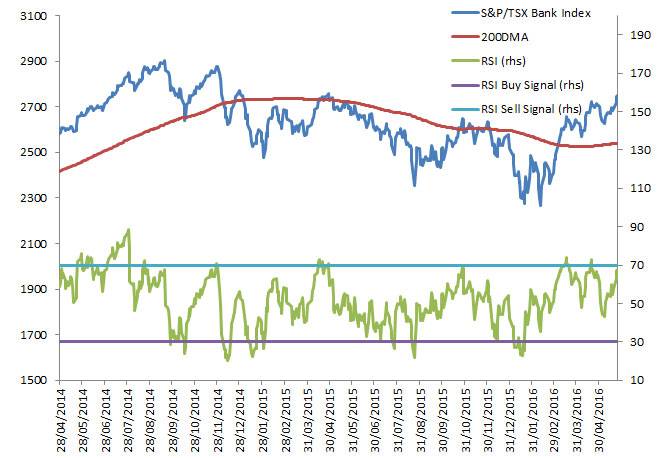

I went a bit off the board and made the S&P/TSX Bank Index the focus chart after most of the sector reported earnings this week. The bank index is closer to overbought than oversold – thanks to generally solid profit results – and recent trends suggest investors should take this seriously.

I should note that RSI is a short-term indicator best suited to traders with short-time horizons, or investors who have already decided to buy a stock and are waiting for the best entry point. The numbers change fast – a stock can go from overbought and technically vulnerable to oversold and technically attractive on a week over week basis.

The RSI for the S&P/TSX Bank index is 67.7, just over two points away from overbought territory. The last two times the index was overbought, March and April of this year, declines of 2.3 per cent and 3.6 per cent followed.

The table of overbought S&P/TSX Composite stocks below shows that only one bank, Royal Bank, is officially in overbought territory with an RSI above 70. Investors intending to buy Royal should probably wait a few days until it's less overbought.

The usual caveats apply. Technical indicators like RSI have proven effective in uncovering solid entry points and the best times to take profits, but technical analysis is not enough on its own. Market participants should complete fundamental research before buying or selling any asset

Follow Scott Barlow on Twitter @SBarlow_ROB.