Economics is known as the dismal science but U.S. economists have contradicted this through excessively optimistic growth forecasts. Canadian economists on the other hand have been both more restrained, and more accurate.

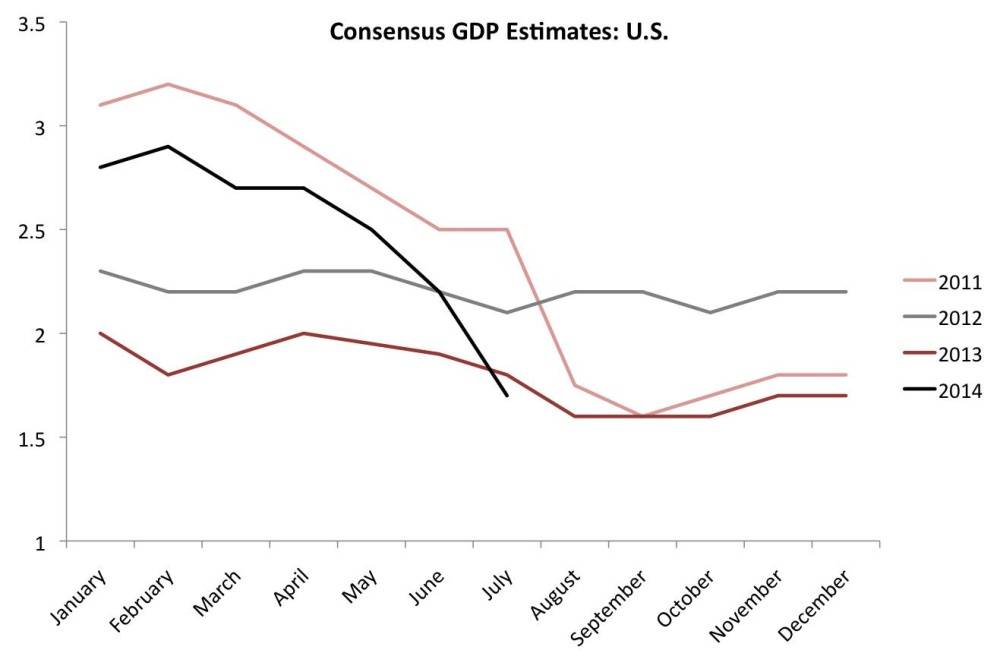

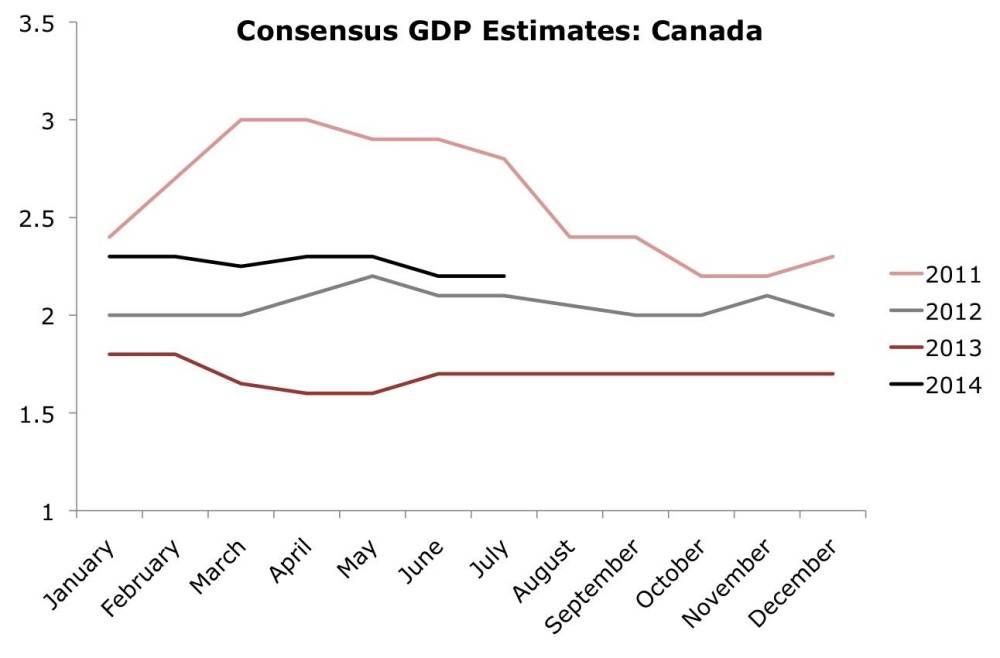

This week's charts show the evolution of gross domestic product estimates during each year since 2010 for both countries. For investors there are two important takeaways. One, U.S. economists tend to start with a big number and steadily reduce expectations through the year. Canadian economists tend to exit the year close to where they started, showing a higher degree of accuracy.

The second takeaway is more pressing for investors. The sharp slide in GDP forecasts for the U.S. economy looks very much like 2011 when the S&P 500 dropped a bloodcurdling 17 per cent in a few short weeks, right about this time of year.

Economists began 2011 with high hopes that full year GDP growth would reach 3.1 per cent. By August, the consensus estimate had been slashed to 1.75 per cent. This year's trend is similar, with January's 2.8 per cent prediction already cut more than 100 basis points to 1.7 per cent.

The major catalysts for the sell-off in the summer of 2011 were the end of the Federal Reserve's second round of quantitative easing and a Standard & Poor's downgrade of the long term credit rating of the United States.

Another credit downgrade for the U.S. is unlikely this year, but the Fed's tapering of its stimulus program – the expected end of QE3 – is uncomfortably reminiscent of the shocks of 2011. Importantly, however, U.S. economic data like industrial production and initial jobless claims, are painting a far more optimistic picture this year.

Domestically, gross domestic product growth predictions are not following their U.S. counterparts lower as they did in 2011. Canadian investors can also take comfort in the relative accuracy of economist predictions which indicate solid full year growth of 2.2 per cent.

Investors in U.S. stocks might want to brace themselves for some volatility until growth forecasts stabilize, and simultaneously prepare to take advantage of more equity market weakness. For the S&P/TSX Composite, the economic backdrop should be less problematic unless growth estimates start following those of our southern neighbors lower.