Briefing highlights

- What to expect from Bank of Canada today

- Global markets mixed so far

Awaiting Poloz

Stephen Poloz is in the same boat as everybody else: He doesn’t know what Donald Trump is and isn’t going to do.

Which makes for an interesting exercise when, later in the morning, the Bank of Canada governor and his colleagues release their rate decision and monetary policy report, followed by a news conference.

They’re not expected to tinker with their benchmark overnight rate, which for a long time has sat at a low 0.5 per cent and will sit there for a long time still.

Given the state of Canada’s economy, they wouldn’t have changed it regardless, Trump or no Trump.

But the heightened uncertainty as Friday’s inauguration looms has many waiting and watching for what could be “things that go Trump in the night,” as CIBC World Markets chief economist Avery Shenfeld put it.

Mr. Trump has been so vague on his fiscal and economic policies that it’s impossible to say what’s going to go bump and what’s not.

But there are fears Canada could be wounded in a trade battle as the president-elect prepares to renegotiate the North American free-trade agreement and his Republican colleagues threaten a U.S. border adjustment tax, which Mr. Trump has actually talked down.

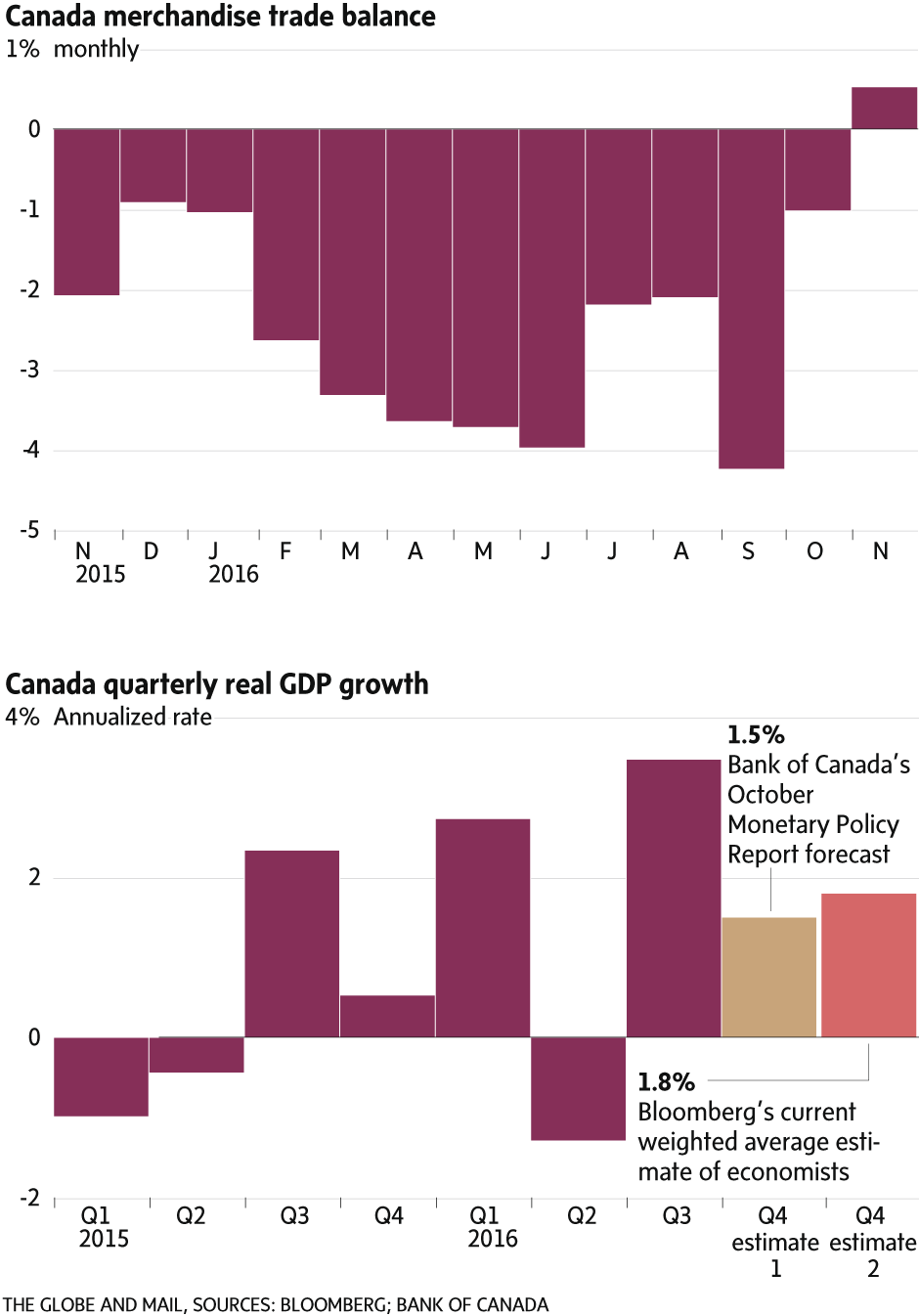

Canadian economic indicators have been stronger of late, and, as Mr. Shenfeld noted in a report Tuesday, we’re seeing a “modest rebound” in spending and output in the oil patch.

