An El Niño weather event is happening this winter and is expected to have an impact on the value of your investment portfolio.

The U.S. National Weather Service released a special El Niño Advisory on Nov. 12, advising the significance of the current El Niño.

The service noted: "Most models indicate that a strong El Niño will continue through the Northern Hemisphere winter 2015-2016. This El Niño could rank among the top three strongest episodes … going back to 1950. El Niño is expected to affect temperatures and precipitation patterns during the upcoming months. Seasonal outlooks generally favor below-average temperatures and above-median precipitation across the southern tier of the United States, and above-average temperatures and below-median precipitation over the northern tier of the United States."

Environment Canada released a statement on Nov. 30, advising the significance of an El Niño event on Canada's weather. It predicted a high probability that temperatures in the eastern half of Canada and the southern part of British Columbia will have greater than average temperatures from December 2015 to February 2016.

Why should investors care?

A warmer-than-average winter in the eastern part of North America is expected to have a positive impact on the economy, particularly when compared to the economic slowdown that occurred during the first quarter this year when the eastern part of North America suffered its coldest weather in over a decade.

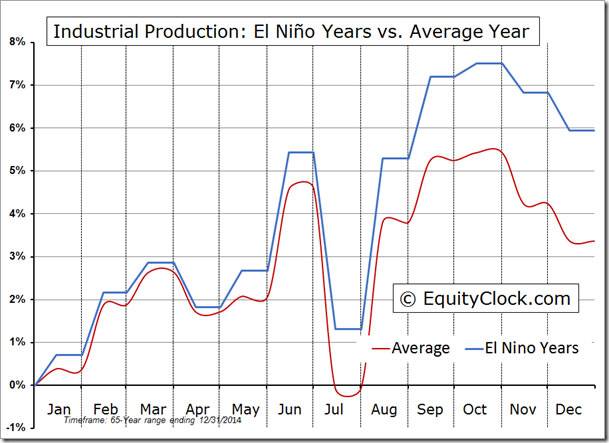

One of the many economic advantages that warmer-than-average weather will bring this winter and next spring is an earlier-than-average start on construction of infrastructure and new homes. The net result is an increase in industrial production on both sides of the border. Following is a chart based on data since 1950 comparing U.S. productivity during El Niño years relative to normal industrial production:

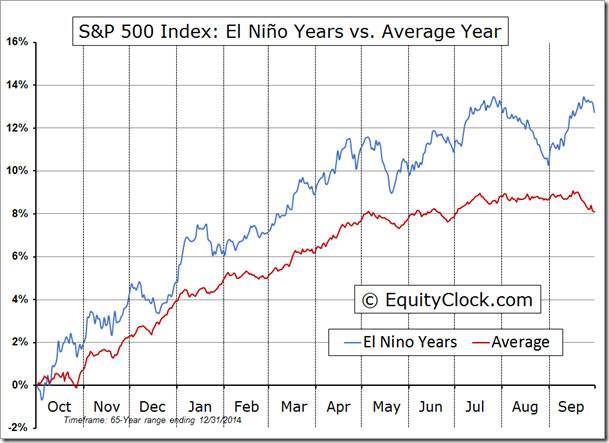

Greater productivity prompts higher-than-average corporate revenues and earnings as well as better stock market performance. The following chart compares performance of the S&P 500 Index during El Niño years relative to normal years:

The chart shows that investors receive an extra return on investment by the S&P 500 Index of approximately 3 per cent during winter periods when an El Niño event occurs. Moreover, the extra 3 per cent is maintained throughout the remainder of the year.

Investors can benefit from an El Niño event by holding U.S. and Canadian equities and equity index Exchange Traded Funds during at least the next three months when the El Niño is expected to have its greatest positive impact on weather and industrial production.

Don and Jon Vialoux are authors of free daily reports on equity markets, sectors, commodities, and Exchange Traded Funds. Daily reports are available at http://TimingTheMarket.ca/ and http://EquityClock.com. The enclosed report is for information only. It should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.