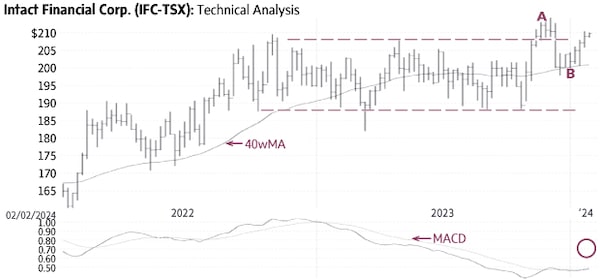

Intact Financial (IFC-T, Tuesday’s close $210.01) traded in a large horizontal trading range mostly between $188 and $210 for about one year (dashed lines). The stock had a breakout above the top of this range recently to signal a breakout and the start of an uptrend toward higher targets (A). Behaviour indicators, including the rising 40-week Moving Average (40wMA), confirm the bullish status.

Intact has since pulled back to the 40wMA (B) and now appears ready to resume the uptrend. Only a sustained decline below the average (currently near $200) would be negative.

Point & Figure measurements provide targets of $240 and $260. The large trading range (dashed lines) supports higher targets.

stock

Monica Rizk is the Senior Technical Analyst of the Phases & Cycles publication (www.capitalightresearch.com). Chart source: www.decisionplus.com

Monica Rizk

Monica Rizk