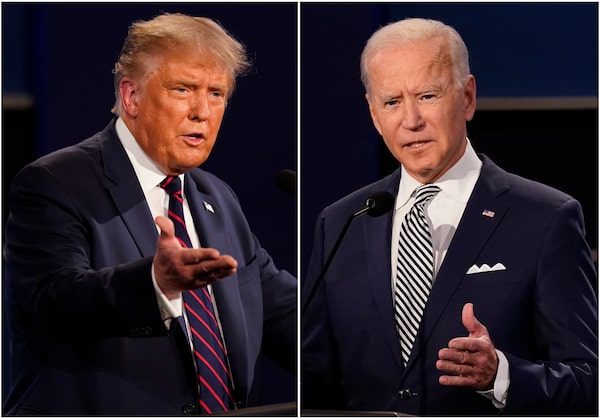

U.S. President Donald Trump, left, and former vice-president Joe Biden debate each other in September, 2020, in Cleveland, Oh.Patrick Semansky/The Associated Press

Canadian business leaders are preparing to navigate political gridlock south of the border, with the U.S. Congress appearing to split between the Democrats and Republicans, reducing the likelihood of a strong policy shift to the left.

Many calculated that a Democratic resurgence in the Senate and the House of Representatives would have meant corporate tax hikes, which would have changed the competitive positioning of Canadian firms, and aggressive spending on green energy.

Now, with the Republicans on track to maintain control of the Senate, and the Democrats keeping a hold on the House of Representatives, the business community is looking at a status quo policy environment, regardless of who wins the White House, said Avery Shenfeld, chief economist at CIBC World Markets.

“Those looking at the election as a turning point on climate change, energy sector policy, financial services regulations, taxation and other issues that have impacts on individual equities or other assets can count on seeing less dramatic change, if indeed any changes are in the wind,” Mr. Shenfeld wrote in a note to clients on Wednesday morning.

A divided Congress is not necessarily a bad thing for businesses on both sides of the border, said Frank McKenna, the former Canadian ambassador to the United States, who now is deputy chair of TD Securities.

“The business community in the United States is not unfriendly toward gridlock. They often find it better to have government out of their lives than intruding too vigorously,” he said.

Oil markets surge as crude stockpiles drop amid U.S. election

Gridlock: U.S. election puts more strain on Federal Reserve to manage economic recovery

Should Joe Biden win the presidency but the Republicans keep control of the Senate, some of Mr. Biden’s more ambitious platform promises could be thwarted, including efforts to undo President Donald Trump’s tax cuts or introduce a major fiscal stimulus package.

“I think if he’s able to achieve anything, it will be far more modest, and I think it will be very difficult for him to change the tax system,” Mr. McKenna said. “If you’re a Canadian company, you would probably say, well, that’s a net positive. We have a lot of Canadian companies that have enjoyed considerable tax advantage from the Trump tax changes.”

But a Republican-controlled Senate would also likely tamp down aggressive spending on renewable energy, which Mr. Biden promised as part of a $2-trillion climate change action plan. That’s bad news for Canadian renewable energy companies that were hoping to capitalize on a surge of infrastructure spending.

“Biden’s many other proposals on the energy front are unlikely to survive a split Congress,” Bank of Montreal chief economist Doug Porter wrote in a note to clients on Wednesday morning.

The picture is less clear when it comes to the Canadian oil patch. If he wins, Mr. Biden may still be able to cancel the Keystone XL pipeline project without the support of Congress, Mr. McKenna said. But he might also have some scope to strengthen environmental policies, which could help make Canadian energy companies that have to meet stricter standards more competitive with U.S. counterparts.

Deals are still getting done in the middle of the political storm. Toronto-based private equity firm TorQuest Partners and Caisse de dépôt et placement du Québec closed their joint acquisition of Ohio-based Barrette Outdoor Living Inc. on Monday. Barrette is North America’s largest fence maker. While the price was not disclosed, the buyers said the transaction was funded with US$405-million of debt, and both the financing and closing process went smoothly in a battleground state.

For the most part, Canadian businesses are in a wait-and-see mode, said Perrin Beatty, chief executive officer of the Canadian Chamber of Commerce. But the fact that the Democrats did not sweep the country was a relief for some business people, he said.

“One of the concerns that people had was if there was going to be a dramatic swing to the left as a result of a blue wave coming in. It appears that we won’t be seeing that, and it means then that if there is a Democratic president, that he is going to have to negotiate the agenda with Congress, which will keep things more to the centre of the road than they might otherwise have been,” Mr. Beatty said.

A Biden victory would reduce the threat of arbitrary tariffs against Canadian industries, such as auto manufacturing and aluminum, Mr. Beatty said. At the same time, both U.S. parties have become more protectionist.

“If we expected that we’re suddenly going to see an administration that’s in favour of taking down barriers and opening up the United States to trade, we may be surprised or disappointed. That particularly would apply as it relates to ‘Buy America,’ where they both seem to be singing from the same song sheet," he said.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.

Mark Rendell

Mark Rendell James Bradshaw

James Bradshaw Andrew Willis

Andrew Willis