Warren Buffett took control of Berkshire Hathaway(NYSE: BRK.A)(NYSE: BRK.B) in 1965. He quickly shifted its focus from textiles to insurance, creating consistent cash flow in the form of insurance premiums, and he has invested that capital to great effect over the years. Berkshire stock has returned 19.8% annually under Buffett's leadership, nearly doubling the return of the S&P 500(SNPINDEX: ^GSPC).

Today, Berkshire is worth $850 billion, and a significant portion of that sum is attributable to its $361 billion stock portfolio. Buffett reportedly manages 90% of that total, while fellow investment managers Todd Combs and Ted Weschler oversee the remaining portion. Berkshire does not disclose which managers are responsible for specific investments, but it seems likely that Buffett controls the largest positions.

With that in mind, Berkshire has more than $10 billion invested in the seven stocks listed alphabetically below. Beside each stock is Wall Street's median price target and the implied upside compared to its share price on April 16, 2024.

- American Express(NYSE: AXP): $234 per share (7.2% upside).

- Apple(NASDAQ: AAPL): $200 per share (18.1% upside).

- Bank of America(NYSE: BAC): $39 per share (12.5% upside).

- Chevron(NYSE: CVX): $180 per share (15.2% upside).

- Coca-Cola(NYSE: KO): $66.50 per share (14.5% upside).

- Kraft Heinz(NASDAQ: KHC): $39.50 per share (7.9% upside).

- Occidental Petroleum(NYSE: OXY): $70 per share (4.8% upside).

Wall Street sees upside in all seven stocks listed above, but the median price targets position Apple as the best best right now. That is noteworthy because Apple is by far Berkshire's largest holding. It accounts for 42% of its portfolio, a clear sign that Buffett has great confidence in the consumer electronics company.

Is Apple stock a worthwhile investment right now?

