If the federal Liberals' first budget was about putting their stamp on a new era in Canadian politics, the second will likely be more subdued.

With little wiggle room for spending, Finance Minister Bill Morneau is expected to shed light on many of the party's established priorities: jobs, innovation and infrastructure.

"Our budget will be very much about trying to increase jobs in this country, to create opportunities for people today, for their children and for their grandchildren," Mr. Morneau has said.

A stay-the-course document would also give the Liberals time to assess a political and economic climate that is vastly different from a year ago.

Then, Hillary Clinton was the presumptive favourite in the U.S. presidential election and the Trans-Pacific Partnership seemed on its way toward ratification.

Now, Donald Trump is President and TPP is dead. Moreover, Ottawa could find itself at the bargaining table later this year to renegotiate the North American free-trade agreement, a challenging task with potentially far-reaching impacts on the economy.

With that in mind, here are six things to look for on Wednesday.

The deficit

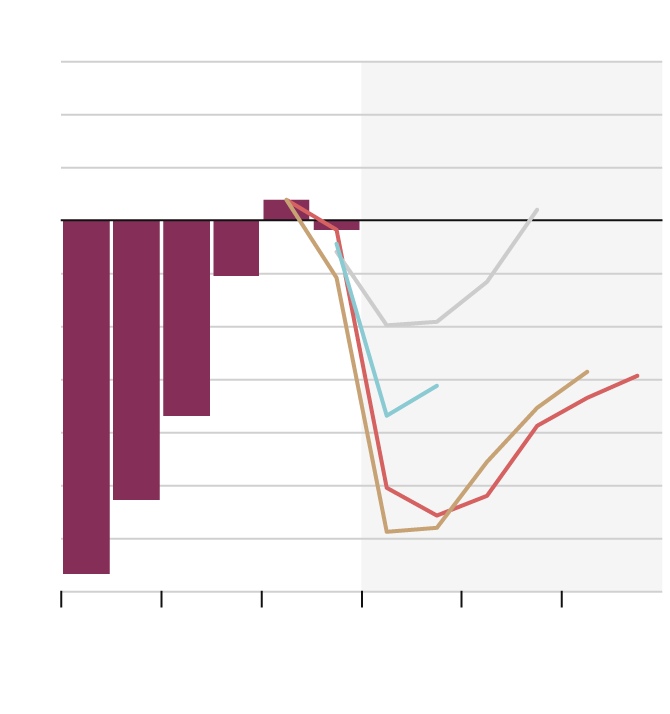

Federal budget balances, by fiscal year

$15

In billions

Projections

10

Liberal Party

platform 2015

5

0

-5

March ‘16

budget

-10

Feb. ‘16

update

-15

-20

-25

Nov. ‘16

update

(current proj.)

