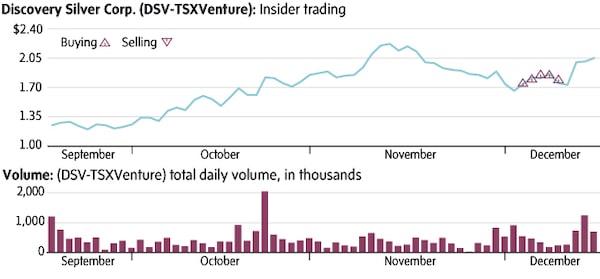

On Nov. 30, Discovery Silver Corp. announced a preliminary economic assessment for its 100-per-cent-owned Cordero silver project in Mexico. The PEA estimates Cordero’s base case net present value to be US$1.2-billion after tax using a 5-per-cent discount rate. Assumptions include US$22-per-ounce silver and all-in-sustaining costs averaging less than US$12.50 per silver equivalent ounce. While the stock jumped on the news, it subsequently gave up all those gains and more. Insiders spent just under $200,000 buying the dip. So far, those trades are in the money.

stock

Ted Dixon is CEO of INK Research which provides insider news and knowledge to investors. For more background on insider reporting in Canada, visit the FAQ section at www.inkresearch.com. Securities referenced in this profile may have already appeared in recent reports distributed to INK subscribers. INK staff may also hold a position in profiled securities.

Chart reflects public-market transactions of common shares or unit trusts by company officers and directors.

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up today.

Ted Dixon

Ted Dixon