Workday Inc(WDAY-Q)NASDAQ

Workday (NASDAQ:WDAY) Q3 Sales Beat Estimates

Finance and HR software company Workday (NASDAQ:WDAY) beat analysts' expectations in Q3 FY2024, with revenue up 16.7% year on year to $1.87 billion. It made a non-GAAP profit of $1.56 per share, improving from its profit of $0.99 per share in the same quarter last year.

Is now the time to buy Workday? Find out by accessing our full research report, it's free.

Workday (WDAY) Q3 FY2024 Highlights:

- Revenue: $1.87 billion vs analyst estimates of $1.85 billion (1.1% beat)

- Calculated Billings: $1.76 billion slight miss vs. estimates of $1.78 billion

- EPS (non-GAAP): $1.56 vs analyst estimates of $1.41 (10.8% beat)

- Full year guidance raised for subscription revenue and non-GAAP operating margin

- Free Cash Flow of $392.3 million, similar to the previous quarter

- Gross Margin (GAAP): 76.1%, up from 72.7% in the same quarter last year

"Workday delivered a strong quarter, demonstrating how organizations across industries and geographies are continuing to place their trust in Workday," said Carl Eschenbach, co-CEO, Workday.

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Finance and Accounting Software

Finance and accounting software benefits from dual trends around costs savings and ease of use. First is the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software. Second is the consumerization of business software, whereby multiple standalone processes like supply chain and tax management are aggregated into a single, easy to use platforms.

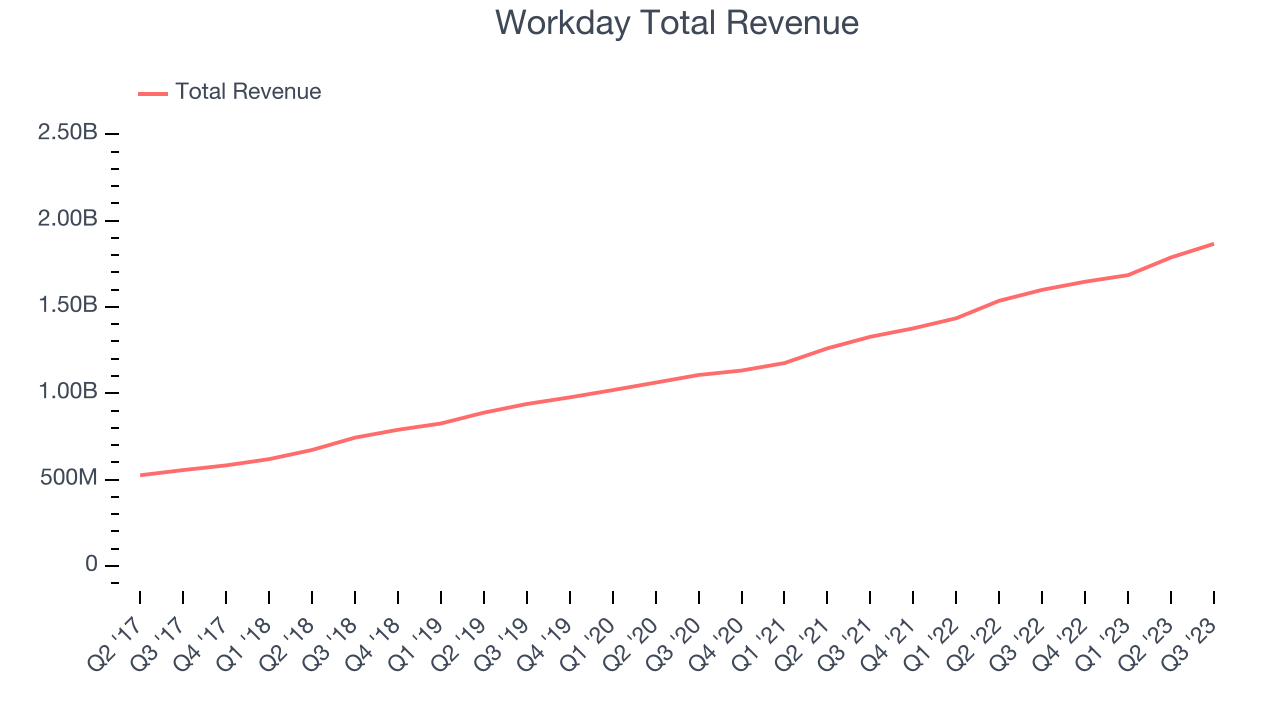

Sales Growth

As you can see below, Workday's revenue growth has been solid over the last two years, growing from $1.33 billion in Q3 FY2022 to $1.87 billion this quarter.

This quarter, Workday's quarterly revenue was once again up 16.7% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $78.91 million in Q3 compared to $102.5 million in Q2 2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Looking ahead, analysts covering the company were expecting sales to grow 16.2% over the next 12 months before the earnings results announcement.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Workday's free cash flow came in at $392.3 million in Q3, up 12.1% year on year.

Workday has generated $1.59 billion in free cash flow over the last 12 months, an impressive 23% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Key Takeaways from Workday's Q3 Results

With a market capitalization of $61.79 billion, a $6.88 billion cash balance, and positive free cash flow over the last 12 months, we're confident that Workday has the resources needed to pursue a high-growth business strategy.

We were also happy its revenue narrowly outperformed Wall Street's estimates despite a slight billings miss. A beat on non-GAAP operating income shows that expense control is solid and outperformance on the free cash flow line was also welcome. It was also encouraging that the company raised its full year outlook for both subscription revenue and non-GAAP operating margin. Zooming out, we think this was a decent quarter, showing that the company is staying on target. The stock is up 3.7% after reporting and currently trades at $246.25 per share.

So should you invest in Workday right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.