Nagging Inflation Will Continue to Impact Commodity Prices

The Fed and other central banks have tools to combat rising inflation, as monetary policy or the control of short-term interest rates can cool the overheating growth that often causes prices to rise. However, when inflation comes from supply-side economic factors, the central banks can do little but sit back and watch the conditions that cause inflation to increase.

The US central bank began increasing interest rates over the past months and has pushed the short-term Fed Funds Rate to the 2.25%-2.50% at the last July FOMC meeting. As the central bank’s FOMC does not meet in August, short-term US rates will stay at that level until at least September.

Meanwhile, the US economy faces inflation and recessionary pressures, which could cause the central bank to rethink its battle against inflation with a hawkish monetary policy approach. Commodities, stocks, bonds, and other asset prices will be watching interest rates over the coming weeks and months as rates influence the path of least resistance of prices.

Inflation and recession=Uncertainty and confusion

While the US administration stated that inflation did not move higher in July and the President said inflation increased by “zero percent,” the statement was more political fodder than reality. The consumer price index was 8.5% higher on a year-over-year basis, and the producer price index rose 9.8% since the same time in 2021. The inflation barometers edged lower from the June report, but the economic condition remains at the highest level in over four decades. The positive spin came as the administration faces the mid-term elections in the fall.

Meanwhile, the US gross domestic product fell 0.90% in Q2 2022, marking the second quarterly decline. The textbook definition of a recession is two successive quarterly GDP declines. Inflation and recession are the hallmarks of stagflation. The administration has euphemistically called the contraction an economic “transition.” However, no matter how you spin or characterize the data, rising prices and a slowdown in growth spell problems for the economy in August 2022. The current environment is causing uncertainty and confusion in markets across all asset classes. While the Fed is battling inflation with a tighter monetary policy path, increasing interest rates weigh on economic growth. After mistakenly calling inflation “transitory” throughout 2021, government economists are now referring to recessionary pressures as a “transition.” The errors of 2021 led to the highest inflation since the early 1980s. The current characterization of the economic slowdown could cause a deeper recession as the attention to inflation takes the central bank’s eye off the economic contraction.

Markets reflect the economic and geopolitical landscapes. While there is financial uncertainty, geopolitics will remain a mess.

Supply-side economic issues are a significant factor

The US Fed has no tools to deal with the supply-side problems caused by deteriorating trade and other relations with Russia and China. In February 2022, Chinese President Xi and Russian President Putin shook hands on a massive trade deal and a “no limits” alliance. Later that month, Russian troops crossed the border into Ukraine, starting the first major war in Europe since WW II. Russia considers Ukraine Western Russia, while the US and Europe believe it is a sovereign country in Eastern Europe. Russia has objected to NATO expansion and has classified members as “unfriendly” countries supporting Ukraine in the ongoing war. The war has turned Europe’s breadbasket that supplies wheat, corn, and other agricultural products into a battlefield. Moreover, the Black Sea ports, a critical logistical export hub, are also a warzone. Meanwhile, Europe depends on Russia for natural gas and crude oil, and the energy commodities have become economic weapons in the war.

While Russia’s relations with the US and Europe have deteriorated, China has stood behind Russia. China considers Taiwan a part of the mainland, while Taiwan believes it is a sovereign country. The US Speaker of the House of Representatives recently traveled to Taiwan, against the wishes of Beijing, to express support. The visit caused relations between Beijing and Washington DC to deteriorate as it is a direct challenge to China’s reunification plans. China is a leading commodity producer and consumer, with the world’s second-leading economy and highest population. Moreover, COVID-19 lockdowns in China have caused an economic slowdown, impacting the demand for many raw materials.

The tensions between Russia/China and the US/Europe have dramatically increased in 2022, causing a bifurcation in the world’s nuclear powers, impacting trade, and interfering with commodity supply and demand fundamentals.

Commodity prices have declined- Oil has dropped, but the selloff could be a short-term event

Agricultural and energy commodity prices rose to multi-year, and in some cases, all-time highs earlier this year before correcting. The war in Ukraine, the Chinese/Russian alliance, and post-pandemic supply chain issues caused an almost perfect bullish storm with agriculture and energy in the eye of the geopolitical hurricane.

Even the most aggressive bull markets rarely move in straight lines. Over the past weeks and months, crude oil and agricultural commodity prices corrected. Crude oil is the energy commodity that continues to power the world.

