Balances that generate interest for banks aren’t rebounding at the same pace as consumer spending, and aren’t likely to regain lost ground any time soon.Chris Graythen/Getty Images

Canada’s big banks have seen customers’ credit-card balances plunge during the pandemic, and bank executives predict that a shift in the way some customers use their cards will be lasting.

Credit cards have been one of the hardest-hit categories of lending for banks as the COVID-19 pandemic reshapes the way Canadians spend and borrow. Massive government stimulus and widespread public-health restrictions helped households build up savings and curb spending, which drove down monthly card balances.

For consumers carrying large debts, that has been good news, and some paid off their card balances altogether. But for banks, that has taken a bite out of a lucrative source of profits.

The latest fiscal quarter, which ended Oct. 31, looked like a turning point for credit-card borrowing: Though balances are still down sharply from prepandemic levels, they mostly increased from the previous quarter, and edged higher year over year at Royal Bank of Canada RY-T , Bank of Montreal BMO-T and National Bank of Canada NA-T .

But balances that generate interest for banks aren’t rebounding at the same pace as consumer spending, and aren’t likely to regain lost ground any time soon.

“That net interest income is not going to come back for a couple of years,” Dan Rees, Scotiabank’s head of Canadian banking, said in an interview. “There’s zero evidence in the consumer research or in the behaviour since we re-emerged that Canadians are dying to get back into using credit cards as a means of lending.”

