Uranium Producers Continue To Gain- CCJ is a leader

Uranium is a silvery-grey metal in the actinide series of the periodic table. Enriched uranium, or U-235 concentrations, are required for fuel for nuclear power plants and the nuclear reactors that run naval ships and submarines. High-grade uranium is also a critical ingredient in producing nuclear weapons.

While uranium is a metal, it is also an energy commodity. Uranium occurs in most rocks in concentrations of two to four parts per million and is common in the earth’s crust. Geopolitical tensions and a shift to greener energy sources have caused the demand for uranium to increase. Cameco Corporation (CCJ) is a leading and established Canadian uranium producer.

The demand is rising for two compelling reasons

In the complicated world in 2022, two factors are increasing uranium demand and the sky-high prices for traditional fuels are making nuclear power projects more attractive. Moreover, the shift towards a greener path of energy that supports alternative and renewable energy sources supports nuclear power compared to coal and natural gas-generated electricity.

Meanwhile, growing tensions between the world’s nuclear power and building up military capabilities worldwide leads to more uranium demand as the number of nuclear weapons will likely increase. Over the past months, the uranium price has been trending higher.

Source: Cameco.com

The chart highlights that uranium fell from a record $136 high in 2007 to $18 in 2016. The price has made higher lows and higher highs over the past six years, reaching $58.20. At the end of August 2022, the price was trading at over $50. The rising demand translates to a higher uranium price.

The world’s leading producing and exporting countries

In 2021, the world’s top six uranium-producing countries were:

- Kazakhstan was the world’s leading producer, with 21,819 tons of output.

- Namibia’s production was 5,753 tons.

- Canada was third with 4,683 tons.

- Australia produced 4,192 tons.

- Uzbekistan’s output was 3,500 tons.

- Russia produced 2,635 tons in 2021.

Source: investingnews.com

The leading exporters were:

Source: Worldstopexports.com

The world’s leading producer was also the top exporter, but Canada, the country with the third-leading output level, was the second in exports.

The leading producer does not have the most reserves

Ironically, Kazakhstan may have the most annual production, but Australia that is home to the most recoverable uranium reserves. Rio Tinto (RIO) and BHP Billiton (BHP) own Australian uranium mines, and the country has around 30% of the world’s known recoverable reserves.

Kazakhstan, the leading producer, and exporter has about 13% of the world’s recoverable uranium reserves. Kazatomprom, the state-owned company, controls the uranium industry in the country through its subsidiaries or via joint ventures with foreign companies. One partner in Kazakhstan is Cameco Corporation, the world’s leading publicly traded uranium miner, and Cameco is a Canadian company.

