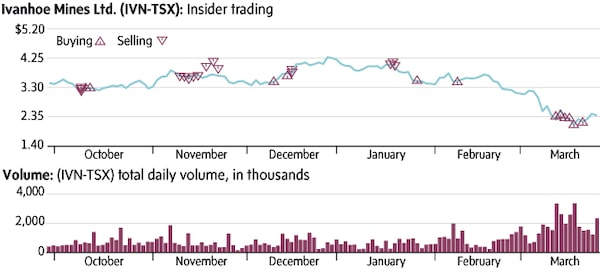

Junior mining shares have been hit as investors fret about how their operations will be impacted by COVID-19. However, mining insiders have been buying, which suggests that the recent pullback could be providing a decent risk/reward opportunity for speculators. For example, this month Ivanhoe Mines Ltd. (Friday’s close $2.26) insiders, including executive co-chairman of the board Robert Friedland, bought a total of 929,300 common shares at an average price of $2.33. Mr. Friedland was responsible for the bulk of the buying, picking a total of 680,300 common shares.

stock

Ted Dixon is CEO of INK Research which provides insider news and knowledge to investors. For more background on insider reporting in Canada, visit the FAQ section at www.inkresearch.com. Securities referenced in this profile may have already appeared in recent reports distributed to INK subscribers. INK staff may also hold a position in profiled securities.

Chart reflects public-market transactions of common shares or unit trusts by company officers and directors.

Ted Dixon

Ted Dixon