A humorous look at the companies that caught our eye, for better or worse, this week.

Sears Canada

SCC (TSX)

Aug. 22, 2014 close: $13.98

down $2.07 or 12.9% over week

The company’s shares fell as it revealed a sharp drop in second-quarter sales. It happened, said CEO Douglas Campbell, “in part due to an unseasonably cool spring.”

Left unsaid: The other “part” of the reason for the sales decline is because it is Sears Canada. (If you read this news release on the company website, you’ll see a picture of a completely empty boardroom. How appropriate.)

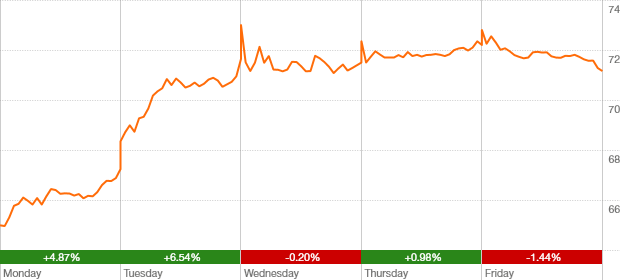

AutoCanada

ACQ (TSX)

Aug. 22, 2014 close: $71.16

up $7.04 or 11% over week

Wait, it was just a week ago that we told you AutoCanada was travelling in reverse! The stock shifted into another gear and reverted to its normal speed-demon ways. Can it travel another $20 back to its 52-week high? Roll down the windows, please – investors may be getting a little carsick from all this action.

Coupons.com

COUP (NYSE)

Aug. 22, 2014 close: $12.67 (U.S.)

down $1.83 or 12.6% over week

We called Coupons.com a doggy back in May when it lost 11.5 per cent and finished at $26.55. Hey, now it’s 50 per cent off! You don’t need a coupon when the discounts keep coming like this. It kind of reminds us of what happened at Groupon, come to think of it. Customers save, investors lose!

Build-A-Bear Workshop

BBW (NYSE)

Aug. 22, 2014 close: $12.66 (U.S.)

up $1.85 or 17.1% over week

So, I took the kid to this Build-A-Bear Workshop thing. Sounds cute, and educational, and all that. And the cuddly bears don’t cost that much. So, clothes – yeah, I guess the bear shouldn’t be naked. Wait – what do you mean, “accessories”? Why does a flippin’ teddy bear need “accessories”? And it really needs a “pawsport” to travel? After what I just spent, I don’t think I’m letting this bear out of my sight.

Bank of America

BAC (NYSE)

Aug. 22, 2014 close: $16.13 (U.S.)

up 91¢ or 6% over week

Bank of America agreed to pay nearly $17-billion to settle charges of selling crummy mortgage bonds. Of that, $7-billion is for consumer relief, but advocates say people who’ve already lost their homes probably won’t be helped. The stock was up, though. That could be because the company will get $4-billion in tax savings from the deal. Don’t you just love unrestrained capitalism? Bank of America, indeed.