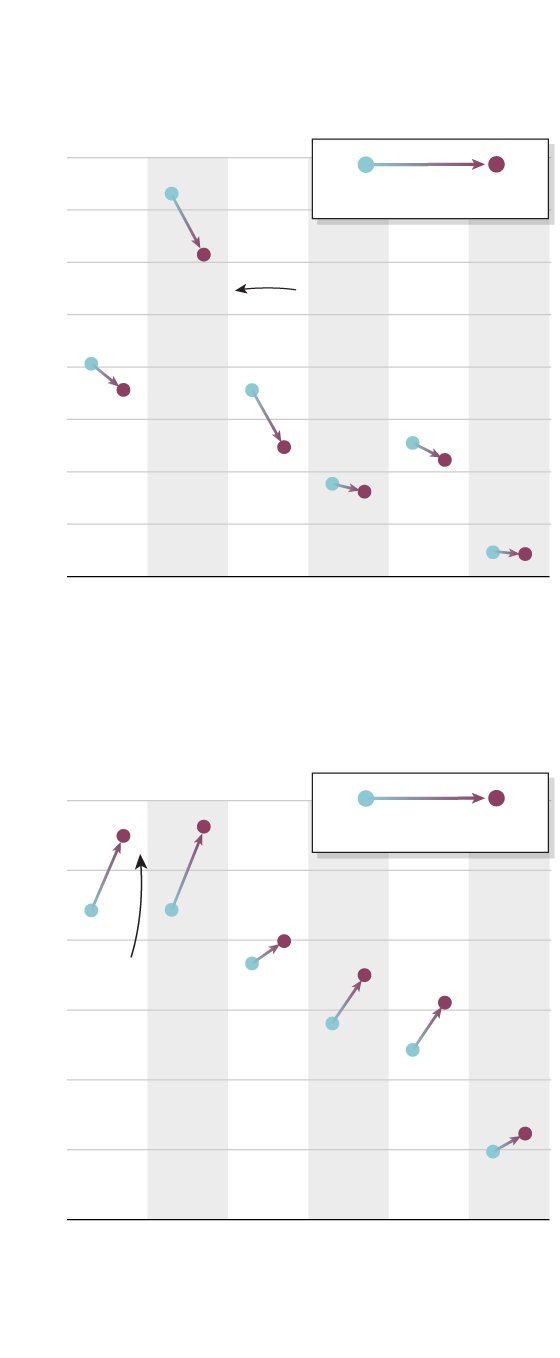

Change in average credit-card balances

by bank

In billions of dollars, Q4 2019 vs. Q4 2021

$40

Q4 2021

Q4 2019

35

30

-16%

Percentage

change

25

20

15

-12%

10

-31%

-13%

-9%

-7%

5

0

RBC

TD

Scotia-

bank

BMO

CIBC

National

Bank

Change in average deposits by bank

In trillions of dollars, Q4 2019 vs. Q4 2021

$1.2

Q4 2021

Q4 2019

27%

24%

1.0

9%

0.8

25%

Percentage

change

28%

0.6

0.4

27%

0.2

0

RBC

TD

Scotia-

bank

BMO

CIBC

National

Bank

THE GLOBE AND MAIL, SOURCE: COMPANY FILINGS

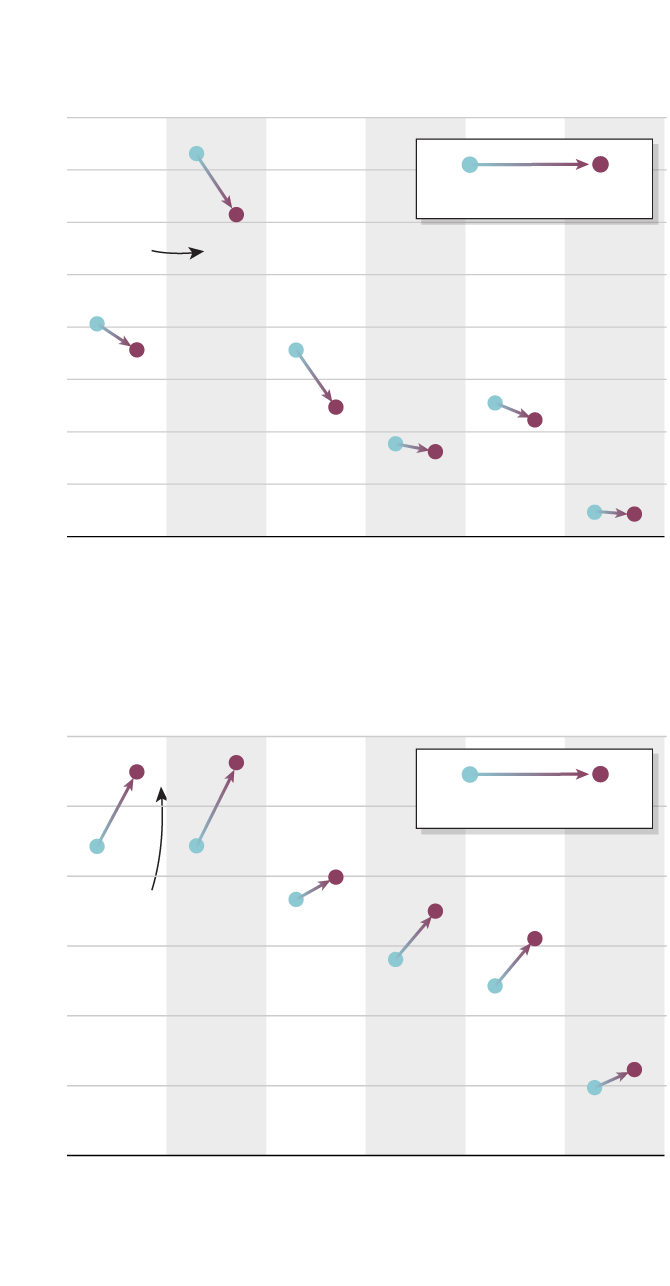

Change in average credit-card balances by bank

In billions of dollars, Q4 2019 vs. Q4 2021

$40

35

Q4 2021

Q4 2019

Percentage

change

30

-16%

25

20

15

-12%

10

-31%

-13%

-9%

-7%

5

0

RBC

TD

Scotiabank

BMO

CIBC

National

Bank

Change in average deposits by bank

In trillions of dollars, Q4 2019 vs. Q4 2021

$1.2

27%

24%

Q4 2021

Q4 2019

1.0

9%

0.8

25%

