A long road

It’s troubling that we still refer to this as a “recovery” so long after the fact.

And as Bank of Montreal’s chief economist puts it, the “unluckiest” recovery ever.

We’re supposed to be in an “expansion” this long after the Great Recession, but, as Douglas Porter notes, many people feel like we’re still recovering.

“I guess technically we are long into the ’expansion’ phase and really shouldn’t be calling it a ’recovery’ any more,” Mr. Porter said.

“However, I suspect most people still feel like we’re still recovering from the financial crisis and its aftermath.”

Income gains are weak, unemployment is sticking stubbornly close to 7 per cent, and 390,000 of our kids can’t find jobs.

Just last week, as The Globe and Mail’s David Parkinson writes, Statistics Canada reported that the economy contracted in the first quarter at an annual pace of 0.6 per cent for the worst showing since the great slump.

Of course, making a struggling economy worse was the oil shock, which has slammed Alberta and other oil-sensitive regions.

BMO has now cut its forecast for economic growth this year to just 1.5 per cent “as a result of the weak March GDP numbers and the Alberta fires and the coal production cuts by Teck,” Mr. Porter said.

He was referring to wildfires that shut down a chunk of oil patch production and the recent decision by Teck Resources Ltd. to stagger temporary shutdowns at six Canadian operations through the summer.

That 1.5 per cent, by the way, would be the slowest pace of growth, outside of a recession year, in at least 30 years.

“At the start of 2015, the overarching view on the Canadian growth outlook was that it faced one big negative (lower oil prices), and one big positive (stronger U.S. growth), which were supposed to roughly offset each other,” Mr. Porter said separately in a report.

“Fully 40 per cent into the year and we have certainly seen the negative at work (business investment plunged 15.5 per cent in Q1), while we are still waiting for the positive to kick in (export volumes have been down over the past two quarters).”

Canada, he added, “desperately needs” the U.S. economy to show some spark, and there is some hope there.

Mr. Porter’s not alone. Other economists also see this as a lagging recovery.

“While we continue to believe that a rebound will unfold in coming months, evens so far this year have clearly proved what we contended a year ago: This is the Unluckiest. Recovery. Ever,” he said.

How a Greek debtholder must feel

Greece at the brink

Temperatures are rising across the euro zone as Greece kicks off a crucial week in talks with creditors.

Ramping up the rhetoric was a Sunday article penned by Prime Minister Alexis Tsipras, who warned that anyone who thinks the crisis concerns only Greece is “making a grave mistake.”

Greece faces paying pensions and salaries, and a key repayment to the International Monetary Fund.

“As the liquidity conditions become alarmingly tight in Greece, the PM Tsipras has little alternative but to secure an agreement with his EU peers as quickly as possible,” said market analyst Ipek Ozkardeskaya of London Capital Group.

“There is little chance for the Greek situation to be clarified this week, as the country will most probably be given the flexibility to service its debt in one shot at the end of June,” she added in a research note.

“However, the problem is only being postponed as Greece’s coffers will not be miraculously filled with cash by the end of the month, if the country refuses to compromise on austerity plans.”

This is going to end, said Alvin Tan of Société Générale, this will end soon. The question is how.

“The Greek cash squeeze has continued into June, but the situation looks like it is heading toward a denouement soon,” he said in a report today.

“Greece has to meet payments to the IMF totalling €1.55-billion this month, plus over €5-billion in maturing Greek T-bills, on top of regular cash expenses,” Mr. Tan added.

“There is a remote chance that the country might sail through June without a credit event if there were no cash injection from its creditors, but it will certainly not be able to come up with the €3.5-billion due to be paid to the [European Central Bank] in July.”

A campaign poster I'd love to see

BlackBerry ends fight

BlackBerry Ltd. has settled its legal battles with a company co-founded and financed by American Idol host Ryan Seacrest.

The Waterloo, Ont.-based smartphone maker said today it has settled its “outstanding legal disputes” with Typo Products LLC and related companies over allegations that Typo ripped off BlackBerry’s trademark mini-keyboard with its accessory for Apple’s iPhone, The Globe and Mail’s Bertrand Marotte reports.

Los Angeles-based Typo has agreed to stop selling anywhere in the world smartphone keyboards and mobile devices with a screen size of less than 7.9 inches, BlackBerry said.

Central bank saves millions

The Bank of Canada is enjoying the fruits of its labour in switching our paper money over to polymer.

Compared with the same period a year earlier, the central bank trimmed $14.4-million in costs associated with Canadian bank notes in the first quarter.

“Because the notes are lasting longer, reducing the need to replace unfit notes, the production of new notes is decreasing,” the central bank said in its quarterly financial report.

