SUPPLIED

The companies within this article are mentioned purely for illustrative and informational purposes only. The mentioning of these companies does not constitute a recommendation to buy, sell, or trade these securities.

The events of war are tragic, but equity markets are cold and calculated. Anytime geopolitical conflicts arise, investors often wonder how Aerospace and Defence (A&D) equities might respond. In this guide, Fisher Investments Canada provides an overview of the Aerospace and Defence industry that might be helpful if you are reconsidering its place in your portfolio.

Where do Aerospace and Defence companies fit in the overall market?

Fisher Investments Canada believes a top-down approach should guide your investment decisions. This means putting more emphasis on macroeconomic forecasts than on random stock picking. Part of that process involves identifying country, sector or equity categories you expect to perform better or worse than the overall market. From there, you can focus on individual equities that best capture the exposure you want.

Therefore, it is important to understand the A&D industry in the context of the broader market. Since A&D companies are in the industrials sector, it is important to consider your views on Industrials. The industrials sector skews toward smaller companies with thinner profit margins that are more sensitive to the direction of the broader economy. These attributes can be more attractive to investors early in market cycles, when economic growth tends to accelerate.

The industrials sector is particularly diverse. Companies can have vastly different business models and customer bases. Below are a few examples of large industrial companies:

- Deere & Company – a US farming-equipment manufacturer

- Recruit Holdings Co – a Japanese recruitment platform (owns Indeed and Glassdoor)

- Airbus SE – a French airplane manufacturer

- Lockheed Martin – a US-based defence contractor

- Experian PLC – an Ireland-based credit reporting agency

- Union Pacific – a US railroad operator

- Fanuc – a Japanese robotics manufacturer

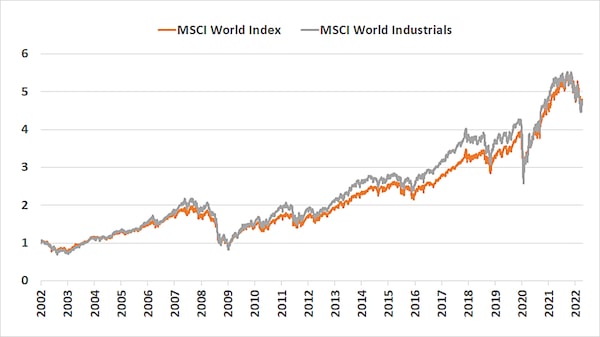

Different demand drivers influence these companies – Airbus is tied to air traffic activity, Fanuc’s robots are used to make automobiles and Union Pacific benefits from increased trade. There are many examples of industrials companies linked to different sectors in one way or another. Because of this interconnection, the sector tends to perform very similarly to the broader market. Figure 1 shows the similarity in performance between industrials and world equities.

Figure 1: Industrials Performance vs. the World

Source: Factset from 28/2/2002 to 9/6/2022SUPPLIED

What are some key characteristics of the A&D industry?

The A&D industry represents about 1.5%¹ of the MSCI World Index – a widely used representation of the global investable market. The industry is narrowly concentrated; the top five by market capitalization – Raytheon Technologies, Lockheed Martin, Boeing, Northrup Grumman and Airbus – represent about 60%² of the group.

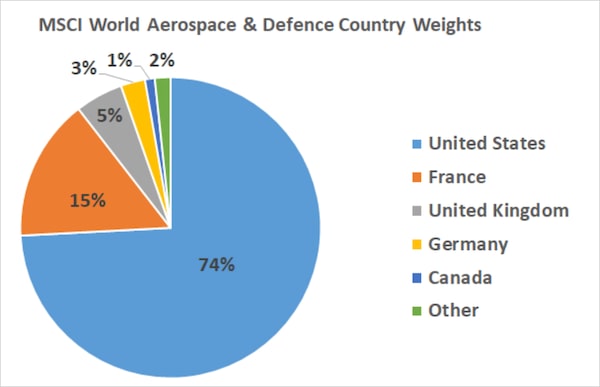

As Figure 2 shows, most A&D companies are headquartered in the US, with some in Europe. Therefore, Fisher Investments Canada believes you should also consider your preference for investing in US equities when looking at this industry.

Figure 2: Aerospace & Defence Companies by Geography

Source: Factset as of 9/6/2022SUPPLIED

A&D companies generally have thinner gross profit margins – net sales minus the cost of goods – than other parts of the industrial sector. (Figure 3) A&D products are expensive to make and rely on complex supply chains. A&D companies can also have a limited customer base, which gives customers pricing power. For example, the U.S. government is the largest customer for most defence companies. Its size allows it to negotiate better pricing relative to other customers.

Companies with thin margin profiles tend to perform better early in market cycles. As a market cycle matures, investors increasingly prefer firms with bigger profit margins because these companies operate in niche industries, have pricing power and can more easily weather economic softness. Therefore, it’s important to consider your market cycle views before adjusting your A&D exposure.