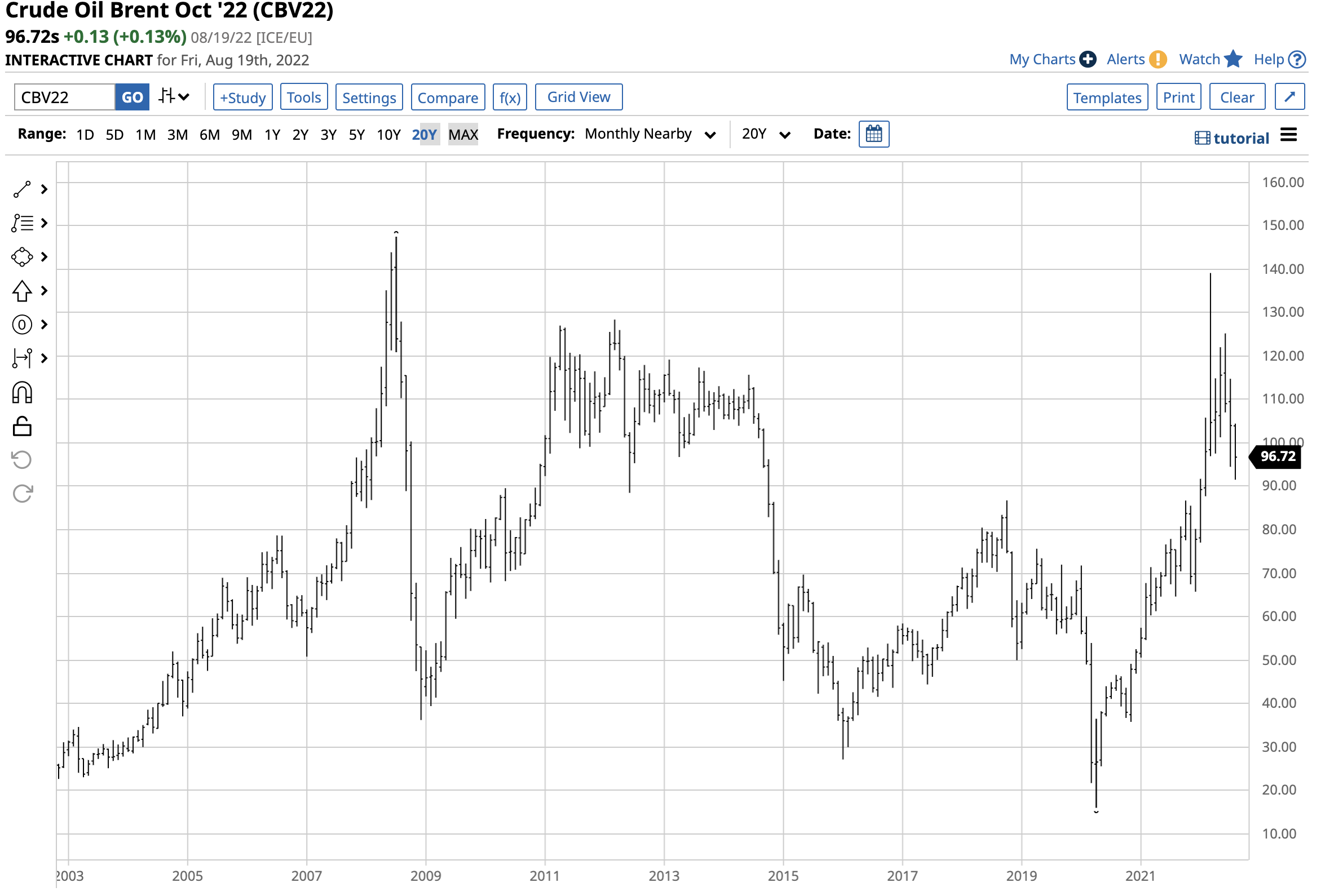

The chart shows that after reaching the highest price since 2008 at $139.13 per barrel in March 2022, Brent crude oil futures declined to the $91.51 level on August 17. Grain prices have also pulled back after CBOT wheat reached a record high in March, and corn and soybean futures prices reached levels just below the 2012 all-time peaks over the past months.

The corrections have taken prices lower, but they remain at multi-year highs. The supply-side economic issues that led to the rallies and have kept prices elevated are immune to the Fed’s monetary policy efforts.