Thus, the central bank’s 2015 order for fresh bills is lower.

“This year’s order is smaller because the Bank has almost completed the replacement of paper notes, and polymer notes are lasting at least 2.5 times longer in circulation,” a spokesperson for the central bank said.

What to watch for this week

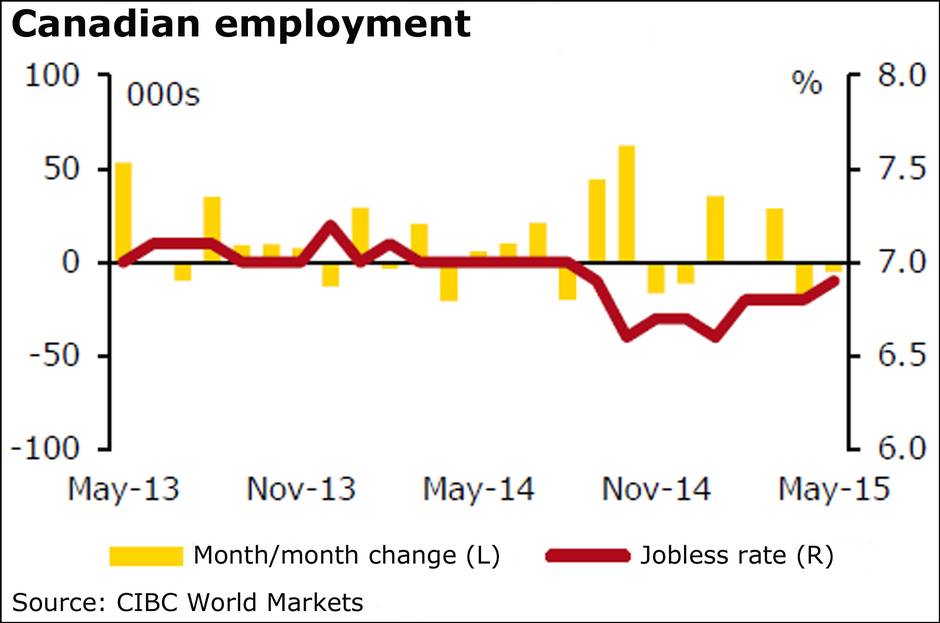

It’s all about jobs.

And your guess is as good as mine as to what Statistics Canada will say on Friday about how the labour market fared in May, because forecasting jobs numbers is always difficult.

Remember that in April, Canada lost almost 20,000 jobs, and the unemployment rate held steady at 6.8 per cent as the impact of Target Corp.’s Canadian shutdown, as well as some other hits in the retail sector, filtered through.

Royal Bank of Canada believes Friday morning’s report will show that about 18,000 positions were created in May, largely on “modest job gains” in manufacturing and some service sectors.

RBC also expects the jobless rate to dip to 6.7 per cent.

“In terms of risks and wild cards we will be watching for, the 20,000 decline in retail trade employment that hit last month due to high-profile store closures is unlikely to be repeated, though the natural resources and construction sectors may prove to be soft points due to the lingering influence of past oil price weakness and reports of wildfires near key energy producing regions,” RBC said.

Others expect a lesser gain than the 18,000 RBC is forecasting, and an unemployment rate still stuck at 6.8 per cent.

Nick Exarhos of CIBC World Markets expects to see an outright loss of 5,000 jobs, with the unemployment rate inching up to 6.9 per cent.

“We’ve pointed to the government sector, along with the oil patch, as potential soft spots for the labour markets this year, and that’s likely to be a theme in May,” Mr. Exarhos said.

U.S. job numbers will be reported at the same time.

Before that, though, Statistics Canada will release the latest numbers on the country’s trade balance, on Wednesday.

The April reading follows a record trade deficit of $3-billion in March, and some observers believe the new measure will show it narrowing to $2-billion.

Watch, too, for what the European Central Bank has to say on Wednesday, not only about monetary policy but also the problem child of the euro zone.

“It will also be be interesting to hear President [Mario] Draghi’s comments about how the ECB intends to respond in the event of a debt default by Greece,” National Bank Financial said in a report.

The Bank of England also meets this week.

A key meeting is also on tap for anyone interested in the oil markets.

The Organization of Petroleum Exporting Countries holds its latest discussions on Friday. As The Globe and Mail’s Shawn McCarthy and Jeff Lewis report, crucial to this is whether Saudi Arabia is still pressing for the status quo, which means not cutting production in a bid to boost prices.

“Regardless of OPEC’s actions [this] week, we do not expect prices to return to levels anywhere near $100 [U.S.] per barrel,” Tom Pugh of Capital Economics in London said in a report, adding that prices are more likely to fall this year rather than rise.