U.S. gross domestic product growth for the third quarter was revised significantly higher Tuesday from 3.6 per cent to 5.0 per cent. This is a clear sign that, after a number of false starts, the American economy is accelerating – the third quarter saw the strongest quarterly result since 2003.

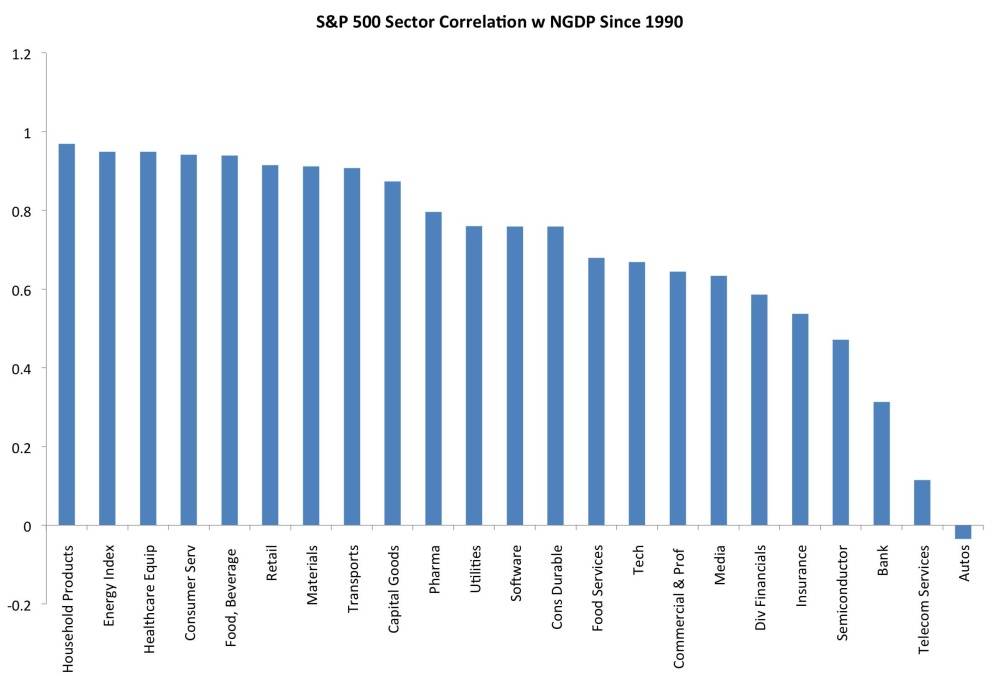

The question for investors is how to benefit most from the improving growth south of the border. To start this process, the chart below highlights the correlation between U.S. nominal GDP growth (I used nominal because stock prices are nominal) and all U.S. industry market sectors since 1990.

The chart suggests that household products stocks will be the biggest beneficiaries of the improving U.S. economy. The subindex has relatively few members, namely Avon Products Inc., Clorox Co., Colgate Palmolive Co., Estee Lauder Cos Inc. Kimberley Clark Corp and Proctor and Gamble Co. A number of these stocks also pay substantial dividends, highlighted by Kimberley-Clark's 2.8 per cent indicated yield.

Energy stocks have historically climbed along with U.S. economic activity, but this time, things could be different. The relationship between energy sector profits and the U.S. economy has changed.

There's no question that stronger U.S. growth will help boost energy sector revenues, but the past decade has seen China and the emerging markets economies supplant the U.S. as the primary driver of commodity prices. Investors can no longer blindly buy Exxon-Mobil Corp or other multi-national oil producers with the same level of confidence that U.S. growth will drive future profits higher to the same extent as in the past.

The correlation between the S&P 500 health care equipment index and the economy might represent the best investment opportunity on the chart. The sector has not only benefited from U.S. GDP growth in the past, but is now also enjoying the earnings tailwind from demographically-led demand.

There are 31 stocks in the health care equipment index. The largest by market cap are Unitedhealth Group Inc. Medtronic Inc., Abbott Laboratories, Express Scripts Holding Co., and Mckesson Corp. (For what it's worth, I am researching two smaller companies in the index as potential personal investments – hospital operator Universal Health Services and medical equipment maker Stryker Corp.)

The numbers on the chart also suggest consumer services stocks and retail stocks are also poised for higher profits if the U.S. economy continues to surge.

Follow Scott Barlow on Twitter @SBarlow_ROB.