Pure Hedge - Livestock and Grain

2/9/24

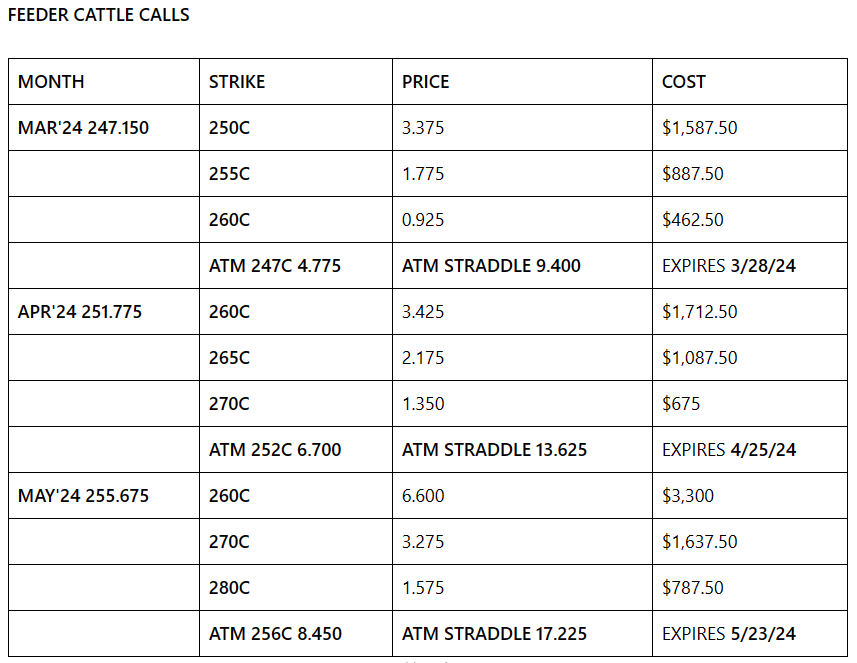

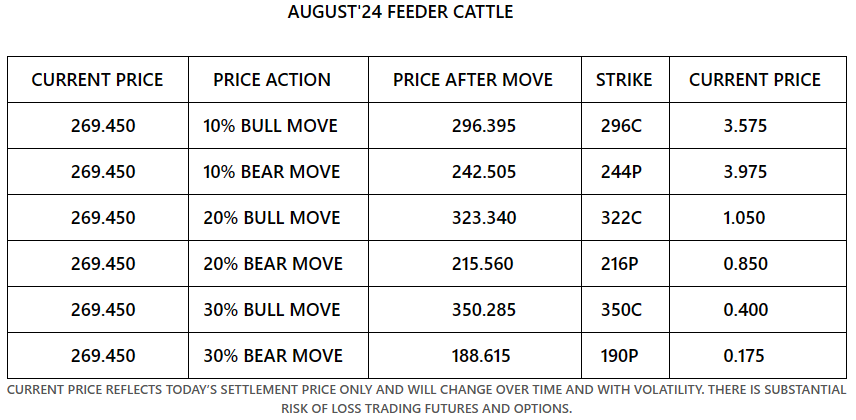

It was a crazy week in the commodity markets. The Grains broke and the Livestock rallied. April'24 Live Cattle was 0.150 higher today and settled at 186.725, not far below today's high of 187.475, which is also the 1-month high. Today's low was 185.825 and the 1-month low is 172.775. Since 1/9 April'24 Live Cattle are 13.125 higher or about 7 ½%. The Feeders also gained today. March'24 Feeder Cattle gained 0.300 today and settled at 247.150. Today's high was 248.350 and the low was 245.925. The 1-month high is 249.150 and the 1-month low is 224.600. Since 1/9 March'24 Feeder Cattle are 22.275 higher or almost 10%. The Hogs were higher as well. April'24 Lean Hogs were 0.800 higher today and settled at 81.150, not far above today's low of 80.750. Today's high was 82.400. The 1-month high is 85.925 and 1-month low is 76.725. Since 1/9 April'24 Lean Hogs are 2.650 higher or over 3%. The Grains continue to break as expected. March'24 Soybeans were 10 cents lower today and settled at 1183 ½, just two cents above today's low of 1181 ½. Today's high was 1198. The 1-month high is 1250 and the 1-month low is 1179 ¼. March'24 Soybeans settled just 38 ¼ cents from the 52-week low of 1145 ½. Since 1/9 March'24 Soybeans are 65 cents lower or over 5%. Corn continued to slide lower today. March'24 Corn was 4 ¼ lower today and settled at 429, just above today's low of 428 ¼, which is also the 1-month and 52-week low. Today's high was 437 and the 1-month high is 461 ¾. Since 1/9 March'24 Corn is 30 ¼ cents lower or about 6%. The Wheat Market closed positive today. March'24 Wheat was 8 ¼ cents higher today and settled at 596 ¾. Today's high was 605 ½ and today's low was 588. The 1-month high is 617 ¼ and the 1-month low is 573 ¼. Since 1/9 March'24 Wheat is 13 ¼ cents lower or over 2%. The Cattle markets have had a nice rally, but I believe that will end soon. The numbers might be lower, but the weights are up, and feed lots are full. I still feel that the Cattle Market will start to break again soon, and through the summer. The charts look very similar to 2014-2015. I highly recommend protecting your downside exposure. The WASDE Report was released yesterday, and there are a lot of Beans out there, and I believe lots of Beans will be planted here this year. The weather in South America has improved and will have a big crop again. I feel that another collapse in the Soybean Market is eminent. I feel the Corn Market will grind lower following the Soybeans. I feel that the $10.00 level in Soybeans is a real possibility this fall. I recommend protecting your downside in the Livestock and Grain Markets. I don't want everything to break, but what happens if it does…

-Bill

312-957-8079

I have Option Strike prices every Friday.

I have market commentary and option charts in Pure Hedge – Livestock

and Pure Hedge – Grain at WWW.WALSHTRADING.COM

Call for specific trade recommendations.

1-312-957-8079

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

On the date of publication, Bill Allen did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.