Cameco is the most liquid investment choice in uranium

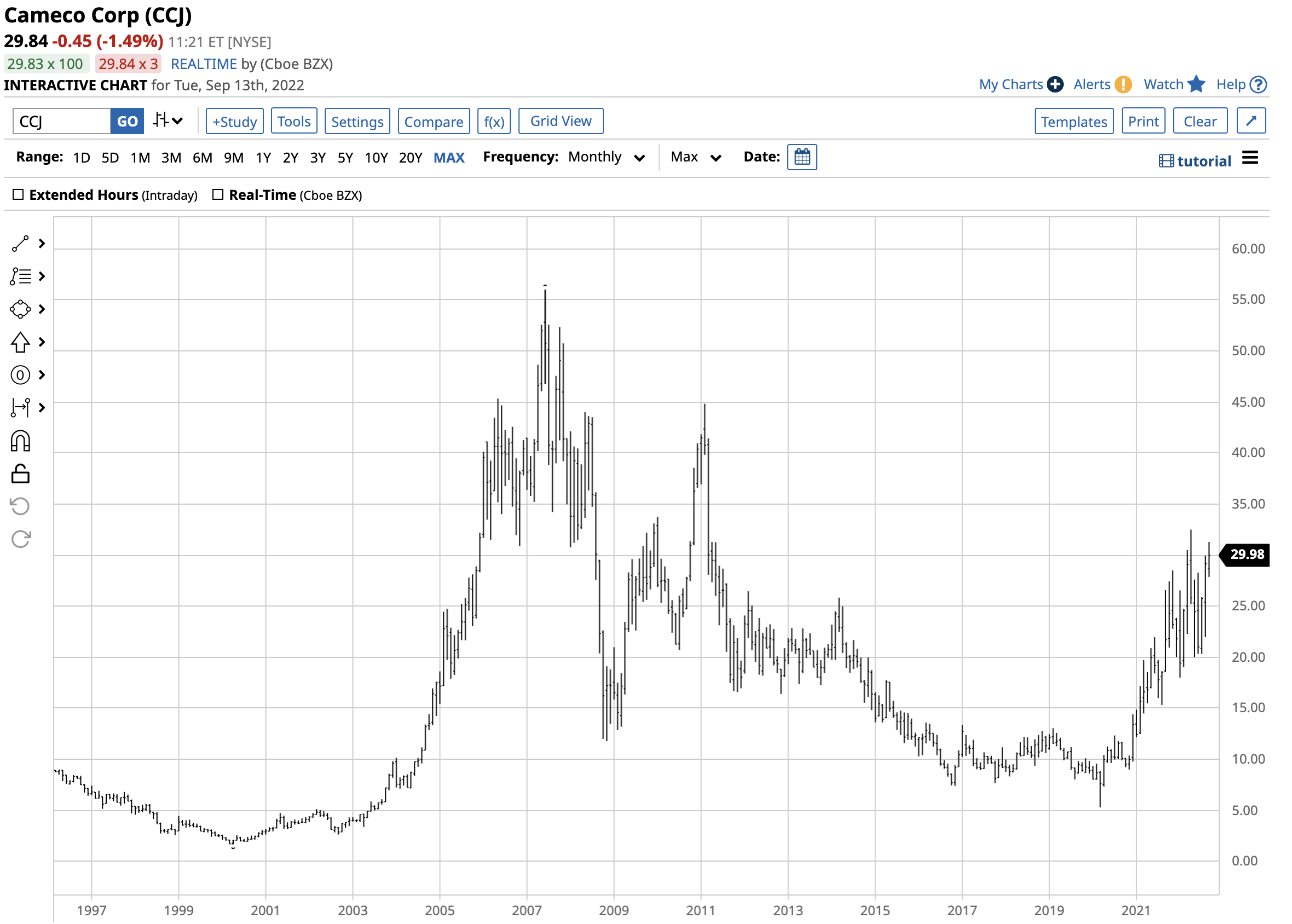

Cameco Corporation (CCJ) is a Canadian company with its headquarters in Saskatoon, Canada. CCJ produced uranium in Canada, the US, Australia, and via the Kazakhstan joint venture. At around the $30 per share level on September 13, CCJ’s market cap was over $12 billion. An average of over 7.6 million CCJ shares change hands daily. The company pays its shareholders a 6.0 dividend, translating to a 0.20% yield on the stock.

CCJ is a highly liquid stock, that follows the uranium price higher and lower. As a producer, it tends to offer leveraged exposure to the commodity.

The uranium price rose from $18 in 2016 to the $51.25 level at the end of August 2022, a 185% gain.

Over the same period, CCJ shares rose from $7.41 to the $29.85 level or over 302%.

Lots of upside room in CCJ shares

As the uranium price has been climbing, CCJ shares have outperformed the commodity on the upside. However, the stock has room to move further as the all-time high in uranium was in 2007 at $136, and CCJ peaked when uranium was at its high.

The chart shows CCJ shares peaked in 2007 at $56, over 87% above the $29.85 level on September 13, 2022. CCJ has been an effective vehicle for participating in the uranium market. As worldwide tensions, concerns over energy supplies, and the trend toward a greener power path continue, uranium demand will likely continue to climb, pushing prices higher. CCJ shares look set to continue to make higher lows and higher highs on a path toward a challenge of the 2007 record high.

More Metals News from Barchart