A humorous look at the companies that caught our eye, for better or worse, this week.

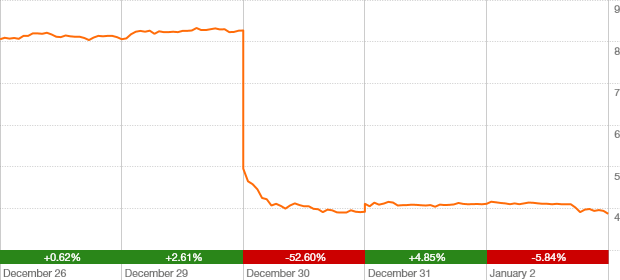

Civeo Inc.

CVEO (NYSE)

Jan. 2, 2015 close: $3.87 (U.S.)

down $4.19 or 52% over week

Memo: With oil at $50 a barrel, the outlook is underwhelming for the Canadian oil patch. Investors in Civeo Corp., which provides worker housing for Albertan and Australian resource companies, seemingly had not received this memo. At least until Monday, when Civeo cut its earnings guidance and eliminated its dividend. Hello, folks: It was the second time in 2014 the shares lost 50 per cent or more.

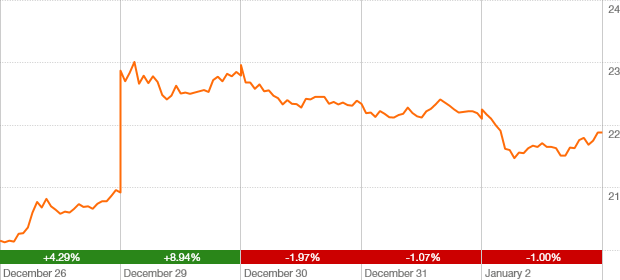

Manitowoc Co.

MTW (NYSE)

Jan. 2, 2015 close: $21.88 (U.S.)

up 96¢ or 4.6% over week

Activist investor Carl Icahn often gets a warm reception from the markets, but a chilly reception from company leaders. Look for the latter when the managers of Manitowoc, a maker of ice machines, cranes and restaurant equipment, respond to Mr. Icahn’s call for the company to break up. Will the shares reach to the sky if the crane division becomes a separate company? Or will they retreat to a deep freeze if Manitowoc tries to put the idea on ice?

Freshpet Inc.

FRPT (Nasdaq)

Jan. 2, 2015 close: $16.50 (U.S.)

up $1.21 or 7.9% over week

“Freshpet” does not sell puppies and kittens. Instead, it produces “natural” pet food that is sold in refrigerated cases for up to 10 times the price of dried food. The shares had declined after their early-November IPO, but are rebounding with their addition to the Russell 2000 small-cap index. The company says it hopes to benefit from “ trends of growing pet humanization” – also known as “rich people whose dogs eat better than most poor people.”

Northern Blizzard Res.

NBZ (TSX)

Jan. 2, 2015 close: $8.26

down 67¢ or 7.5% over week

See, if Northern Blizzard Resources sold things that you could use when you were hit by a northern blizzard, then its business would be really good right now, and its stock would be up. Because, you know, it’s winter, and there are blizzards and stuff like that. Except the company explores for heavy oil in Saskatchewan, so northern blizzards are more like a problem. Not as big a problem as the collapse of oil prices, of course. But still.

Weight Watchers Int'l

WTW (NYSE)

Jan. 2, 2015 close: $21.53 (U.S.)

down $5.18 or 19.4% over week

You can only hope that your 2015 resolution to lose some weight will be as effective as Weight Watchers’ ability to shed value from its shares. The company, which has struggled to adapt to a world of low-cost and free weight-management apps, launched a redesigned magazine this week that it said would include “amazing close-ups of beautifully prepared but not-so-perfect foods.” Shareholders got an amazing close-up of a far-from-perfect return on their investment.