Today, we look at Latin America-focused Leagold Mining Corp., which looks set to increasing its gold production.

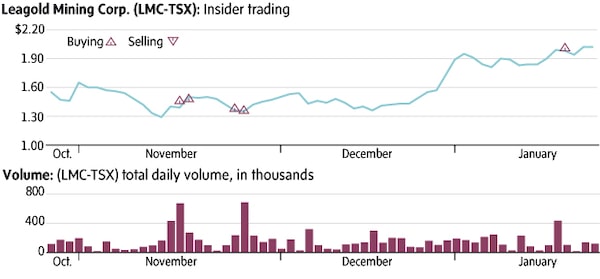

Over the past three months, the stock is up about 20 per cent, ahead of the iShares S&P/TSX Global Gold Index ETF up about 4 per cent.

A pair of directors, including Frank Giustra, have spent a combined $1,347,800 buying shares in the public market in this period.

Leagold’s gold production guidance for 2019 is between 380,000 and 420,000 ounces at an all-in sustaining cost of between US$920 and US$970 an ounce. In 2018, Leagold produced 302,550 ounces

Ted Dixon is CEO of INK Research, which provides insider news and knowledge to investors. For more background on insider reporting in Canada, visit the FAQ section at www.inkresearch.com. Securities referenced in this profile may have already appeared in recent reports distributed to INK subscribers. INK staff may also hold a position in profiled securities.

Chart reflects public-market transactions of common shares or unit trusts by company officers and directors.

Ted Dixon

Ted Dixon