Percentage

change

28%

0.6

0.4

27%

0.2

0

RBC

TD

Scotiabank

BMO

CIBC

National

Bank

THE GLOBE AND MAIL, SOURCE: COMPANY FILINGS

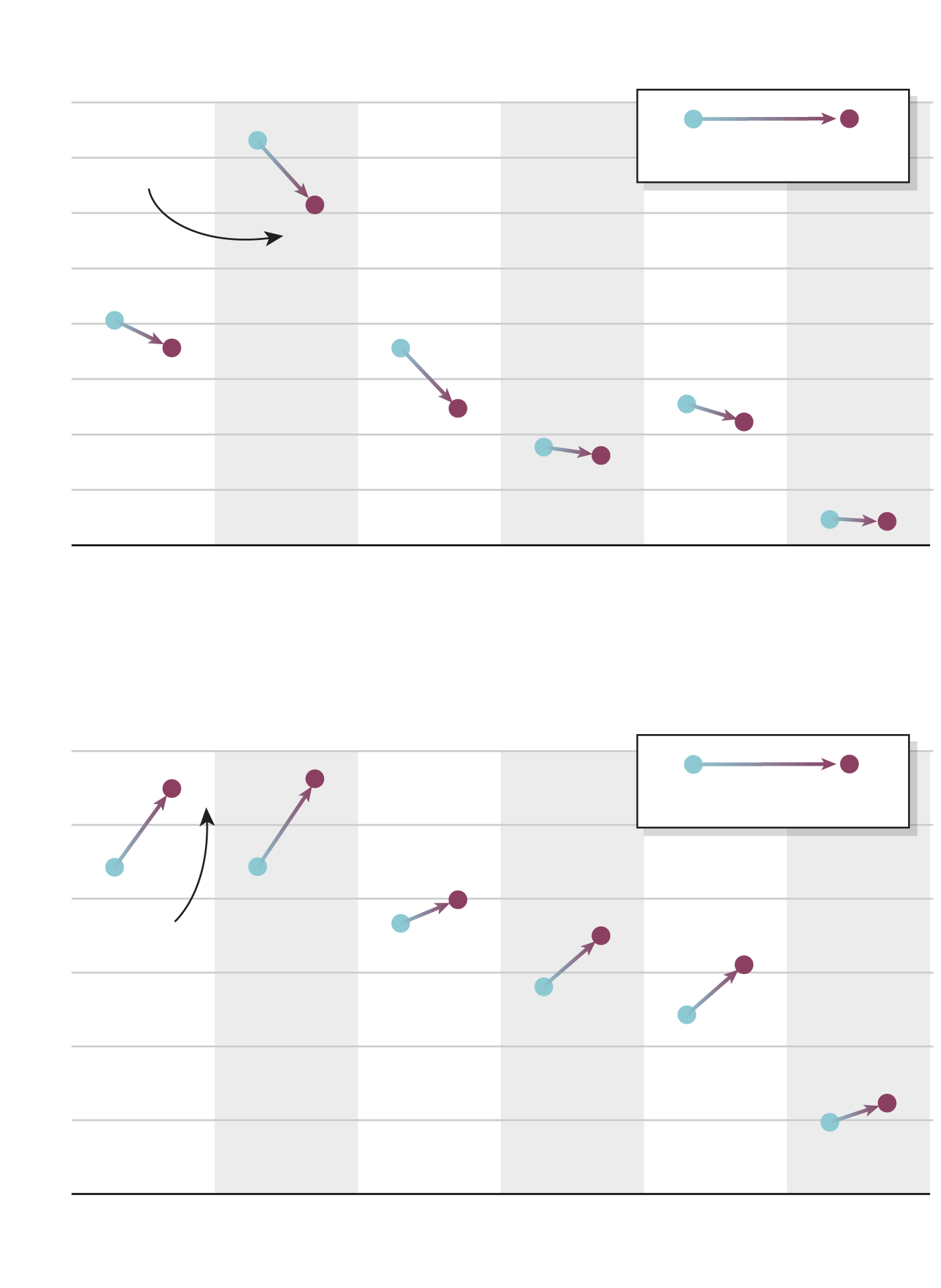

Change in average credit-card balances by bank

In billions of dollars, Q4 2019 vs. Q4 2021

$40

Percentage

change

Q4 2021

Q4 2019

35

30

-16%

25

20

-12%

15

-31%

10

-13%

-9%

5

-7%

0

RBC

TD

Scotiabank

BMO

CIBC

National

Bank

Change in average deposits by bank

In trillions of dollars, Q4 2019 vs. Q4 2021

$1.2

27%

24%

Q4 2021

Q4 2019

1.0

9%

0.8

25%

Percentage

change

28%

0.6

0.4

27%

0.2

0

RBC

TD

Scotiabank

BMO

CIBC

National

Bank

THE GLOBE AND MAIL, SOURCE: COMPANY FILINGS

The decline in revolving balances – those that carry over month to month – stabilized in the fourth quarter. “It’s sort of bottomed out and now started to pick up a little bit,” Andrew Pilkington, TD’s executive vice-president of lending solutions and specialized sales forces, said in an interview.

