Briefing highlights

- New forecast sees lame economy

- Oil patch companies hit

- But Encana boosts its spending plan

- A word of caution to bond issuers

- A Ted Cruz scene I'd love to see

- Video: Use of social media in the office

Canada's economy lame

The Conference Board of Canada is the latest group to trim its outlook for the domestic economy, citing several factors that will be offset only partly by government stimulus.

The Conference Board cut its forecast for Canadian economic growth this year to just 1.4 per cent, with a pickup to 2.1 per cent in 2017. These projections are similar to those of the International Monetary Fund earlier this week.

Against this backdrop are forecasts that unemployment in Canada will remain stubbornly high.

Here’s what the Conference Board says:

1. Corporate investment is the biggest trouble spot: “Business investment in the oil and gas sector fell by almost $19-billion last year, and with the price of oil expected to remain near $50 (U.S.), we expect oil and gas investment to fall by another $14-billion this year. Unfortunately, non-energy firms have shown few signs of taking up the investment slack.”

2. While the lower Canadian dollar is good news for manufacturers, it’s holding back the industry’s purchases of machinery and equipment via higher import prices.

3. The wildfires that devastated the Fort McMurray area will take its toll on the economy, eroding oil production by 57 million barrels this year and denying energy companies $3.5-billion in revenues. Of course, the rebuilding efforts will help juice the economy going forward.

4. Brexit will have a “minimal” impact on Canada’s economy, but the U.K.’s decision to leave the European Union “could hurt business confidence and investment.”

