A humorous look at the companies that caught our eye, for better or worse, this week.

SunOpta

SOY (TSX)

May 16, 2014 close: $13.56

up $1.64 or 13.8% over week

Thirsty? Nothing says refreshment like an ice-cold glass of sunflower milk. Tip: It goes great with a plate of boiled edamame beans. SunOpta’s natural and organic foods may not appeal to everyone’s taste buds, but investors can’t get enough: With first-quarter revenue surging 18 per cent and earnings topping expectations as more consumers turn to healthy foods, the stock is on a natural high.

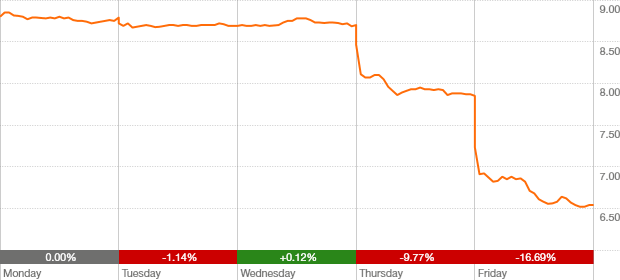

Just Energy

JE (TSX)

May 16, 2014 close: $6.54

down $2.25 or 25.6% over week

Just Energy sells fixed-price contracts that let customers lock in electricity and natural gas costs. That’s great for consumers when energy prices rise, but not so great for Just Energy, whose quarterly results missed expectations as the company absorbed price spikes caused by the severe winter weather. With the stock plunging and some analysts now expecting a dividend cut, investors are freezing in the dark.

Ainsworth Lumber

ANS (TSX)

May 16, 2014 close: $2.90

down 37 cents or 11.3% over week

Business quiz!

Shares of Ainsworth Lumber sank this week because:

a) Termites destroyed the company’s main distribution centre;

b) A growing number of home builders are using inexpensive imported Chinese plastic for framing instead of wood;

c) Louisiana-Pacific called off its $1.1-billion (U.S.) bid for Ainsworth after the companies said U.S. and Canadian regulators would have required asset sales “significantly beyond those contemplated.”

Answer: c.

ExOne

XONE (Nasdaq)

May 16, 2014 close: $26.52 (U.S.)

down $5.62 or 17.5% over week

Three-dimensional printers can make all sorts of items, from clothing and kitchen utensils to firearms and musical instruments. In the case of ExOne, however, the one thing they can’t make is profits: Hurt by the delay of a $2-million machine order, the maker of 3-D printers and products posted first-quarter revenue below expectations and said its loss widened to $5.5-million from $1.8-million, causing the stock to plunge.

Whirlpool

WHR (NYSE)

May 16, 2014 close: $145.98 (U.S.)

down $5.55 or 3.7% over week

You know when you accidentally leave some money in your pocket and it comes out of the washing machine in pieces? Whirlpool investors can relate: The world’s biggest maker of household appliances slumped after Longbow Research downgraded the shares to “neutral” from “buy,” citing a slowdown in the U.S. housing market and weakness in Brazil. Investors are being put through the wringer.