But then came the rapid spread of the Omicron variant and a new wave of restrictions on businesses and travel, throwing a potential wrench in the recovery. And even after the current wave of the virus subsides, this shift in customer behaviour and borrowing on credit cards is likely to have a lasting impact on credit-card revenues, bank executives say.

Two Canadian banks join with U.S. banks on managing climate change risks

Can CEO Bharat Masrani make TD a bolder bank?

The category of customers who pay their full credit-card balance each month – a group called “transactors” in the industry, as opposed to “revolvers” who carry monthly balances – has been growing. The proportion of total credit-card balances paid off each month through November in 2021 averaged 55 per cent, compared with less than 46 per cent the previous year, according to data from DBRS Morningstar Canada.

Rising use of debit cards has also eaten into credit-card spending, as customers who paid down credit-card balances and saved money during the pandemic feel more confident spending from their chequing accounts, especially for online purchases.

Lower balances have persisted even as the volume of spending by customers is bouncing back. In particular, purchases on cards have been driven by increased spending on electronics, retail goods, home improvement and groceries.

Even dining at restaurants was roaring back before provincial governments imposed the latest round of restrictions on indoor dining: In the final months of 2021, restaurant spending on TD cards was 20 per cent above prepandemic levels, Mr. Pilkington said. “Because the restaurants have been open and people have been, I guess, dying to get out and enjoy themselves.”

Profits that banks and other lenders earn from credit cards have been slower to recover. Scotiabank’s interest earned on credit-card balances fell 25 per cent from pre-COVID levels, Mr. Rees said, wiping out hundreds of millions of dollars in annual revenue.

There are some benefits to banks from changing credit-card trends. As customers use cards more for everyday spending, banks earn more fees from each transaction, on top of annual fees charged for premium cards. Contactless payments made by “tapping” cards, which can charge a higher fee per purchase to merchants, are also up since the pandemic started.

Bank customers are also more financially healthy, and the risk of losses from customers who can’t repay their credit-card bill is also much lower. Customers who are more than 90 days behind on their payments accounted for only 0.49 per cent of total balances in the third quarter last year, down from 0.7 per cent two years earlier, according to DBRS Morningstar.

Yet even the combination of increasing card fees and lower credit losses have not provided enough of a boost to offset that decline in interest income from lower card balances – “not even close,” Mr. Rees said.

Some of Canada’s banks have made major investments to bolster their credit-card offerings in recent years. TD and CIBC spent a combined $1.3-billion to be partners with Air Canada in a revamped Aeroplan loyalty program that launched just as the pandemic had dramatically reduced air travel. More recently, CIBC struck a deal to become the sole issuer of Costco-branded Mastercards in Canada.

Travel spending started to recover toward the end of 2021, but travel restrictions continue to have an impact. “It’s still not where it was prepandemic, but it’s a lot better than where it was a year ago,” Mr. Pilkington said.

That means loyalty-point balances accumulated by cardholders have been rising, as customers rack up rewards from everyday spending, but the options to use them – especially to pay for travel – are still limited.

In response, some banks experimented with promotions to encourage customers to redeem some of their points. TD temporarily offered double points on food and grocery deliveries, and introduced a feature that allows customers to use TD reward points to pay for purchases at Amazon.com. In one year, customers used 28 billion points through more than two million redemptions when shopping at Amazon – the equivalent in points of more than one million free flights from Toronto to Vancouver.

Banks are also keeping a close watch on another trend that could eat into credit-card revenues: The rise of buy-now-pay-later options from providers such as PayBright, Flexiti Financial Inc., Afterpay and Affirm. They allow customers to pay for purchases in instalments at interest rates that are typically lower than those charged on credit cards. Several banks including Scotiabank, TD and CIBC have introduced their own instalment-plan options in response.

“Is that a fad, is that a phenomenon, is that a trend?” Mr. Rees said. “It’s really hard to say.”

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.

James Bradshaw

James Bradshaw