Natural gas reflects the supply-side problems

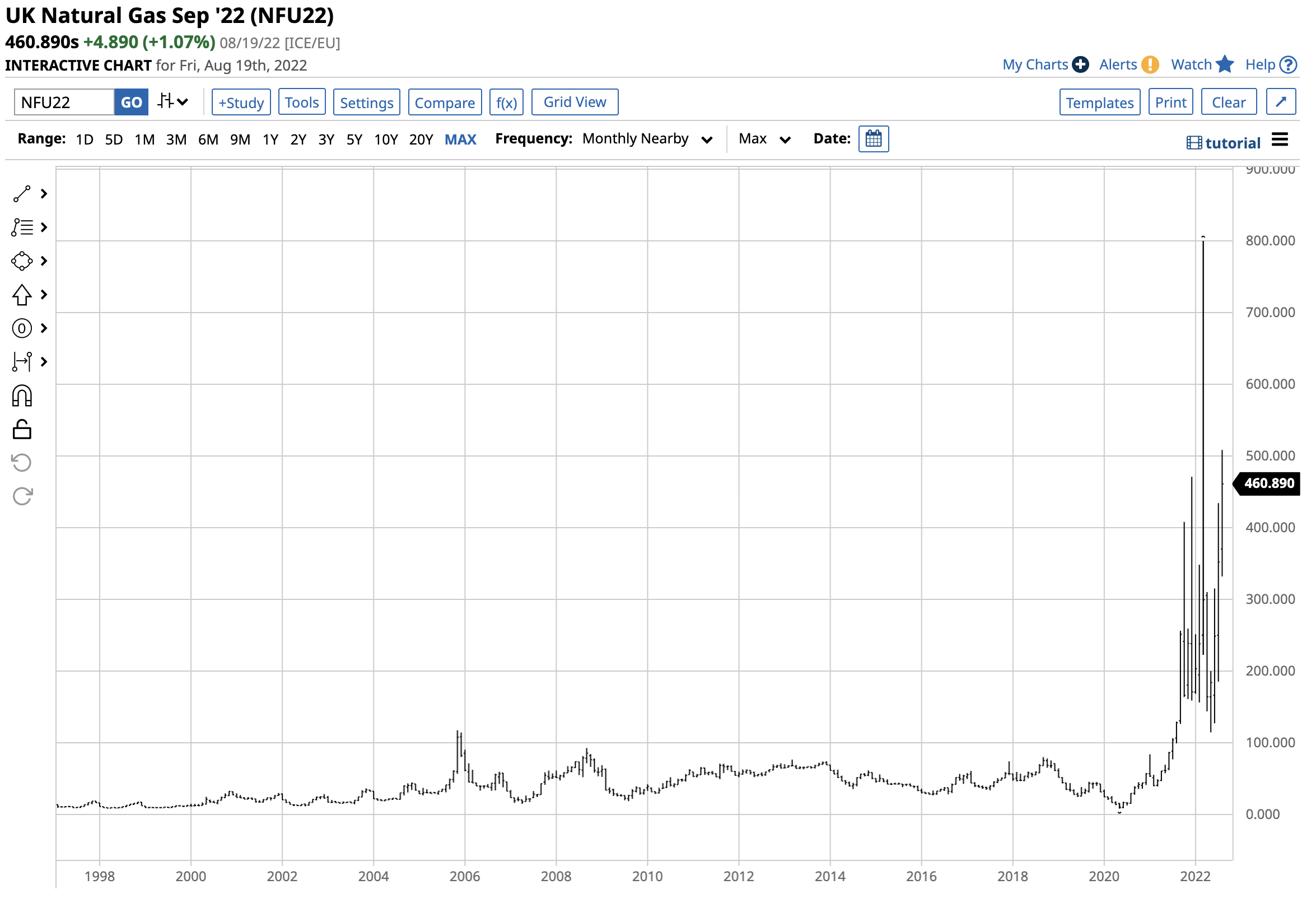

Natural gas has been the energy commodity in the eye of the geopolitical storm as Europe depends on Russian supplies. European natural gas prices have soared.

The chart shows the explosive rally in Dutch natural gas prices.

UK natural gas prices are in record territory. As the peak winter heating season approaches, Russia will likely squeeze Europe as punishment for supporting Ukraine in the ongoing war.

