There is no real way to sugarcoat this; the current shape of the Canadian yield curve – an important, long-standing forward indicator for equity returns – is bad news for investors.

The importance of the yield curve – the difference between shorter term and longer term government bond yields – as a forward-looking investment signal is difficult to overstate. The yield curve represents the aggregation of all expert opinions on future economic growth rates, inflation and (to a lesser extent) investor risk tolerance. When the curve is flattening as it is now – the difference between longer-term and current rates is shrinking – this reflects expectations of slower economic growth in the years ahead.

The success rate of the yield curve in predicting future equity returns was substantiated several years ago by a study by the New York Federal Reserve, which concluded that relative to other economic indicators, "the yield curve strongly outperforms … over longer time horizons [making] its use as a forecasting tool even more compelling."

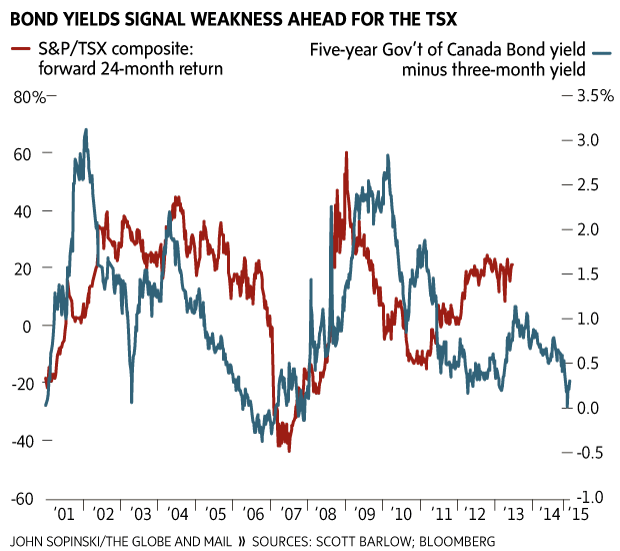

The chart highlights the success of the Canadian yield curve in predicting the future two-year returns for the S&P/TSX composite index during the past 14 years (maximum data available). For example, the first equity data point indicates that between Feb. 23, 2001, and Feb. 23, 2003, the cumulative return for the TSX equity benchmark was minus 18 per cent.

The steadily steepening yield curve in the early 2000s successfully predicted an equity market rally into 2003. More important, the pervasive flattening trend beginning in June, 2004, provided a prescient warning of the coming financial crisis that investors ignored, to their eventual detriment, for a long time.

The connection between bond yields and equity returns still worked, but faded somewhat in the wake of the financial crisis, likely because of the U.S. Federal Reserve's unprecedented intervention in North American bond markets. Canadian bonds have always been priced using U.S. Treasury bonds as a benchmark, and Fed policy determined Canadian bond yields to a significant extent (and still does). Federal Reserve chair Janet Yellen, however, is widely expected to raise interest rates in mid-2015, as the end of U.S. monetary stimulus takes effect.

A U.S. central bank hike will likely flatten the American yield curve – the Fed will raise short-term rates, but longer-term rates will not move higher as much. If Canadian yields move in the same way, this will only make a bad situation worse – the domestic yield curve will flatten further even though it already indicates trouble for equity markets.

The difference in yield between three-month and five-year Government of Canada bonds stands at 30 basis points (or 0.3 per cent), about 70 basis points lower than the historical average. As the accompanying chart shows, this suggests deeply negative equity performance over the next 24 months.

Scott Barlow, Globe Investor's in-house market strategist, writes exclusively for our subscribers at ROB Insight and Inside the Market online. Subscribe to Globe Unlimited at globeandmail.com/globeunlimited.