Figure 3: Industry Gross Margins

Source: Factset as of 9/6/2022SUPPLIED

When do A&D equities perform well?

Fisher Investments Canada believes two key drivers heavily influence sales patterns at A&D companies: government defence spending and air traffic. For example, airline traffic affects Airbus and Boeing (commercial jet manufacturers) more than defence spending. The reverse is true for Lockheed Martin – 71 per cent of its 2021 sales came from US military spending alone.

Aerospace companies with more exposure to air traffic tend to perform better when the economy is healthy and travel activity is rising. Aerospace-linked companies produce the planes, parts and maintenance equipment to handle an increasing volume of passengers and cargo. Increased use of e-commerce platforms, strong consumer spending on holidays and business travel all help drive sales. Naturally, COVID 19 lockdowns severely affected the industry, but air traffic has nearly returned to pre-pandemic levels in certain parts of the world.

Conversely, companies with more exposure to defence spending tend to perform well in down markets. This is because defence spending is not economically sensitive – meaning it usually doesn’t fluctuate with economic conditions. Instead, defence companies typically enjoy a relatively stable source of income. Defence budgets in many nations are subject to long, drawn-out legislative negotiations where changes occur slowly. Government defence contracts are often multi-year and negotiated in advance because of classified nature of many defence technologies.

How should investors think about their exposure to A&D?

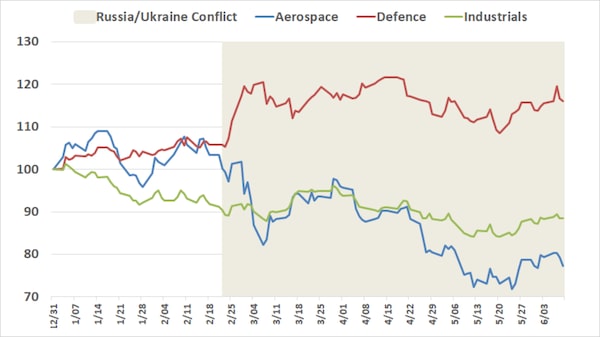

Some investors have been tempted to adjust their exposure to A&D because the industry has performed well in 2022. Defence equities, in particular, are performing better than aerospace peers year to date as markets coldly attempt to assess potential winners and losers from the Russia/Ukraine war. (Figure 4) This deviation highlights how differently A&D companies can perform in different market conditions over short stretches of time. However, making long-term investment decisions based on short-term trends in equities can prove foolhardy.

The equity market is constantly pre-pricing all widely known information – including implications of the Russia/Ukraine war – and past performance is not indicative of future results.

Figure 4: Defence equities have behaved differently since the conflict began

Source: Factset, from 31/12/2021 to 9/6/2022. Commercial Aerospace Index: Boeing, Airbus, Spirt Aerosystems market cap weighted. Defence Index: Lockheed Martin, General Dynamics, Raytheon, Northrup Grumman market cap weighted. Industrials Index: MSCI World Industrials IMI Local CurrencySUPPLIED

Fisher Investments Canada believes it is prudent to make investment decisions based on long-term macroeconomic forecasts instead of short-term sentiment-driven wiggles. Investors can be taking on unnecessary risk by making decisions based on a small sample size of recent performance in a niche part of the market.

If you are considering adjusting your exposure to equities in aerospace and defence, make sure you have a long-term view in mind. Here are some questions you might want to ask yourself:

- Are you bullish on the industrials sector?

- Do you believe U.S. equities will outperform non- U.S. companies? Recall, A&D companies are predominantly U.S. based.

- How much of your portfolio do you want to allocate to A&D, considering it represents such a small portion of the MSCI World Index (about 1.5%³)?

- Are you bullish or bearish on the market for the next 12-18 months? Does that influence the types of A&D companies you may want to consider?

Answering these questions can help guide your fundamental outlook on A&D equities. Fisher Investment’s Canada believes maintaining proper diversification in your equity portfolio is paramount to your success.

Investing in stock markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance is no guarantee of future returns. International currency fluctuations may result in a higher or lower investment return. This document constitutes the general views of Fisher Investments Canada and should not be regarded as personalized investment or tax advice or as a representation of its performance or that of its clients. No assurances are made that Fisher Investments Canada will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. In addition, no assurances are made regarding the accuracy of any illustration made herein. Not all past illustrations have been, nor future illustrations will be, as accurate as any contained herein.

Fisher Investments Management, LLC does business under this name in Ontario and Newfoundland & Labrador. In all other provinces, Fisher Asset Management, LLC does business as Fisher Investments Canada and as Fisher Investments.

¹ Factset. MSCI World Index Industry Weights as of 9/6/2022

² Factset. MSCI World Aerospace & Defence Index as of 9/6/2022

³ Factset. MSCI World Index Industry Weights as of 9/6/2022

This content was produced by Fisher Investments Canada. The Globe and Mail was not involved in its creation.