At the pump

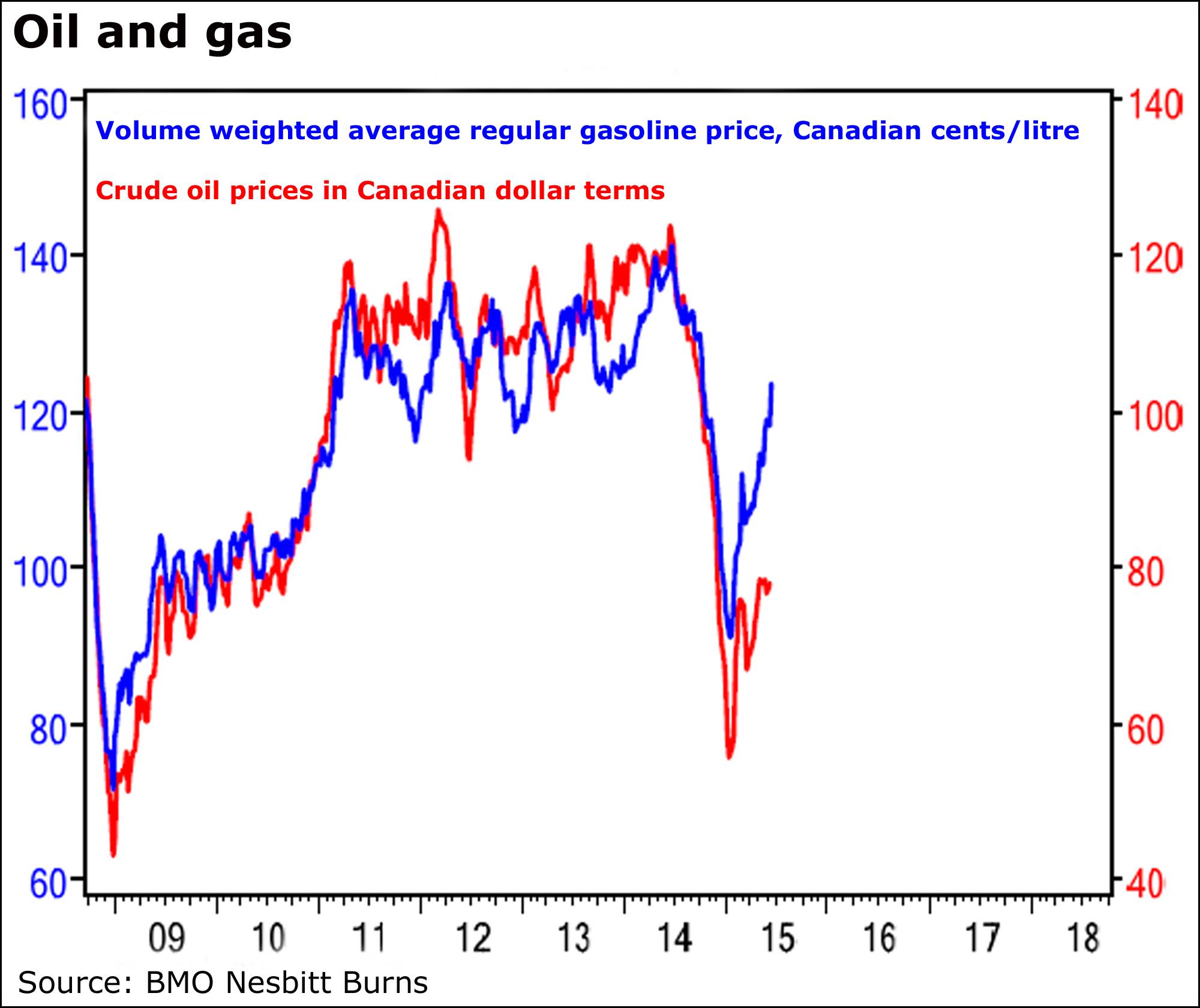

The recent jump at the gas pump has far outpaced that of oil. Just in time for a summer driving holiday.

Gas prices have recently topped $1.20 a litre in Canada and $2.80 (U.S.) a gallon south of the border, up 35 per cent to 40 per cent from mid-January, noted chief economist Douglas Porter of BMO Nesbitt Burns.

“True, oil prices have also bounced from the Q1 lows,” Mr. Porter said.

“And, true, for Canada, the drop in the Canadian dollar in the past year has pressured prices,” he added in a research note.

“But ... even converting oil prices into Canadian-dollar terms suggests that the jump in gasoline has gone way beyond the move in crude.”

Over the course of a year, costs at the pump are still about 10 per cent lower.

