Many investors don't want to be bothered reviewing their portfolios on a regular basis. They prefer to buy a few good stocks and hold them indefinitely. I understand this psychology, even though I don't think it's a great idea – every portfolio should be re-assessed at least once a year to ensure it is appropriate for your situation and is performing respectably.

My Buy and Hold Portfolio was launched in June 2012 for laissez-faire investors. It is comprised mainly of individual stocks, although it also includes a bond ETF to provide some balance.

The focus is on blue-chip stocks that offer long-term growth potential plus, in most cases, regular dividend payments. When the portfolio was created, I included both Canadian and U.S. issues, and each original stock was given a 10-per-cent weighting. I added a 20-per-cent bond weighting to provide some downside protection.

I used several criteria to choose the stocks including a superior long-term growth profile, industry leadership, good balance sheet, solid dividend record, and relative strength in bad markets. Given the nature of the portfolio, the intention is to make changes only when necessary.

At the time, I stated that the objective was to generate decent cash flow and slow but steady growth. The target rate of return is 8 per cent annually.

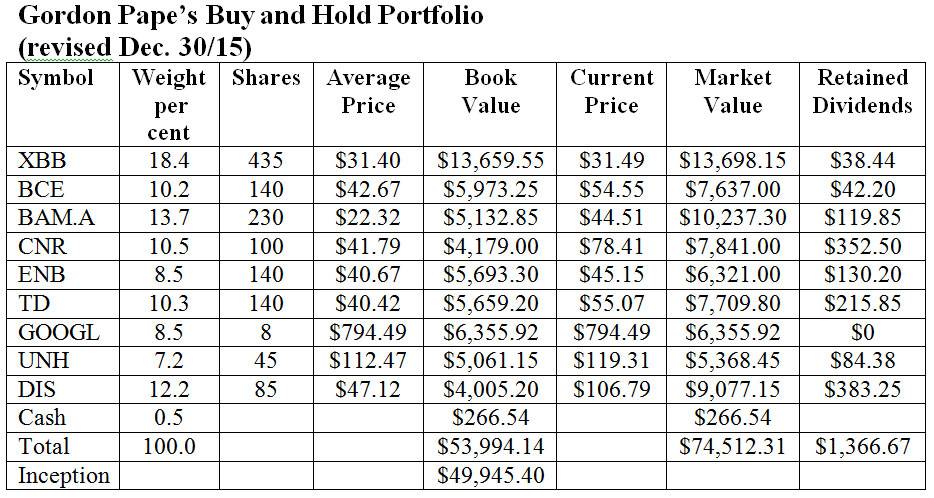

These are the current securities we hold with some comments on how they have performed since my last review on June 24. Prices are as of the morning of Dec. 30.

iShares Canadian Universe Bond Index ETF (XBB-T). The unit price of this bond ETF barely changed over the six months, adding just 2 cents. However, we received distributions totalling almost $0.45 per unit so we came out of the period with a small gain.

BCE Inc. (BCE-T, BCE-N). After losing more than $5 in the January to June period, BCE rallied modestly, adding $0.93 in the latest six month. We received two quarterly dividends of $0.65.

Brookfield Asset Management (BAM.A-T, BAM-N). We saw a little slippage during the period with the shares giving back $0.41. However, two quarterly dividends of 12 cents (U.S.) each almost offset that.

CN Rail (CNR-T, CNI-N). CN shares recovered after losing more than $9 between January and June. The stock added $3.10 and the increased dividend provided us with two payments totalling 62.5 cents per share.

Enbridge (ENB-T, ENB-N). There's no sugar coating this one. Enbridge was sideswiped by the crunch in the energy sector and the shares dropped more than $15 during the period. That's a huge loss for a stock that until now has been a rock of stability. Enbridge is a great company and it will recover, but this setback hurt.

Toronto Dominion Bank (TD-T, TD-N). Bank stocks have struggled this year but TD shares managed a small gain of 64 cents since our last review. We also received two quarterly dividends of 51 cents.

AT&T (T-N). This giant U.S. telecom has been dead in the water for some time. The share price is actually down slightly from when we first bought it. The yield is attractive at 5.4 per cent and we've gained on the currency exchange, although that is not factored into the results below as we treat the Canadian and U.S. dollars as being at par for consistency of reporting.

UnitedHealth Group (UNH-N). This health care stock was added to the portfolio in January as a replacement for McDonald's. The stock showed a nice gain in the period to June 24 but has given back $2 (U.S.) per share since. UNH pays a quarterly dividend of 50 cents per share.

Walt Disney Corp. (DIS-N). Disney shares have been on a roll for the past few years so it's not surprising they eventually paused to consolidate. Even the new Star Wars movie couldn't stem the reversal and we dropped $7.26 (U.S.) per share during the period. That was only partially offset by two dividends totalling $1.37. Despite the decline, this remains the top performing stock in the portfolio.

Cash. At the time of the last review, our cash reserves, including retained dividends, were $1,059.02. We invested that money at 0.9 per cent, earning $4.77 in interest.

Here is the status of the portfolio as of the morning of Dec. 30. For consistency, the Canadian and U.S. dollars are considered to be at par, although obviously the differential in the currencies makes U.S. dollar dividends and capital gains more valuable to Canadian investors. Trading commissions are not factored in although in a buy and hold portfolio they are not significant in any event.

Comments: We're down 1.9 per cent from our last review, due mainly to the big drop in our Enbridge shares. Still, given the state of the market, that's not bad. Since inception the portfolio has gained 51.9 per cent, for a three-year average annual compound growth rate of 12.7 per cent. That's still well ahead of our target return of 8 per cent annually.

Changes: This is a Buy and Hold Portfolio so we don't make changes lightly. However, I am not happy with the performance of AT&T and I don't see much prospect of improvement going forward. Moreover, I feel we need some exposure to the burgeoning information technology sector. Therefore, we will sell the AT&T position for a total of $6,540.65, including retained dividends. We will use the money to buy eight shares of Alphabet Inc. (GOOGL-Q), better known as Google, which was trading at $794.49 at the time of writing. Total cost is $6,355.92. The remaining $184.73 will be added to cash.

We will also make the following small purchases using retained dividends. Don't try to do these yourself because of the commissions involved; use dividend reinvestment plans instead.

XBB. We will add five units at a cost of $157.45. That will bring us to a total of 435 units and leave us with cash of $38.44.

BCE. We'll purchase five shares for $272.75 to bring our total to 140. That will leave cash of $42.20.

Here is the revised portfolio. I'll revisit it in June.

Gordon Pape is Editor and Publisher of the Internet Wealth Builder and Income Investor newsletters.