Apple reported mixed results in the December quarter

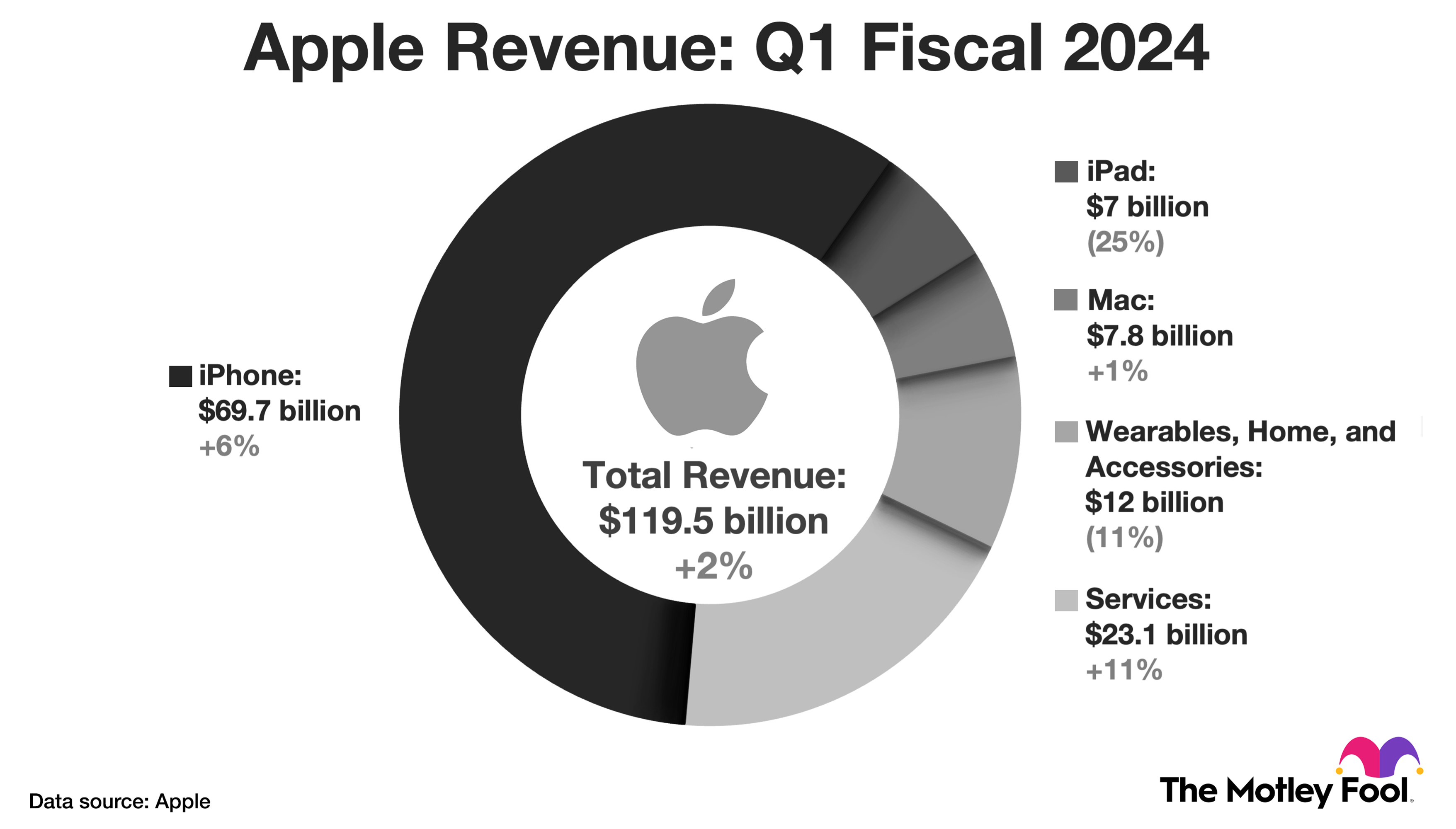

Apple reported first-quarter financial results that beat Wall Street's expectations on the top and bottom lines, but the performance itself was mixed. Total revenue increased just 2% to $119.5 billion on modest sales growth in the iPhone and services categories, offset by declines in the iPad and wearables categories.

Meanwhile, generally accepted accounting principles (GAAP) net income jumped 16% to $2.18 per diluted share due to disciplined cost management, stock buybacks, and a revenue mix shift toward high-margin services. The chart below provides more detail on first-quarter revenue growth across each product category.

The chart above shows Apple's revenue across individual product categories in the first quarter of fiscal 2024, which ended Dec. 31, 2023.

Looking ahead, the investment thesis for Apple centers on its ability to not only maintain its strong presence in several consumer electronics verticals, especially smartphones, but also to monetize its installed base with adjacent services. When I say services, I am referring to revenue from iCloud storage, App Store fees, advertising, subscription products like Apple TV+, and financial products like Apple Pay.

To elaborate, Apple has an installed base that exceeds 2.2 billion devices, a testament to its brand authority. That should keep the company at the forefront of consumer electronics. However, consumers purchase devices infrequently and hardware earns lower margins than software and services. As such, Apple has a more sustainable and profitable growth opportunity in its services business.

Apple is beset by challenges in China and Europe

Apple is facing tough competition from Chinese smartphone companies like Huawei and Xiaomi. iPhone shipments declined 9.6% in the March quarter, and Apple lost more than three points of market share, according to the International Data Corp (IDC). That is especially concerning because total smartphone shipments increased 7.8% during the quarter, with all market share gains going to Chinese competitors.

Apple is also facing headwinds from the Digital Markets Act (DMA) in Europe, recent legislation forcing the company to allow third-party app stores on its devices. Apple has historically had a strong presence in the mobile application market. Its App Store earned twice as much revenue as the closest competitor last year, and it accounted for 50% of mobile application spending. However, the DMA could weaken its grip on the market by letting developers bypass its transaction fees and distribute mobile applications through alternative platforms.

The DMA also poses another problem. Apple ranked among the fastest-growing advertising companies in the world last year, and search ads (in the App Store) were the largest source of advertising revenue. But the DMA could weaken Apple's grip on that market by making the App Store less consequential. In other words, developers will probably spread their advertising dollars across third-party platforms as they become popular with European consumers.

Apple stock looks expensive compared to Wall Street's earnings forecast

Wall Street analysts expect Apple to grow earnings per share at 10.2% annually over the next five years. That consensus estimate makes its current valuation of 26.3 times earnings look expensive, especially when headwinds across China and Europe could lead to slower-than-expected earnings growth.

As mentioned, Warren Buffett has 42% of Berkshire Hathaway's stock portfolio invested in Apple, which screams high conviction. However, I doubt Apple can outperform the S&P 500 over the next five years based on its current valuation. Personally, I would avoid this stock right now.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, and Chevron. The Motley Fool recommends Kraft Heinz and Occidental Petroleum. The Motley Fool has a disclosure policy.