My warnings last week about frothy conditions in the S&P/TSX Composite Index finally proved useful as the benchmark lost 1.0 per cent for the trading week ending with Thursday's close.

The TSX is no longer technically overbought, according to Relative Strength Index (RSI), with a current reading of 56 that is well below the sell signal of 70.

There are seven oversold, technically attractive benchmark constituents – trading with RSI levels below the buy signal of 30 – this week led by Hudson's Bay Co. yet again. Gildan Activewear Inc. is the only other non-energy name on the oversold list.

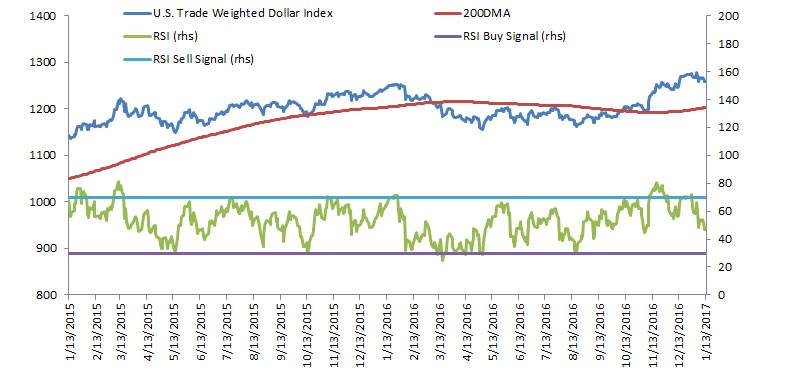

I went off the board and picked the trade-weighted U.S. dollar index as the focus chart this week. The greenback is hugely important at the moment as a reflection of U.S. economic growth expectations, bond yields, and commodity prices.

The effectiveness of RSI in predicting changes in the dollar index follows a similar pattern to many Canadian stocks – buy signals work well as long as the price level stays above the 200-day moving average (where it is now).

RSI buy signals in May and October, 2015, proved profitable entry points for investors buying dollar assets as significant rallies followed. But the index fell below the 200-day moving average in March of 2016 and remained mired in oversold territory without any meaningful rally. In October of 2016, the dollar index climbed above the 200-day, retested the trendline shortly thereafter and has remained well above it since.

The index has not been oversold since the summer of 2016 and currently stands in neutral technical territory. The RSI sell signal of 70 has been the more important indicator in recent months. The dollar was significantly overbought in November and also hit the sell signal in December. Mild corrections followed.

I will continue to follow the technical outlook for the U.S. trade-weighted dollar index. It looks to be rolling over a little bit as U.S. economic optimism wanes. Things will get really interesting if the index threatens its 200-day moving average. The recent rally in high beta, riskier asset classes, like U.S. small caps, financials and industrial metals, will be questioned.

Back to domestic equity markets, there are eight overbought, technically vulnerable stocks according to RSI. Uranium miner Cameco Corp. is the most overbought stock in the S&P/TSX Composite followed by Milestone Apartment REIT, Firstservice Corp., Capital Power Corp. and Bombardier Inc.-B.

The usual caveats apply. Technical analysis is an important tool but fundamental research should be completed before any market transactions occur.

Follow Scott Barlow on Twitter @SBarlow_ROB.