Chegg Inc(CHGG-N)NYSE

Chegg (NYSE:CHGG) Reports Q1 In Line With Expectations But Stock Drops

Online study and academic help platform Chegg (NYSE:CHGG) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 7.1% year on year to $174.4 million. On the other hand, next quarter's revenue guidance of $160 million was less impressive, coming in 7.8% below analysts' estimates. It made a non-GAAP profit of $0.26 per share, down from its profit of $0.27 per share in the same quarter last year.

Is now the time to buy Chegg? Find out by accessing our full research report, it's free.

Chegg (CHGG) Q1 CY2024 Highlights:

- Revenue: $174.4 million vs analyst estimates of $174.1 million (small beat)

- EPS (non-GAAP): $0.26 vs analyst estimates of $0.25 (5.6% beat)

- Revenue Guidance for Q2 CY2024 is $160 million at the midpoint, below analyst estimates of $173.6 million

- Gross Margin (GAAP): 73.3%, in line with the same quarter last year

- Free Cash Flow of $25.3 million, down 51.1% from the previous quarter

- Services Subscribers: 4.7 million, down 400,000 year on year

- Market Capitalization: $721.1 million

“Nathan has been core to Chegg’s success from our earliest days as a textbook rental company, to leveraging AI today to create a truly personalized learning assistant,” said Dan Rosensweig, CEO & President of Chegg, Inc.

Started as a physical textbook rental service, Chegg (NYSE:CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Sales Growth

Chegg's revenue growth over the last three years has been unimpressive, averaging 0.3% annually. This quarter, Chegg reported a year on year revenue decline of 7.1%, in line with analysts' estimates.

Chegg is expecting next quarter's revenue to decline 12.5% year on year to $160 million, a further deceleration from the 6.1% year-on-year decrease it recorded in the comparable quarter last year. Before the earnings results were announced, analysts were projecting revenue to decline -1.9% over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Usage Growth

As a subscription-based app, Chegg generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Chegg has been struggling to grow its users, a key performance metric for the company. Over the last two years, its users have declined 1.7% annually to 4.7 million. This is one of the lowest rates of growth in the consumer internet sector.

In Q1, Chegg's users decreased by 400,000, a 7.8% drop since last year.

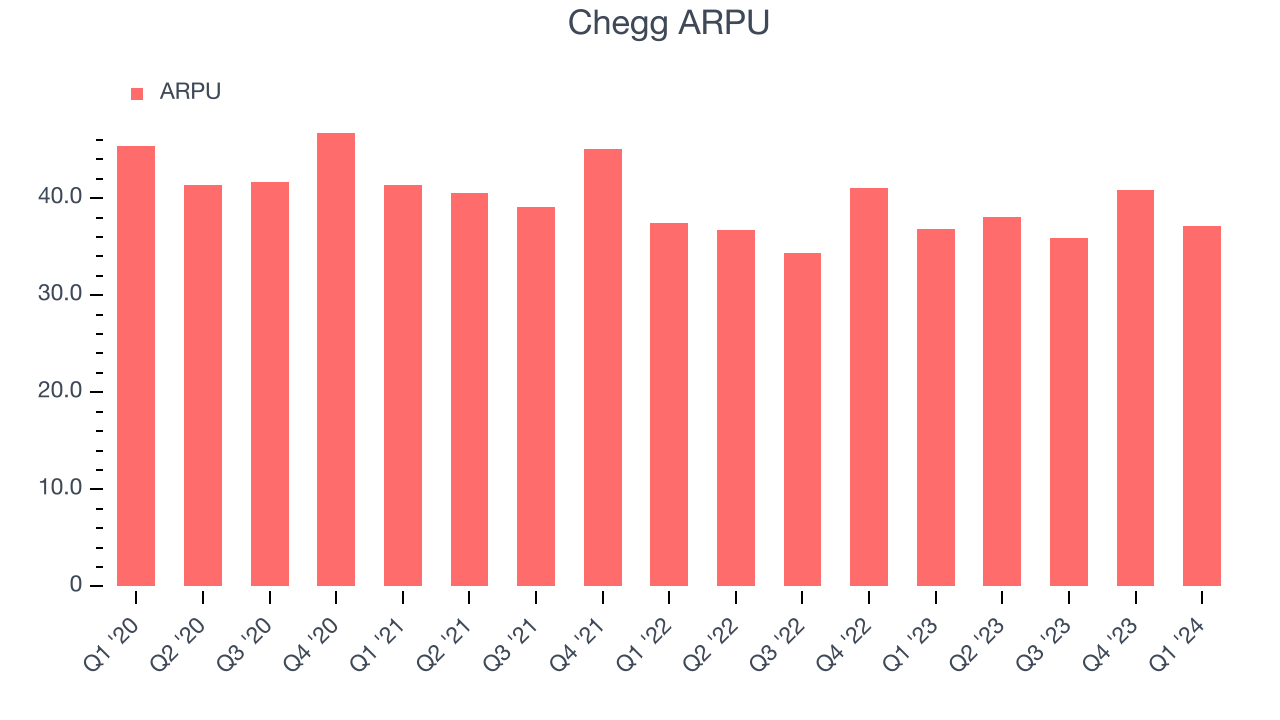

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Chegg because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Chegg's ARPU has declined over the last two years, averaging 3%. On top of that, its users have also shrunk, indicating that the business is encountering some serious problems. This quarter, ARPU grew 0.8% year on year to $37.10 per user.

Key Takeaways from Chegg's Q1 Results

We struggled to find many strong positives in these results. Its revenue and subscribers were in line with expectations while its EPS and EBITDA slightly beat. More importantly, next quarter's revenue and EPS missed analysts' estimates, driving the stock lower. The weak guidance was triggered by a worse-than-expected outlook for its subscription revenue, which has higher margins than its other revenue streams. Overall, this was a mediocre quarter for Chegg. The company is down 6.5% on the results and currently trades at $6.71 per share.

Chegg may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.