©Adil Boukind/The Globe and Mail

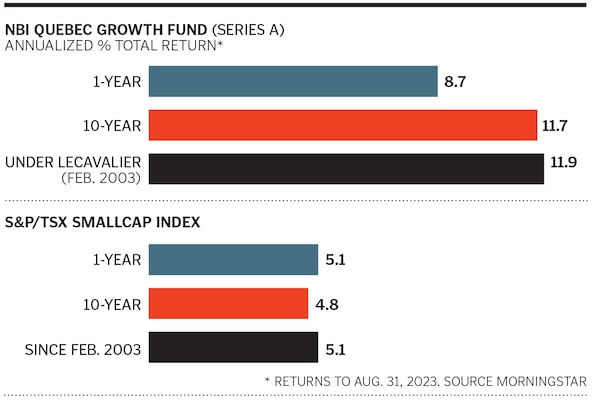

Some fund managers search the world for the best stocks. Others stick to Canada. But Fiera Capital’s Marc Lecavalier, who oversees National Bank of Canada’s NBI Quebec Growth Fund, has unearthed gems by focusing largely on la belle province. The $542-million fund, which has a bias toward smaller-cap companies, has outpaced both the S&P/TSX SmallCap and S&P/TSX Composite Total Return indexes over 20 years. That remarkable performance even comes from the fund’s A series, which includes fees that eat away at returns. We asked the 45-year-old why Quebec has been a fertile ground for stocks and why convenience-store giant Alimentation Couche-Tard is still compelling.

How has your fund been able to outperform?

I have a long-term time horizon and tend to be less invested in cyclical sectors, such as commodities and energy. They are volatile and create less value over time. I own more industrial, technology and consumer-related names, which are more resilient. We purchased MTY Food Group and Stella-Jones [maker of pressure-treated wood products] when they were under the radar 15 to 20 years ago, and we made 50-baggers with them. I also manage a Quebec and North American micro-cap fund for Fiera Capital. I get to see the rising stars and will have had a relationship with those companies for several years. It’s like having a farm team.

Why is Quebec fertile ground for investing?

The NBI Quebec Growth Fund name is a bit misleading, because our companies are all North American. I own very few companies that only do business in Quebec. It’s just that their headquarters are there. Some are even global leaders, when you think of CGI, an IT company, or WSP Global, an engineering firm. We also have a history of being entrepreneurial. It was obviously helped by the Quebec Stock Savings Plan [which allowed tax writeoffs for investing in new Quebec companies]. It helped companies raise money and do initial public offerings. But I can invest in companies with headquarters outside of Quebec, too.

When do you go beyond Quebec’s borders?

Currently, 25% of the assets in the fund have their headquarters outside Quebec. But many of those companies do a large part of their business in the province. Champion Iron is headquartered in Australia, but its iron-ore mine is near Sept-Îles in Quebec. If I see a great opportunity in the rest of Canada, I jump on it. That’s why I own Intact Financial. However, at least 51% of the assets must be invested in companies headquartered in the province.

What is your outlook on the small-cap sector?

I own fewer micro-cap stocks now. Many stocks in small-cap land have fallen a lot. I am wary of an economic slowdown and a consumer with less disposable income, but there are opportunities to invest at great prices. A good thing about current market conditions is that higher interest rates have dried up the excessive liquidity once available to private equity to compete against our companies for acquisitions. Most of our firms can now negotiate for other companies at better prices. They will be able to swallow competitors, gain market share and become stronger in this slowdown.

Alimentation Couche-Tard, which owns chains such as Circle K and On the Run, is a top holding. What’s the attraction?

Alimentation Couche-Tard sells essentials, such as food and gasoline, so it’s recession-resistant. It generates free cash flow to make acquisitions, buy back stock or increase its dividends. It also benefits from past acquisitions, growing its network and capturing synergies. Once you’ve grown that network globally, it gives you lots of opportunities.

Has your fund benefited from takeovers lately?

We have had several takeovers since the start of 2022. They have included Uni-Select, an automotive products distributor; Intertape Polymer Group, a packaging products company; and LifeWorks [formerly Morneau Shepell], an employee assistance provider. But the value creation in my companies really comes from the other side of the table. It’s when you have companies, such as CGI, Alimentation Couche-Tard, Stella-Jones and MTY Food Group, buying other companies.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.