-30

-35

FY

2010

2012

2014

2018

2020

2016

THE GLOBE AND MAIL, SOURCE: DEPARTMENT OF FINANCE,

RBC ECONOMICS RESEARCH

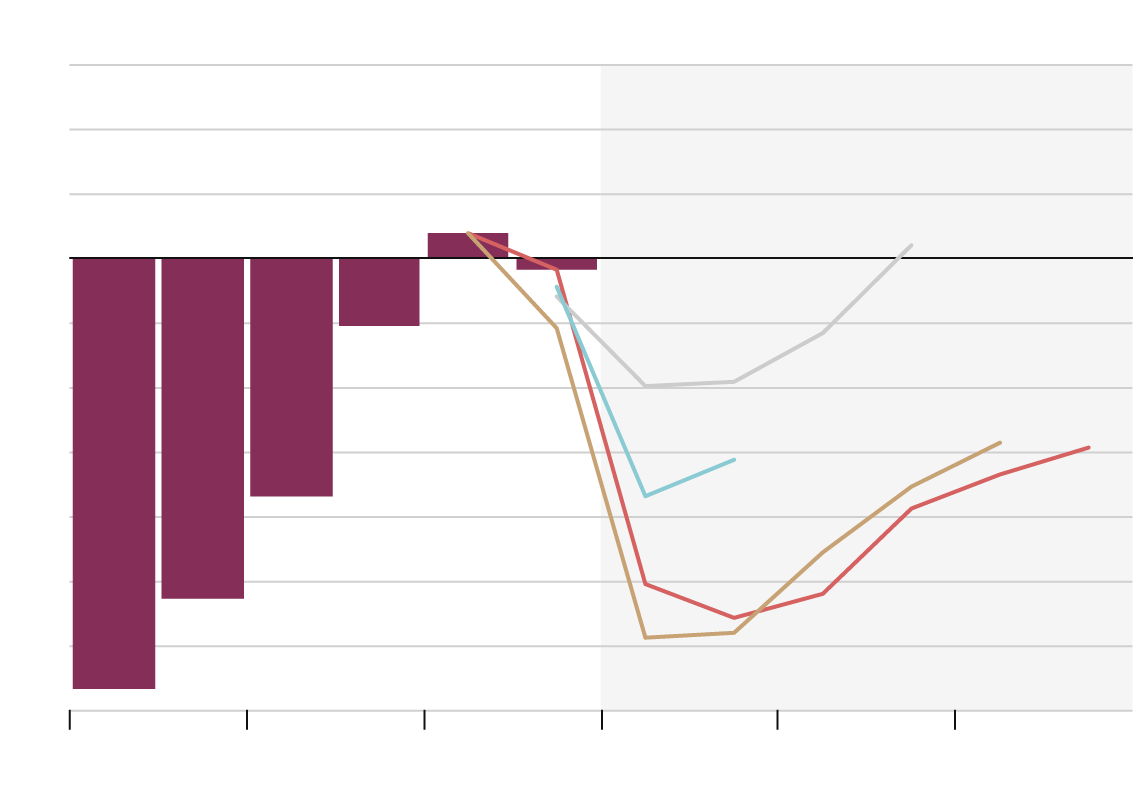

Federal budget balances, by fiscal year

$15

In billions

Projections

10

Liberal Party

platform 2015

5

0

-5

March 2016

budget

-10

Feb. 2016

update

-15

-20

-25

Nov. 2016 update

(current proj.)

-30

-35

FY

2010

2012

2014

2018

2020

2016

THE GLOBE AND MAIL, SOURCE: DEPARTMENT OF FINANCE,

RBC ECONOMICS RESEARCH

Federal budget balances, by fiscal year

$15

In billions

Projections

10

Liberal Party

platform 2015

5

0

-5

March 2016

budget

-10

Feb. 2016

update

-15

-20

Nov. 2016 update

(current proj.)

-25

-30

-35

FY 2010

2012

2014

2018

2020

2016

THE GLOBE AND MAIL, SOURCE: DEPARTMENT OF FINANCE, RBC ECONOMICS RESEARCH

During the 2015 federal election campaign, the Liberals repeatedly hammered a pledge they would run deficits no greater than $10-billion a year, and would balance the budget in time for the next election. The Liberals abandoned these pledges, citing sluggish economic growth. Mr. Morneau is now targeting a reduction of the federal debt-to-GDP ratio.

Projections published by the Department of Finance last fall put the overall deficit at around $25-billion for the next few years, adding $130-billion to the federal debt by 2022. "While the federal debt-to-GDP ratio will remain low relative to other G7 countries, Canada compares less favourably to the handful of other AAA-rated countries," Royal Bank of Canada economists warned in a recent report.

Economists also expect to see the return of the "fiscal cushion," a contingency fund in the budget to offset risks and unforeseen changes in the economy. The Liberals axed the cushion during the 2016 fall update. Adding it back into their budget forecasts "would push the deficit profile up an additional $6-billion or so throughout the forecast horizon," according to RBC.

Skills training

Skills training is likely to play a key part in Wednesday's budget.

Job growth has been robust in recent months, but the Canadian economy is hardly immune to colossal forces that are reshaping labour markets, as new technologies displace workers and hollow out communities. Nearly 42 per cent of Canadian workers are at "high risk" of being affected by automation over the next one to two decades, the Brookfield Institute for Innovation + Entrepreneurship at Ryerson University concluded in a 2016 report.

The downsides of automation are seen as contributing to public anger, which Prime Minister Justin Trudeau blames on corporate and government elites. "It's time to pay a living wage, to pay your taxes, and to give your workers the benefits – and peace of mind – that come with stable, full-time contracts," he said last month in a speech.

Despite overall employment gains since the Great Recession, job quality is a lingering concern. Wage growth is sluggish and employment gains have been driven by services jobs, which typically pay less than positions in the goods-producing sector. Since the outset of 2008, part-time job growth has outpaced that of full-time positions in percentage terms.

Canada Infrastructure Bank

The federal government is expected to offer further details of its planned Canada Infrastructure Bank, an initiative to marry public and private funds for large, revenue-generating infrastructure projects.

Ottawa will commit at least $35-billion in funding, with an aim of attracting private capital that is several times greater. Toronto-Dominion economists recently wrote that "on its face, this would deliver a much-needed boost to Canada's aging system of infrastructure." The above chart, a version of which was included in last year's fall economic update, outlines how a $500-million project could be financed under the bank.

Infrastructure spending was a key plank of the federal Liberals' platform in the last election campaign; as such, the government plans to spend $187-billion on infrastructure over the next 12 years. However, the Parliamentary Budget Officer and a Senate committee say funds have been slow to trickle out.