5. The troubles of the global economy and a “sluggish” America will also hurt Canada by dampening our exports.

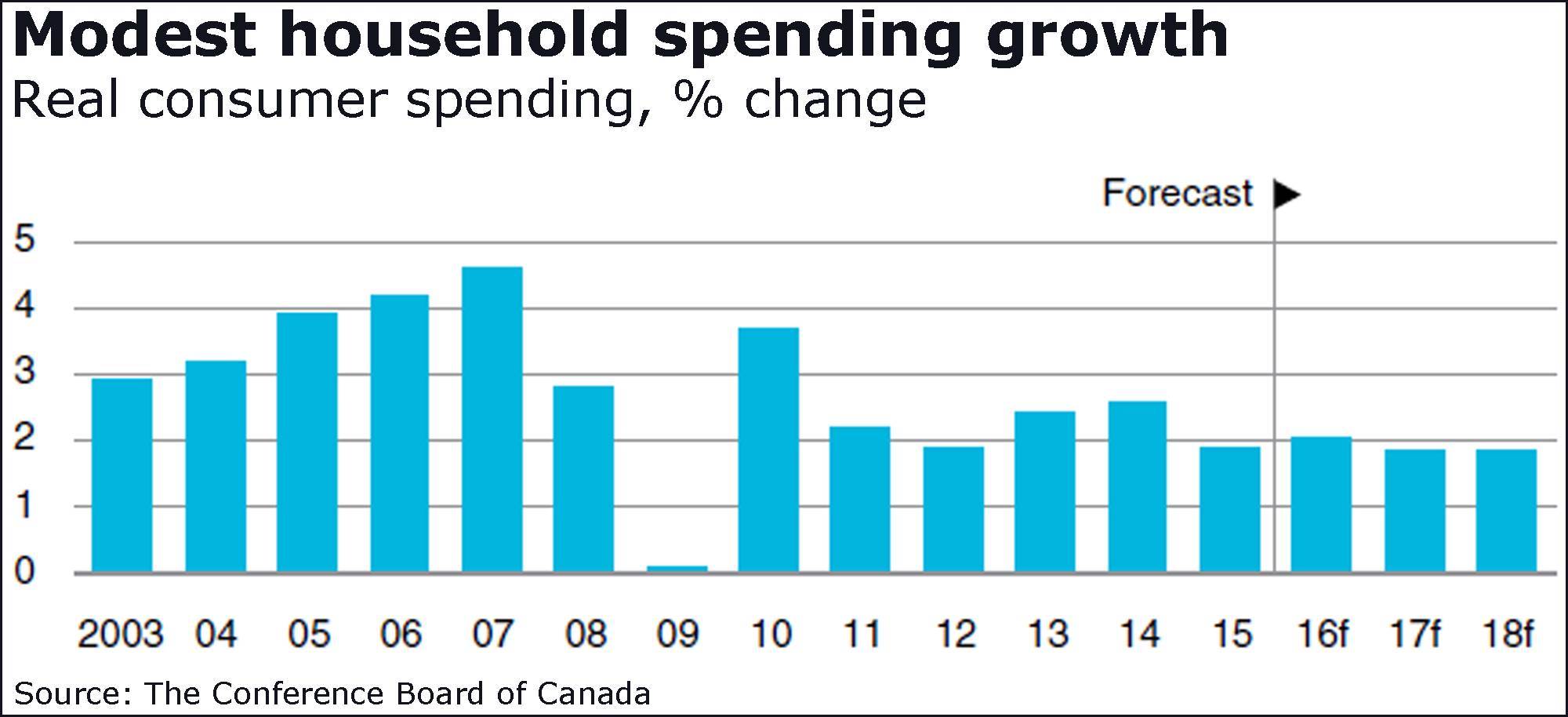

6. Canadian consumers are weary and wary, having been “stretched thin” by their borrowing binge. Playing into that are a weak jobs market, soft pay increases and higher inflation, all putting a damper on a rise in disposable income that will hold household spending to a 2-per-cent pace.

7. The lame labour market will turn in its worst showing since the recession, with job creation held to just 109,000 positions. Next year will be better, though. Unemployment is forecast to climb to 7.3 per cent this year, easing to a still-elevated 6.9 per cent in 2017.

This one’s iffy: Home prices are projected to rise at the fastest pace in almost three decades, driven, of course, by the “enormous” gains in Vancouver and Toronto. The Conference Board sees the national average price rising by 13.5 per cent in 2016, falling to a “more sustainable” 4.2 per cent next year. Slow increases in interest rates should help home owners juggle their debts, though “there are increasing risks, particularly in some markets: “Rapidly rising house prices in B.C.’s lower mainland and Ontario’s golden horseshoe continue to capture headlines and worry governments.”

Helping to offset all of this economic angst is the Trudeau government’s stimulus program, one of the hallmarks being the Canada Child Benefit that kicked off this week with its first payments.

A scene I'd love to see ...

“What did you expect? I was born in Canada.”

Oil patch hit

Two Canadian oil patch companies are the latest to be hit.

Encana posted a second-quarter loss of $601-million, or 71 cents a share, largely for special reasons and well down from the loss of $1.6-billion a year earlier.

Encana, though, also said it would boost capital spending this year, a rare development in the industry.

Precision Drilling’s second-quarter loss widened to $58-million, or 20 cents a share, from $30-million or 10 cents.

Revenue declined by a sharp 51 per cent to $164-million.

“North American oil and gas companies demonstrated a near instantaneous reaction to the low commodity prices experienced earlier this year by slashing spending, which resulted in the lowest drilling activity levels in decades,” said chief executive officer Kevin Neveu.

Cautionary note

Here’s a word of caution for government and corporate bond issuers from National Bank: “If it all sounds too good to be true, it just might be.”

Warren Lovely, the bank’s head of public sector research and strategy, was referring to the “aggressive hunt for yield in all corners of the globe” in a low- or no-yield environment, a quest that has driven foreign investors into Canadian debt.

“At the end of the day, Canada’s highly rated liquid and politically stable fixed income assets look like a compelling choice for global asset managers,” he said in a report.

When all is said and done, Mr. Lovely said, “incremental demand” for bonds is welcome news for government and corporate issuers that get to borrow on the cheap.

“For a given amount of supply, additional demand can mean lower underlying yields and tighter spreads, a combination that makes debt increasingly affordable for any number of issuers,” he said.

“International investors hungry for yield also opens up funding opportunities for Canada in foreign debt markets.”

Here’s where we come to that might-be-too-good-to-be-true bit. And there are several issues here.

“Low yields are a function of soft global growth, which is nothing to cheer,” Mr. Lovely said, adding later in an interview that, while it may not cost as much for an issuer to borrow, it could be reflecting economic anxiety.

There are other drawbacks as well, he noted, including the vulnerability of issuers should foreign investors suddenly sour on Canada and “the tide rolls out.”

Foreign buying, too, can push domestic investors out of their own market, or at least cause them more competition.

“All else equal, extra international demand for Canadian paper drives up the price, reducing the yield/return that domestic investors would otherwise benefit from,” Mr. Lovely added, citing what is believed to be a similar issue in some housing markets.

Mr. Lovely’s report comes amid new figures showing a record-setting pace of foreigners buying up Canadian assets.

So far this year, Statistics Canada reported this week, foreign investors have bought a net $75-billion of Canadian securities, the bulk of them debt, marking the fastest pace recorded.

“The slump in the loonie at the start of the year also juiced demand as Canadian assets were on sale,” BMO Nesbitt Burns senior economist Benjamin Reitzes said.

“However, with the loonie rebound sharply from early year lows, there’s clearly more to the buying than just a cheap currency,” Mr. Reitzes said.

“Canada is an oasis of stability in a pretty chaotic world. The failed coup in Turkey, Brexit, U.S. elections and worries about Italian banks are just a few of the events/concerns clouding the global economic backdrop.”