To riff off Charles Dickens, on matters of valuation, the S&P/TSX Composite index has become a tale of two markets.

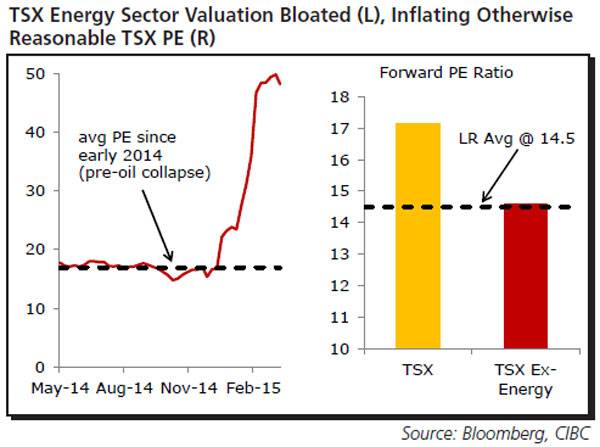

As a whole, Canada's benchmark index has a forward price to earnings multiple of 17.2 times, which is modestly below that of the S&P 500 and well above the S&P/TSX Composite's long-run average of 14.5 times.

But this figure is heavily skewed by very expensive energy stocks.

As Inside The Market has noted on a number of occasions, just because energy stocks have come under pressure, that doesn't necessarily make them cheap.

Oil and gas stocks have become divorced from the commodity price, companies' capital budgets continue to assume that prices will be substantially higher than they are today, sentiment north of the border remains surprisingly constructive, and analysts haven't been ratcheting down their earnings estimates aggressively enough, which manifested in largely disappointing fourth-quarter results.

In CIBC World Markets weekly note, economist Nick Exarhos points out that the energy sector's forward P/E is a whopping 48.2 times.

"Stripping that sector out, the TSX's multiple drops to 14.6," said Mr. Exarhos. "That looks quite attractive when benchmarked against low bond yields."

The economist also observes that the median stock in the vast majority of Canadian sectors – all but materials – is expected to see better earnings growth than their peers in the S&P 500.

"The Toronto composite has taken its lumps recently, but is it really time for a broad-based 'short Canada' trade?" he said. "The evidence doesn't seem to point that way."

This insight into the stretched valuations of energy stocks comes at a time when West Texas Intermediate crude oil futures fell to a fresh six-year low on Monday morning, dropping below $43.40 per barrel (U.S.)

Citigroup's commodity team believes that WTI will break below $30 per barrel, with chief U.S. equity strategist Tobias Levkovich warning that "fighting an oil price decline historically has not made much sense."