Cotton-Waiting Until the Spring

Cotton is a highly volatile soft commodity that trades in the futures market in the soft commodity sector. The Intercontinental Exchange (ICE) lists cotton futures contracts. Each contract calls for 50,000 pounds of fluffy fiber that has many applications, from textiles to other everyday products. Cotton is an agricultural commodity, so the weather across the primary growing regions is one of the most significant factors for the annual crop. After reaching a high of $1.5802 per pound in May 2022, the price has halved and was sitting below the 80 cents per pound level on October 26. Cotton is a seasonal commodity that has historically rallied during the spring.

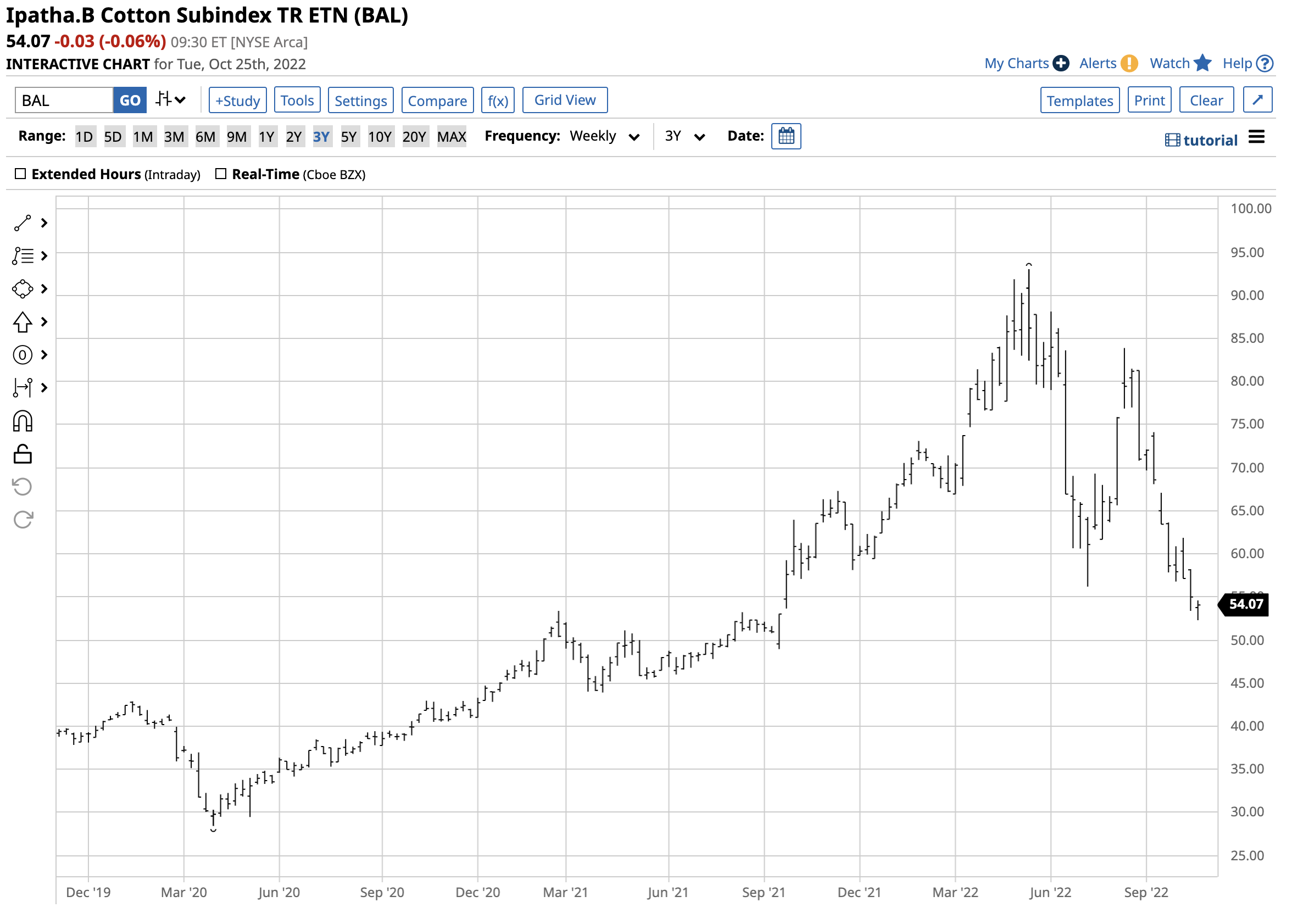

The iPath Series B Bloomberg Cotton Subindex Total Return ETN product (BAL) tracks the cotton futures price.

The world’s leading cotton-producing countries

The top four cotton-producing countries produce the lion’s share of the fiber each year:

Source: Statista

The chart highlights China and India lead the world in annual cotton output, with the US and Brazil the third and fourth leading producers.