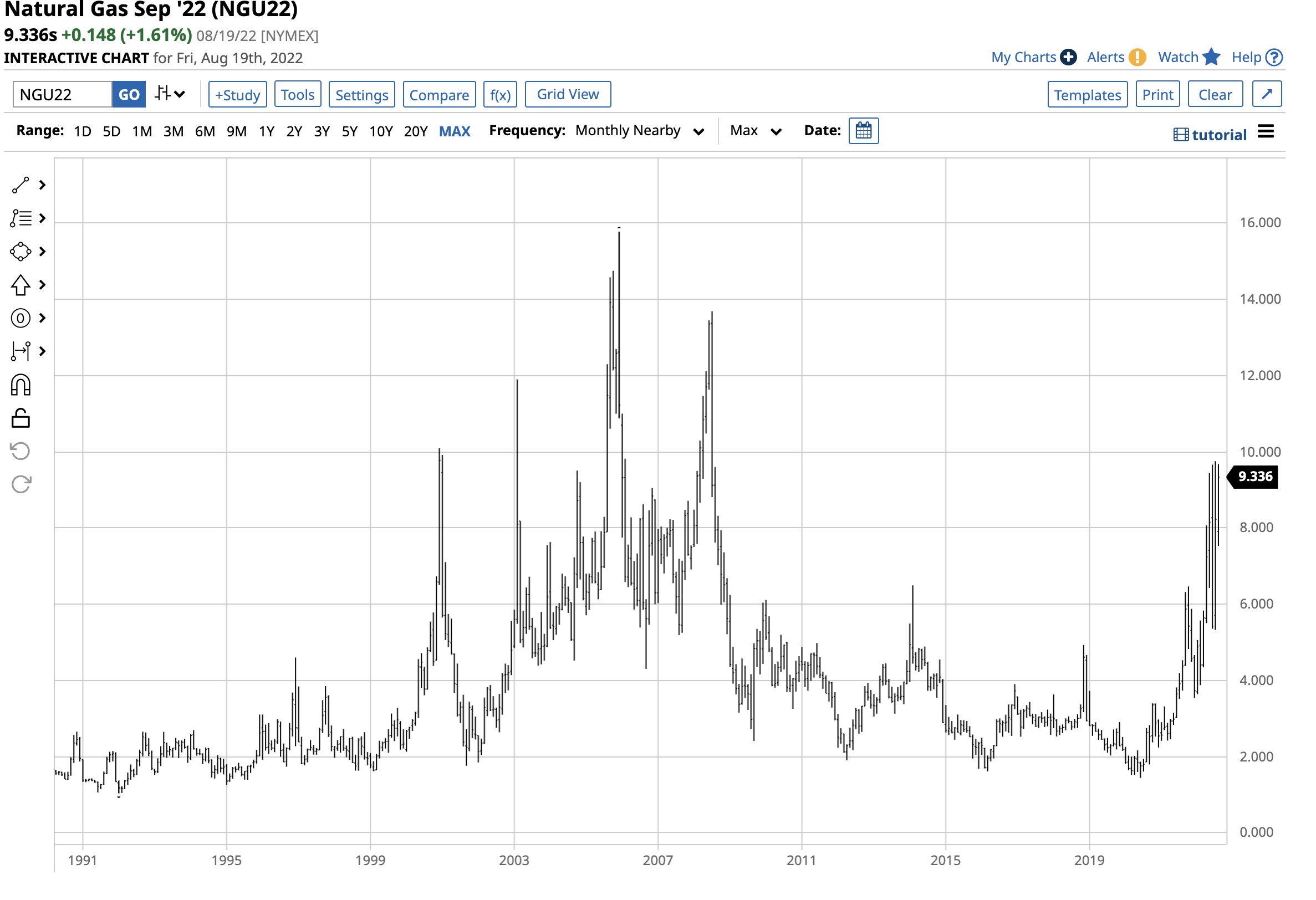

The rally in European natural gas has had a knock-on impact on US prices as liquefied US natural gas now travels worldwide.

As the chart illustrates, September US natural gas futures at above the $9 per MMBtu level are at the highest price since 2008.

The Fed’s attempt to control inflationary pressures falls short when it comes to supply-side economic factors. Natural gas, crude oil, and agricultural products are in the eye of the storm as Russia is a leading producer and exporter of the commodities.

Do not expect inflation to go away over the coming months- Buying commodities during the correction could be the optimal approach

While higher interest rates will impact inflation, the war in Ukraine and the bifurcation of worldwide nuclear power present unique challenges for the coming months and years. Moreover, signs of a US recession could handcuff the US central bank, slow interest rate hikes, and add more fuel to the inflationary fire.

I favor buying commodities during the current correction, leaving plenty of room to add on further price weakness. Inflation erodes money’s purchasing power and causes raw material production costs to rise. Nagging inflation will remain an elusive problem for the US and worldwide economies, supporting higher commodity prices. Expect the pattern of higher lows and higher highs to continue.

More Energy News from Barchart