Candice Ward/The Globe and Mail

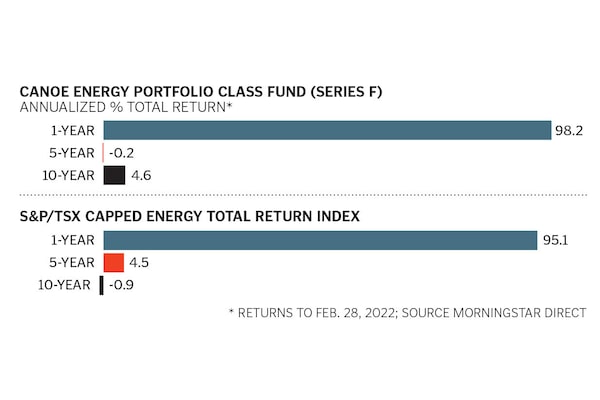

Rafi Tahmazian lives and breathes the energy sector. Born and raised in Calgary, he’s surrounded by family and friends in the oil patch. Although the six-year crude bear market was rough, his roots have always helped him navigate his niche. He and co-manager David Szybunka oversee $1.2 billion in three funds, which have some U.S. holdings. Over the past decade, their flagship Canoe Energy Portfolio fund has outpaced the S&P/TSX Capped Energy Index, including dividends. They also run Canoe Energy Income Portfolio and Canoe Energy Alpha, a multistrategy fund. We asked Tahmazian, 55, why he believes an oil supercycle is well underway and why he’s bullish on energy-service stocks like Trican Well Service and Halliburton.

What’s it like running energy funds from Calgary?

Oil and gas are my DNA. I have been on well sites since I was six. My father was a petroleum geologist who later built a couple of oil and gas businesses, and my brother is a vice-president at Paramount Resources. But the 2014 oil price collapse, followed by federal regulations curtailing growth in the industry, was the worst time in my career. It affected friends who had to find new ways to make a living. It was tough on me because I was treading water in my funds. I had to look more globally and expand my energy definition. What excited me was that people who threw money at environmental, social and governance (ESG) funds and thought they didn’t need oil remain addicted to it—think of those vans carrying online shopping parcels to homes.

Prices have swung above and below US$100 a barrel since Russia invaded Ukraine. What’s your outlook?

We are in an oil supercycle. Supply is tight due to a lack of investment by producers because their investors want dividends and share buybacks. The oil supermajors, under attack by ESG investors, have reduced spending for growth, too. But there is enormous post-COVID-19 demand for oil, and not just from the developed world. Developing countries need fossil fuels to build hospitals, transportation networks and other infrastructure. The market, however, underappreciates the profitability of energy companies at US$80-per-barrel oil. We don’t need US$100-plus oil because it can trigger demand destruction, but producers need price stability to commit to more capital spending. Energy stocks still trade at attractive valuations despite their rally, but there will be a flight to quality. Canadian Natural Resources and Cenovus are names we like.

Why do you have big bets on energy service plays?

There is pressure on oil companies to grow production, particularly after the U.S. ban on Russian oil imports and concerns about relying on OPEC. Drillers are seeing rising prices for their services. Margins for producers will shrink a bit, so we are chasing the money. We like Trican Well Service, Halliburton and Liberty Oilfield Services because they are frackers. There are barriers to entry because fracking requires expensive equipment and trained crews.

What does your crystal ball say about energy-stock dividends?

Dividends look robust, and I see them rising dramatically. With consolidation, energy firms are transitioning from exploration and growth to a manufacturing business whose widget—oil—is getting cheaper to produce. They are getting stronger financially and can distribute more dividends. In our energy income fund, we have producers like CNRL and Paramount Resources. We also like Viper Energy Partners, a royalty company.

You have a strategy for alternative energy holdings in your funds, too. What’s the focus?

We want investments in the future, while making money from old-economy energy sources. We have interests in three private companies. Hydrostor is a provider of bulk energy storage for wind and solar power. (For more on Hydrostor, see page 46.) Canary Biofuels turns farm waste and cooking oils into fuel, and Aureus Energy Services recycles water used in the energy industry. Our stocks include Altius Renewable Royalties, which gets royalties from solar and wind companies, and Aris Water Solutions, which recycles water for oil and gas producers in the U.S. Permian Basin. Together, they make up 12% of our assets.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.