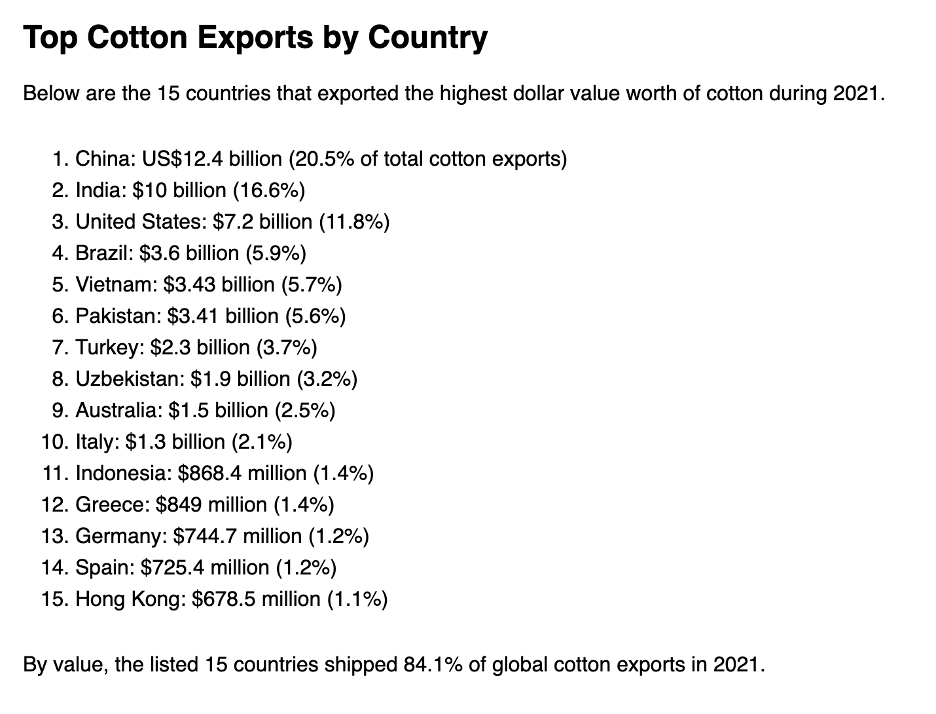

The top four producers were also the leading exporters in 2021:

Source: worldstopexporters.com

The weather and climate support producing the agricultural product in the four leading producing and exporting countries.

The world’s leading cotton-consuming countries

The top two cotton producers and exporters are also the leading consumers, but the US and Brazil are not significant consuming countries:

Source: CISION PR Newswire

Cotton consumption is the greatest in the countries with the lowest labor costs.

Inflation pushed cotton to its highest price since 2011

In 2011, nearby ICE cotton futures reached an all-time peak at $2.27 per pound.

The chart shows that cotton futures fell to 48.35 cents per pound in April 2020 as the global pandemic gripped markets across all asset classes. Cotton made higher lows and higher highs, reaching $1.5802 in May 2022, the highest price since 2011.

After reaching a lower high, cotton halved in value and was below 79 cents per pound on Wednesday, October 26.

Spring is the fiber’s rally season

Cotton tends to reach seasonal highs during the spring months in the Northern Hemisphere as the uncertainty of the annual crop peaks. The high in 2011 came in March; in 2014, 2017, 2018, and 2022 the peak occurred between March and June.

If history and seasonal trading patterns are a guide, the cotton futures market will not likely experience significant upward pressure until spring 2023, with the price below the 80 cents per pound level.

BAL is the only alternative to the futures

After halving in value over the past five months, it could be an excellent time to put the cotton market on your investment and trading radar. At under the 80 cents level, building long positions on a scale-down basis for next spring could be the optimal approach to the soft commodity for 2023.

The most direct route for a risk position in cotton is via the ICE cotton futures and futures options contracts. The iPath Series B Bloomberg Cotton Subindex Total Return ETN product (BAL) provides an alternative for those looking to participate in the cotton market without venturing into the futures arena.

At $54.07 per share on October 26, BAL had $11.903 million in assets under management. BAL is a thinly traded ETF with an average of 6,604 shares changing hands daily. The ETN charges a 0.45% management fee.

Nearby ICE cotton futures rose from 48.35 cents in April 2020 to a high of $1.5802 per pound in May 2022, a 226.8% increase.

The chart illustrates that BAL rose from $28.45 to $93.03 per share or 227% over the same period. BAL did an excellent job tracking the nearby cotton futures price.

Cotton is an agricultural product that has many applications. While the weather is a critical factor for the path of least resistance of cotton’s price, geopolitical factors, the bifurcation between the world’s nuclear powers impacting trade, and inflationary pressures could affect cotton’s price in 2023. At below 80 cents, cotton could be inexpensive compared to the price next spring.

More Softs News from Barchart

- Cotton Futures Fading into Midweek

- Cotton Futures Bounce Back

- Coffee Falls Moderately as Supply Prospects Improve

- Sugar Prices Fall as Global Supply Concerns Ease