And there are traditional seasonal issues involved.

“In each of the past two years, the annual highs for gasoline prices were hit in the fourth week of June,” Mr. Porter said.

“As well, there are some good old supply (refinery ‘issues’) and demand (driving is way up this year) factors at play, compounding the normal seasonal forces.”

In case you missed it

“No, don't throw it out!”

Inflation edges up

Some of what Mr. Porter is talking about is showing up in Canada’s inflation numbers.

Gas prices rose in May by 5.5 per cent, Statistics Canada said today, though they’re still down markedly from a year earlier.

Over all, consumer prices rose 0.4 per cent from April to May on a seasonally-adjusted basis, pushing up the annual inflation rate to 0.9 per cent from April’s 0.8 per cent.

A separate report from Statistics Canada showed consumers were laggards in April as retail sales dipped 0.1 per cent.

Lower sales at food and beverage, electronics and appliance shops were the culprits.

“Like many other indicators early this year, we suspect these soft retail results were somewhat polluted by the Target closure (in mid-April), but drive home the point that overall growth has taken a step back due to the heavy weight from lower oil prices,” Mr. Porter said.

“On the flip side, while oil prices remain low, gasoline prices are mounting a spirited comeback and look to push inflation a bit higher yet in coming months. Over all, the [Bank of Canada] is largely looking past the gyrations in both headline and core inflation, and instead is likely more concerned about the sluggish growth backdrop – a concern that will be slightly deepened by soft retail spending.”

ECB steps up

The European Central Bank is reportedly coming to the aid of Greece’s commercial banks with emergency assistance amid the exodus of cash from accounts.

According to several reports today, the ECB is boosting its emergency liquidity assistance, or ELA, program to get the banks through Monday.

The finance ministers of the euro zone failed yesterday to strike a deal with Athens, setting Greece on course to miss a hefty payment to the International Monetary Fund at the end of the month as its bailout program expires.

A crisis summit of EU leaders has now been scheduled for Monday.

“We’ll have to wait and see but irrespective of what is agreed on Monday between the political leaders, any agreement will still need to be ratified at a technical level between the finance ministers to make sure they add up,” said chief analyst Michael Hewson of CMC Markets.

“It’s going to be a long week next week, but I still think it’s an each way bet on default,” he added.

The ECB assistance is just kicking the can down the road, said market analyst Ipek Ozkardeskaya of London Capital Group.

“The ELA liquidity just flows into Greece’s banking system and gets lost in transition,” she said.

“As the deposits massively flow out of Greece, the only way to keep the Greece banking system awake is to set capital controls. Otherwise, the system will be frozen.”

And at this point in the talks, there’s little chance of either Athens or its creditors opting for compromise.

“The EU is getting close to a painful wake-up, as the IMF insists on getting paid the €1.6-billion they are due by the end of June,” Ms. Ozkardeskaya said.

Quote of the day

“Greek tears attract no more sympathy.”

Ipek Ozkardeskaya, London Capital Group

Enbridge in deal

Enbridge Income Fund Holdings Inc. is eyeing a series of dividend hikes after striking a deal today to buy certain assets from Enbridge Inc.

The $30.4-billion deal includes Enbridge’s Canadian liquids pipeline business, among other assets.

Enbridge Income Fund said it plans to raise its dividend by 10 per cent after the deal closes in September, followed by annual increases of the same amount each year from the start of 2016 through 2019.

A scene I'd love to see: Greece's last option?

Chart of the day

Some observers suggest first-time homebuyers in Canada are “as reckless as Americans were a decade ago,” Matthieu Arseneau notes.

But the evidence suggests otherwise, the senior economist at National Bank Financial said in a recent report.

“Several indicators are showing that the vast majority of first-time homebuyers are rather cautious,” Mr. Arseneau said, citing findings by the Canadian Association of Accredited Mortgage Professionals since 2013.

Cenovus in talks

Cenovus Energy Inc. confirms it’s in talks with a potential buyer of its royalty lands in Western Canada.

It said today it “continues to make progress on its previously announced plan to pursue opportunities to maximize the value of its royalty interest and mineral fee title lands,” The Globe and Mail’s Bertrand Marotte reports.

It didn’t name the party, though Reuters reported yesterday that Cenovus is in talks with the Ontario Teachers’ Pension Plan for the possible sale of it royalty lands, valued at between $2.5-billion and $3-billion.

How Groucho Marx might put it today, on Greece

“Money flies out the door when love comes innuendo.”

Word of the day

Inflation

The rise in consumer prices. Not to be confused with the rise in taxation, though both do rhyme with frustration.