I created this Defensive Portfolio in March 2008, when markets were approaching record highs, which were reached a few months later.

It is designed for investors who want some stock market exposure but also wish to contain their risk. The initial weighting was 40-per-cent fixed income, 60-per-cent stocks, with a starting value of $10,000. Because of the defensive nature of the portfolio, I set a target of 5-per-cent to 6-per-cent annual returns.

I've made several changes over the intervening years, but I have always aimed at keeping the fixed income exposure to about one-third of the total assets or more. The rest is invested in blue chip, dividend-paying stocks from both Canada and the U.S.

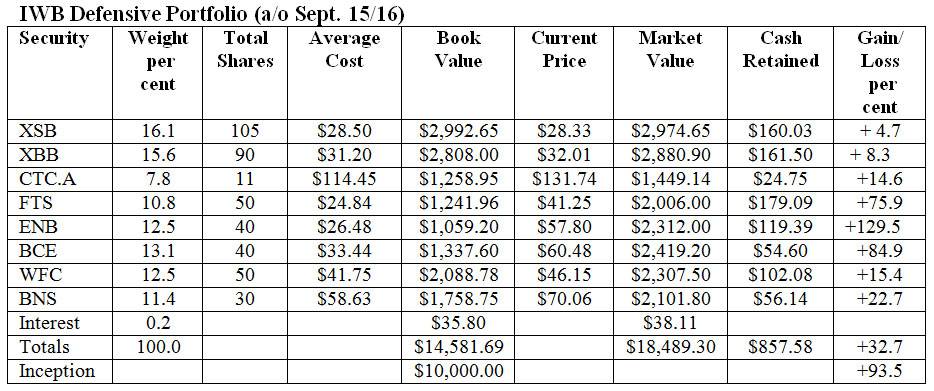

Here's a summary of the securities we currently hold with some comments on how they have performed since my last review in March. Prices are as of the close of trading on Sept. 15.

iShares Canadian Short Term Bond Index ETF (XSB). This short-term bond fund was added to the portfolio in October 2013 in anticipation of higher interest rates. That scenario has yet to materialize. We sold part of the position in October 2014 and invested the money in units of the companion XBB fund (see below). Since the last review in March, the units have dropped by $0.14 but we received about $0.39 in distributions so we made a small gain over the period.

iShares Canadian Universe Bond Index ETF (XBB). This ETF tracks the performance of the broad Canadian bond market, including both government and corporate bonds. Bond funds have recovered well in recent months with this one gaining $0.42 since the last review. We also received monthly distributions totalling about $0.51 per unit for a total return of 2.9 per cent for the six-month period.

Canadian Tire (CTC.A). We added this stock to the portfolio last October, buying 11 shares at a cost of $1,258.95. The shares have pulled back by $4.39 since our March review but we still have a respectable total return of 14.6 per cent on this one.

Fortis (FTS). Utility stocks did well over the summer and Fortis is up $1.23 from our last review. We received two quarterly dividends for a total of $0.75.

Enbridge (ENB). Enbridge has been on an uptrend since our last review, with investor interest spurred by the recently announced merger with Spectra Energy of Houston. The net result is a jump of $7.21 in the share price since March. That push helped Enbridge regain its position as the top performer in the portfolio.

BCE Inc. (BCE). BCE's growth rate slowed in the latest six months, although the stock did manage to add $1.07. We received two dividends, for total per share income of $1.365.

Wells Fargo (WFC). U.S. bank stocks have been under pressure recently and Wells Fargo shares have dropped $2.64 since our last review. The two dividends totalling US$0.76 fell well short of making up the difference.

Bank of Nova Scotia (BNS). By contrast, Canadian bank stocks have been strong and BNS is up an impressive $8.25 since the last review. The bank announced a 2.8 per cent dividend increase, effective with the Sept. 30 payment.

Interest. We put our cash holdings of $578.47 into a high interest savings account paying 0.8 per cent. We received $2.31 in interest over the six months.

This is how the portfolio looked based on prices at the close on Sept. 15. Brokerage commissions have not been taken into account and the Canadian and U.S. dollars are deemed to be at par for tracking purposes. The gain/loss column shows the total return since the inception of the portfolio or since the security was added, if it was at a later date.

Comments: The total value of the portfolio is now $19,346.88. That's an improvement of 3.97 per cent since my last update, which is slightly ahead of target. All our stocks gained ground over the summer except Canadian Tire and Wells Fargo.

Since inception eight and one-half years ago, the portfolio has delivered a total return of 93.5 per cent. The compound annual growth rate is 8.07 per cent. That is well in excess of our 5-per-cent-6-per-cent target.

Changes: We have enough retained earnings to buy five more units of XSB at a cost of $141.65, bringing our total to 110. Cash remaining will be $18.38.

We will switch our savings account to EQ Bank, which is currently paying 2 per cent on deposit accounts. We have $754.04 at this time.

Here is the revised portfolio. I will revisit it on its ninth anniversary in March.

-----

Gordon Pape is Editor and Publisher of the Internet Wealth Builder and Income Investor newsletters. For more information and details on how to subscribe, go to www.buildingwealth.ca.