That, in turn, should more than make up for what’s expected to be a cooling in the housing market and softer spending by consumers who have gorged on credit and now face faster inflation and tighter mortgage conditions.

“Still, we would need a huge and unlikely upside surprise to push the Bank of Canada into a rate hike this year,” Mr. Shenfeld said.

“Particularly since, relative to the base case, the Trump administration’s trade-policy-by-Twitter, and a Republican-backed corporate tax reform plan biased against import content, both represent a major downside risk if Canada gets caught in the crossfire.”

So expect the central bank to make few changes, aside from possibly tweaking economic forecasts.

Markets will be watching, though, to see if there’s a hawkish or dovish slant to the policy statement, report and comments to reporters.

“An easing bias to counter potentially adverse turns in U.S. trade policy is possible but unlikely at this juncture, in my opinion,” said Derek Holt, the head of capital market economics at Bank of Nova Scotia.

“Recall that Poloz stated in November: ‘We only incorporate actually announced policy changes, and there haven’t been any of those,’” Mr. Holt added.

“A similar approach was taken ahead of last year’s federal budget and stimulus contained within. Both on trade and fiscal policy, the BoC is likely to wait until it sees what - if anything - transpires.”

Mr. Holt said he expects a “little less” caution from Mr. Poloz when all is said and done over the course of the morning.

“Conditions have improved since the last policy meeting in December, and that likely has to be acknowledged by the BoC,” Mr. Holt said.

“Nevertheless, trade policy uncertainty matters an awful lot to Canada,” he added.

“One-third of GDP is derived from exports, and the BoC needs to see a sustained trend of export growth that rotates the economy away from excess reliance upon household sector activity. Until it does - and conditioned by U.S. trade policy - it would be more than a tad unwise to shift toward sounding more hawkish at this juncture. Ditto for bond market uncertainty that rests upon U.S. fiscal management.”

Here’s what some other observers expect:

“Our expectation is that the central bank will continue to assume sustained above-potential growth in 2017 and 2018 premised on still stimulative monetary conditions, a cessation of declining energy investment in the face of rising oil prices and greater fiscal stimulus.” Paul Ferley, Royal Bank of Canada

“Given the elevated level of uncertainty related to the regulatory, fiscal and trade agendas of the new administration in Washington, an overly dovish or upbeat statement both appear unlikely [Wednesday morning]. However, the wide range of potential consequences from Trump’s proposed policies, as well as new developments regarding Brexit and political events in the euro zone, could lead to multiple and sudden shifts in market expectations regarding the BoC’s next moves during 2017.” Sébastien Lavoie, Laurentian Bank

“The Bank of Canada and Governor Poloz are expected to be as neutral as can be ... The outlook is evolving largely as expected and there’s little reason to rock the boat.” Benjamin Reitzes, BMO Nesbitt Burns

“The Bank will probably conclude that it would be more prudent to wait a few more months for more details on the incoming Trump administration’s plans. As it stands now, it is impossible to tell whether the proposed policies would have a net positive or negative impact on Canada’s economy.” Paul Ashworth, Capital Economics

Ultimately, it is likely that the Bank of Canada will hold its policy interest rate at 0.5 per cent on Wednesday, while at the same emphasizing the softness in core inflation measures, the elevated level of uncertainty, and the remaining Canadian economic slack (in contrast to the U.S.). Poloz may push back against expectations of interest rate increases, perhaps hoping to talk down longer-term yields.” Brian DePratto, Toronto-Dominion Bank

Stocks mixed

Global markets are mixed so fa.

Tokyo’s Nikkei gained 0.4 per cent, Hong Kong’s Hang Seng 1.1 per cent, and the Shanghai composite 0.1 per cent.

In Europe, London’s FTSE 100 was up 0.1 per cent by about 7:35, while Germany's DAX was down marginally and the Paris CAC 40 by 0.6 per cent.

New York futures were little changed.