Finally, this weekly technical look at the S&P/TSX has uncovered an interesting entry point for a prominent stock – Encana Corp – that we'll discuss after the usual house-cleaning.

The domestic benchmark climbed 0.87 per cent in the five trading days ending Thursday. According to my favoured technical indicator, Relative Strength Index, the equity market as a whole is firmly in neutral territory with an RSI reading of 53.6, close to mid-way between the buy signal of 30 and the sell signal of 70.

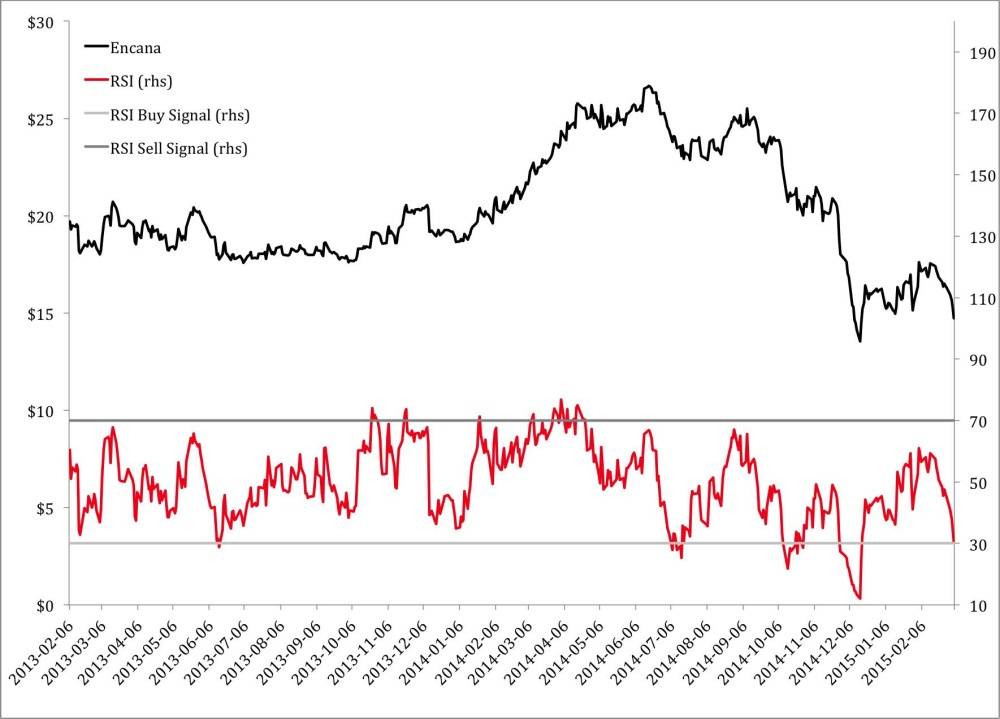

There are two oversold TSX constituents by RSI – SNC Lavalin Group Inc. and something called China Gold International Resources. But it's Encana Corp, trading right on the RSI buy signal at 30.5, that I find the most interesting.

RSI has provided decent trading signals for Encana in the last eight months despite the incredible volatility in the broader energy sector. The July 15, 2014 buy signal signalled a rally, although not a huge one. The sub-30 RSI buy signal in October wasn't overly lucrative for traders who bought it at that point, but did successfully predict a temporary bottom.

At this point, Encana's RSI reading indicates a possible re-test of the December lows around 13.50 that, in a technical sense, will be all-important. A bounce higher off the previous low will be a very promising sign for the short term performance of the stock.

Fundamental research – always required before any market transaction – is particularly important for investors considering Encana. The trailing price to earnings level of eight times is attractive, but investors should be wary of the forward estimated price to earnings ratio of over 600 times.

The average analyst price target on Encana is $19.20 according to Bloomberg data, more than 30 per cent above current levels.

Turning to the frothier, overbought segment of the TSX, Cott Corp remains the most overbought stock in the index with an RSI reading well above the sell target of 70 at 83. Rona Inc. and Valeant Pharmaceuticals International Inc. remain on the list from last week.

Investors and traders should be reminded that the RSI measure, while historically useful for buy and sell signals, changes extremely quickly. An oversold, attractive opportunity could jump to overbought levels in a few days so readers should update RSI readings before making any transactions.

Follow Scott Barlow on Twitter @SBarlow_ROB.