Housing

Teranet House Price index

for six major cities

260

Index, 2005 = 100

Vancouver

240

220

Toronto

200

180

160

140

120

100

Composite 6

index

80

2006

2008

2010

2012

2014

‘16

THE GLOBE AND MAIL, SOURCE: TERANET

Teranet House Price index for six major cities

Index, 2005 = 100

260

Vancouver

240

220

Toronto

200

180

160

140

120

100

Composite 6

index

80

2006

2008

2010

2012

2014

2016

THE GLOBE AND MAIL, SOURCE: TERANET

Teranet House Price index for six major cities

260

Index, 2005 = 100

Vancouver

240

220

Toronto

200

180

160

140

120

100

Composite 6

index

80

2006

2008

2010

2012

2014

2016

THE GLOBE AND MAIL, SOURCE: TERANET

Though it's far from certain it'll be addressed in the budget, Canada's frenzied housing market is definitely on Mr. Morneau's mind.

Ottawa tightened its rules around mortgages and home ownership in October of last year, and while it may be too soon for the Liberals to tinker further with the real estate sector, it's becoming clear that low interest rates and the government's efforts to cool mortgage borrowing have driven Canadians to take on debt elsewhere.

The result? Canadians' household-debt-to-disposable-income ratio reached a record high 167 per cent in the fourth quarter of 2016. As housing prices continue to soar in Canada's largest cities, Ottawa is under scrutiny to bring the housing market under control.

Economists don't see the housing market cooling down anytime soon, however. "In light of mortgage rates remaining low and mortgage regulation changes having negligible impact on home demand, there appears to be no visible brake that would stop this train in this year," said Toronto-Dominion Bank economist Diana Petramala in a recent note.

Child care

Ottawa is expected to make a long-term funding commitment to daycare, The Canadian Press reported last week, noting the federal government has restarted child-care talks with the provinces.

Child-care fees can put a considerable strain on family finances. In a 2016 report, the Canadian Centre for Policy Alternatives noted a middle-income family living in Toronto with an infant and three-year-old would face a monthly bill of nearly $3,000 for regulated child care if they found spots. Likewise, nearly one-third of respondents to a Globe survey on household finances last year were paying for daycare, at an average monthly rate of $975, and with many paying more than double that amount.

Last year's budget unveiled details of the Canada Child Benefit, which the Liberals said would allow nine out of 10 families to receive more in benefits than under the previous system.

"In general, families who were previously eligible for the old system, and who continue to be eligible for the new system, will see their annual federal transfer increase from an average of $4,439 to $5,493," the Parliamentary Budget Officer said in a report. The PBO cited two factors for the increase: higher spending under the new system and a declining number of families eligible for monthly payments.

Tax reform

Capital gains tax scenarios

Investor A is an Ontarian in the top tax bracket

with a capital gain of $100,000. Here’s how that

gain would be taxed under current rules, along

with inclusion rates of two-thirds and

three-quarters.

Tax owing on capital gain

Capital gain pocketed after tax

$100,000

$26,765

Current rule

Two-thirds

inclusion rate

$35,687

Three-quarters

inclusion rate

$40,148

THE GLOBE AND MAIL, SOURCE: AUTHORS’ CALCULATIONS

Capital gains tax scenarios

Investor A is an Ontarian in the top tax bracket with a

capital gain of $100,000. Here’s how that gain would be

taxed under current rules, along with inclusion rates of

two-thirds and three-quarters.

Tax owing on capital gain

Capital gain pocketed after tax

$100,000

$26,765

Current rule

Two-thirds

inclusion rate

$35,687

Three-quarters

inclusion rate

$40,148

THE GLOBE AND MAIL, SOURCE: AUTHORS’ CALCULATIONS

Capital gains tax scenarios

Investor A is an Ontarian in the top tax bracket with a capital gain of $100,000.

Here’s how that gain would be taxed under current rules, along with inclusion

rates of two-thirds and three-quarters.

Tax owing on capital gain

Capital gain pocketed after tax

$100,000

$26,765

Current rule

Two-thirds

inclusion rate

$35,687

Three-quarters

inclusion rate

$40,148

THE GLOBE AND MAIL, SOURCE: AUTHORS’ CALCULATIONS

Will the budget target wealthy Canadians?

Rumours are floating around Bay Street of a potential shakeup to taxation of capital gains. Currently, the capital gains inclusion rate sits at 50 per cent – meaning, Ottawa taxes half of the profits Canadians earn on the sale of capital property, such as stocks, bonds, cottages or land. (Capital gains in a registered account, such as a tax-free savings account or a registered retirement savings plan, are either tax-free or tax-deferred.)

Hiking the inclusion rate to two-thirds or three-quarters would deal a direct blow to primarily wealthier Canadians, but could raise billions of dollars in additional revenue for the government. That said, there's skepticism the Trudeau government will take such action.

"That move could be hard to square with the government's billing of the document as an innovation budget, given that some sectors use stock-based compensation to attract talent," RBC economists recently wrote.

Still, many investors are spooked. Bank of Montreal economists are "fielding plenty of questions," chief economist Douglas Porter said in a February research note, adding "this government seems to have few qualms about taxing the 'rich.' "

The Globe has reported that

any proposals for major tax changes would not be implemented right away, but would be recommended for further study.